Minor relief: Prices of petrol, diesel cut by Rs5 per litre

OGRA had proposed a reduction, ranging between Rs7 and Rs11 per litre

PHOTO: REUTERS

The government announced on Saturday a downward revision in the prices of petroleum products for February, slashing rates by Rs5 per litre. The Oil and Gas Regulatory Authority (Ogra) had proposed a cut between Rs7 and Rs11 per litre.

From Feb 1, petrol will sell at Rs71.25 and high speed diesel (HSD) at Rs75.79 per litre, according to the announcement. Similarly, the price of high octane (HO) will be Rs75.66 per litre while that of kerosene oil and light diesel oil (LDO) will be Rs43.25 and Rs39.94 per litre, respectively.

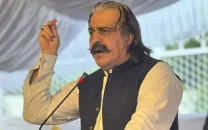

Talking to journalists in Lahore, Prime Minister Nawaz Sharif said on Saturday that the trickle-down effects of his government’s economic policies could be witnessed in the declining prices of petroleum and other basic daily-use commodities. “The decision to cut petroleum prices will bring relief to the common man,” he said.

Consumers were expecting a major revision in oil prices for February. But the government chose to pass on only partial relief to the consumers while changing the mechanism of charging the general sales tax (GST) and guaranteeing its revenue from petroleum products. The government had been charging GST in percentage and, therefore, the reduction in oil prices after June 2014 led to a fall in revenues and a loss of Rs100 billion.

In the past, the government had been charging 17 per cent GST on petroleum products. This rate was increased mainly on the HSD to 50 per cent in view of the falling international oil prices.

However, this time around, Finance Minister Ishaq Dar directed the Federal Board of Revenue (FBR) to issue a notification to fix the GST on petroleum products in rupee form instead of percentage, depriving consumers of any major relief.

Officials said the government would collect Rs30 billion on account of the GST on petroleum products during month of February due to fixed rate despite a cut in oil prices. Earlier, the government was collecting Rs20 billion GST per month. In addition, the government will also collect Rs10 billion on account of petroleum levy on petroleum products.

The rate of GST on HSD has reached to Rs29.57 per litre. After the increase in the rate of GST by Rs1.25 per litre, the new rate of GST on petrol stands at Rs14.48 per litre. The government has also increased GST on the HSD by Rs2.28 per litre, on HOBC by Rs3.22, on kerosene oil by Rs1.70 and on the LDO by Rs0.93 per litre.

On kerosene oil, the rate of GST had gone up to Rs10.40 per litre. New rates of GST on HSD, HOBC, kerosene oil and LDO stand at Rs29.57, Rs18.57, Rs10.40 and Rs9.63 per litre, respectively, according to a notification issued on January 29.

Due to a change in the GST fixing mechanism, the government has deprived consumers of a relief by Rs3.81 per litre on petrol, Rs8.28 per litre on HSD, Rs8.37 per litre on HOBC, Rs4.87 per litre on kerosene oil and Rs3.29 per litre on LDO.

In addition to the GST, government is collecting petroleum levy on petroleum products which stands at Rs8 per litre on diesel, Rs10 per litre on petrol and Rs6.50 per litre on kerosene oil.

Experts are of the view that government should keep oil prices unchanged to collect money. But this money should be spent on building oil storages in the country.

However, it is clear that this money will be spent on bridging the budget deficit as the government did in the case of the Gas Infrastructure Development Cess.

Published in The Express Tribune, January 31st, 2016.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ