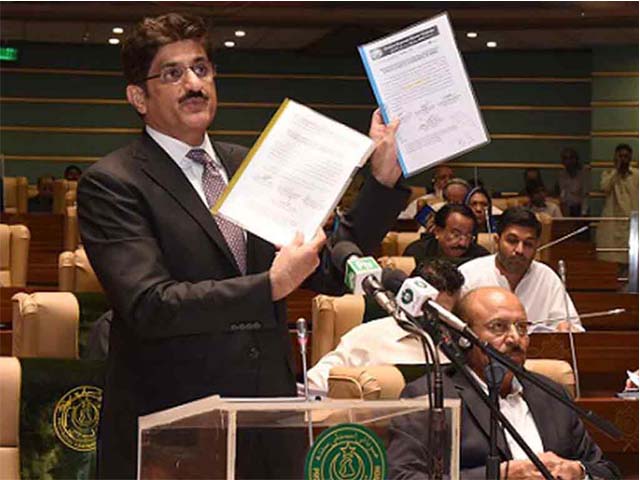

In the budget speech Chief Minister Syed Murad Ali Shah noted that the current fiscal year has been a year of phenomenal changes both within and outside the country. PHOTO: APP

Dear Murad Ali Shah, do you even know what Sindh’s tax collectors are upto?

Do you know that there are hundreds of restaurants in Karachi alone whose owners don’t pay sales tax?

Dear Murad Ali Shah,

It is well known that if you want to get anything done in your province, you have to pay the right people. In most cases, the right people are the ‘baboos’ as they are the ones who can skilfully insert whatever you want in any document knowing that the person who approves it will do so without reading it.

Sometimes, if a baboo is not paid anything or not paid what he wants, he can do the opposite; he can get a tax imposed or increased on a particular commodity or service. This is what seems to have happened in the recently announced Sindh budget. Sindh now has the dubious distinction of being the only province in the country which recovers sales tax from the fledgling Information Technology (IT) services business. Even the federal government has exempted the IT sector from taxes. So what’s the aim of this harassment, do you want to kill the IT business or drive it away to the other provinces? If I were you, I would immediately transfer the baboo or whoever is responsible for this to the remotest corner of the province (where he will not be able to earn the millions he is doing now).

Sir, your recent budget has a deficit of Rs14 billion, which means that your expenditure for the year will be greater than your revenue by that amount. Being the finance minister of the province, you should realise that this deficit should be reduced to the minimum, if not eliminated entirely. I can, however, show you how it’s done, and how your budget can be converted to a surplus budget. I will not charge you anything for my advice. I only request that the extra money be spent to help save the starving people of Thar. And you might consider spending a few billion to clean up Karachi (which contributes 96% of Sindh’s revenue).

You can begin with restaurants. Do you know that there are hundreds of restaurants in Karachi alone whose owners don’t pay sales tax? Those that are registered with the sales tax department pay only a token amount which is a few thousand rupees to the government every year. They can get away with this robbery by bribing your sales tax collection staff heavily. To increase the revenue from such restaurants (many of which serve more than five hundred customers a day), all you have to do is to hire honest people to monitor the sales of these restaurants.

Obviously, you can’t ask your sales tax department personnel to do so, since they are already taking millions from the restaurant owners to look the other way. I suggest that you hire eunuchs who are erroneously called ‘transvestites’ to do the job. They should be persuaded to stop begging, and you can employ them to report how many customers eat daily at the restaurants in the province. This data can be compared with that submitted by the restaurant owners. You will be shocked at the large scale evasion of sales tax, if you don’t know that already. I’m sure the eunuchs will do a better job than Sindh government employees, and the amount recovered as sales tax from restaurants will increase to at least 25 times of what is collected today.

Coming to the most lucrative of them all; the property sector. Of course you must have some idea of the loot and plunder going on in the sale and purchase of property in Karachi. Your predecessor took over the Karachi Building Control Authority (KBCA) and renamed it the Sindh Building Control Authority (SBCA), so that the taxes recovered from this sector would not be spent on Karachi. Out of the 25 directors in this authority, 21 are working in Karachi.

The price of a 500-square yard plot in Karachi is Rs70 million (equivalent to Rs140, 000 per square yard). However, the value fixed by your government (known as District Collector (DC) value) is only Rs1,980 per square yard. Your government therefore receives only Rs49, 500 as tax and stamp duty instead of Rs3,500,000 (which would have been the tax, if levied on the actual price). So, every time a 500-square yard plot in Karachi changes hands, the government loses Rs3,450,500.

Since hundreds of transactions take place in Karachi every day, the Sindh government loses billions every year. My estimate is Rs500 billion at least, if not more. If the DCs don’t know the actual value of properties, they can visit web sites like zameen.com, and they will get a good idea of the quantum of taxes the property sector mafia is evading. And if the DCs refuse to levy taxes on the actual property values, you can conclude that they too are in collusion with the mafia and making millions every year.

Sir, if you do what I have suggested, you will be able to change the face of Sindh. Please, for once do the right thing, don’t be afraid of those who will be affected. Stop the loot and plunder, recover the due taxes from these two sectors and soon Sindh will become the richest province in the country.

COMMENTS (3)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ