Stories from Bilal Umar

More News

-

Weekly review: Bourse kicks off new year on a negative note

Gas price hike and foreign outflow dampen investor sentiments.

-

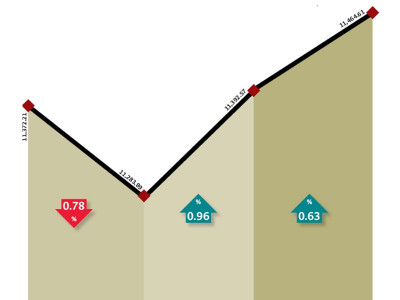

Weekly review: Stock market makes modest recovery

President’s return along with proposed relaxation in Capital Gains Tax helps the index climb.

-

Weekly Review: Politics and fertiliser sector keep KSE-100 at bay

Index fails to make solid gains while volumes improve 17%.

-

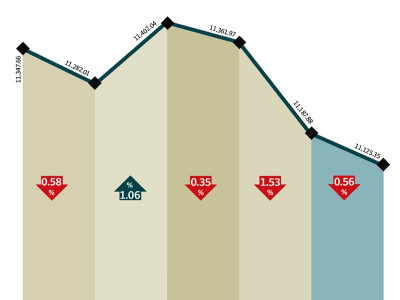

Weekly review: KSE-100’s slump continues as volumes dwindle further

Benchmark index drops 2.4% during a dull week for traders.

-

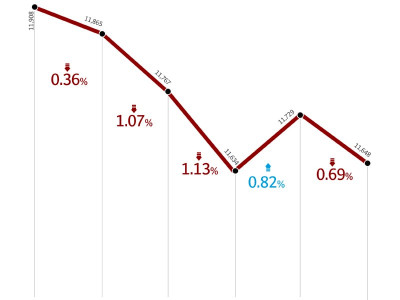

Weekly review: KSE-100 sheds 0.7% amid falling volumes

Index remains range-bound due to lack of triggers.

-

Weekly review: Market fails to surge despite strong corporate results

Growth remains stagnant as foreigners continue to remain net sellers.

-

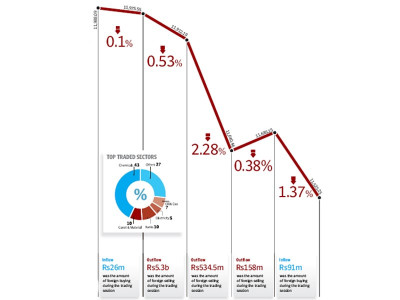

Weekly review: Corporate results fail to lift stock market

KSE’s benchmark 100-share index sheds 463 points as foreigners continue to sell.

-

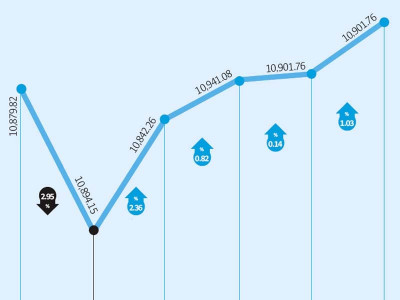

Weekly review: Discount rate cut sparks rally at bourse

Volumes increase 66 per cent as KSE-100 index gains 134 points.

-

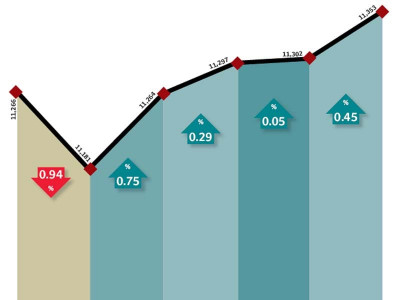

Weekly review: KSE gains despite Pak-US tensions

Expectation of a discount rate cut provided stimulus to the market.

-

Weekly review: KSE-100 recovery continues despite global economic concerns

Volumes fall sharply as results season culminates and monsoons hit Karachi.