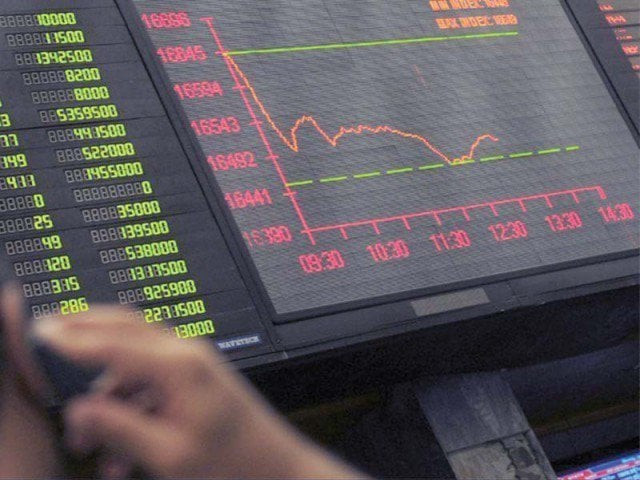

Market watch: Index ends negative amid profit-booking

Benchmark KSE-100 index falls 163.41 points

Benchmark

KSE-100 index

falls 163.41 points.

Investors seemed eager to cash in whatever gains they made to put the index under pressure. Disappointing export figures and depressed oil prices meant bulls remained on the sidelines.

At close on Friday, the Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 0.49% or 163.41 points to end at 33,048.51.

JS Global analyst Arhum Ghous said profit taking was witnessed across the board.

“Investors preferred to book profits ahead of the weekend, while speculation over increase in interest rates by Fed in the coming week also kept investors cautious.

“Oil sector remained depressed due to tanking international oil prices as Pakistan Oilfields Limited (POL) and Pakistan Petroleum Limited (PPL) closed down 2.5% and 1.8%, respectively.”

Meanwhile Global Research’s report stated that the KSE-100 index finally succumbed to selling pressure losing a portion of recovered grounds.

“During the first half, the index traded within a narrow band for majority of the session, maintaining yesterday’s level. The market, however, plummeted by 165 points within the opening minutes of the second half after news broke over certain details related to Dr Asim’s investigation, causing cautious investors to liquidate their positions and book profits.

“The oil sector continued to underperform as investors tracked depressed international crude prices, with WTI and Brent falling by 1.5% and 1.71%, respectively.

“Index heavyweights, Nestle (-5.00%), MCB (-1.04%), Engro (-1.35%) and PPL (-1.82%) cumulatively caused the index to erode 81 points. Mari Petroleum (+5.00%) continued its upper cap spree for 5th consecutive day after the news of additional flows of 200mmcfd and an application for incremental flows to benefit from 2012 policy.”

Trade volumes rose to 189 million shares compared with Thursday’s tally of 171 million shares.

Shares of 323 companies were traded on Friday. At the end of the day, 109 stocks closed higher, 193 declined while 21 remained unchanged. The value of shares traded during the day was Rs7.9 billion.

Bank of Punjab was the volume leader with 45.3 million shares, losing Rs0.54 to finish at Rs9.73. It was followed by Sui Southern Gas Company with 28.1 million shares, gaining Rs0.62 to close at Rs44.55 and TRG Pakistan with 9.2 million shares, losing Rs0.41 to close at Rs37.54.

Foreign institutional investors were net sellers of Rs317 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 12th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ