Weekly review: Index remains upbeat, climbs 541 points

Landmark Chinese investment, banking sector rally fuel gains

Landmark Chinese investment, banking sector rally fuel gains.

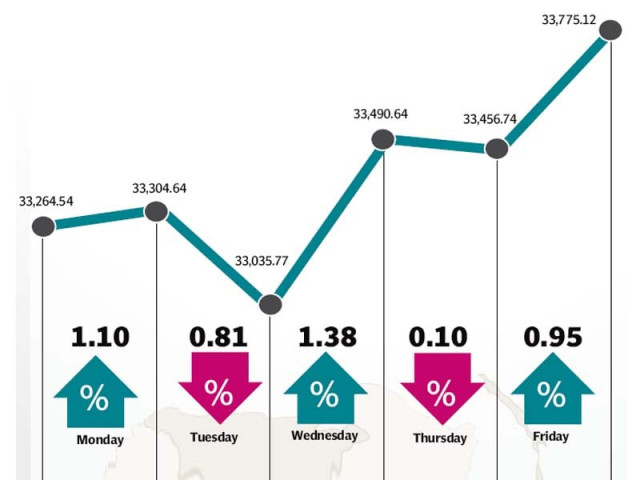

The stock market continued its upward trajectory, looking set to climb to new highs after the benchmark KSE-100 index posted gains of 541 points (1.6%) to close at 33,775 during the week ended April 24.

The gains came on the back of a landmark visit of the Chinese President Xi Jinping to the country and an onslaught of market-beating corporate results which created excitement at the bourse. Impressive macroeconomic data and foreign buying also lifted market sentiments.

The KSE-100’s latest gains have propelled it 17.8% higher since hitting its 2015 low of 28,648 points at the end of March. The impressive rally looks set to continue as companies announce their results for the quarter ended March 30 and the index is poised to climb to a new record high in the coming weeks.

The week started off on a positive note with the Chinese President announcing an investment of more than $46 billion in the country aimed at solving Pakistan’s energy crisis and building infrastructure to connect China with the port city of Gwadar.

The materialisation of the visit and the announcement of deals were well received by investors and have been hailed as a potential game-changer for the country in the coming years.

With the earnings season in full flow, sector-specific activity kicked in with the banking sector leading the way providing the biggest boost to the market.

The sector contributed 413 points to the KSE-100’s gains during the week with UBL and MCB Bank alone contributing 135 points and 124 points, respectively, to the KSE-100’s gains.

Similarly, the cement, fertiliser and automotive sectors were also in the limelight after posting impressive results. Lucky Cement and Engro Fertilizers led the way for their respective sectors while Pak Suzuki and Ghandara Nissan posted earnings 2 times and 3 times over the previous year, respectively.

To further add to the excitement, some impressive macroeconomic data came to light as the current account posted a surplus of $200 million on the back of strong remittances ($1.58 billion) in March. The country’s foreign exchange reserves also shot up by $673 million to a 3-year high of $17.5 billion.

A major concern for local investors was also alleviated with foreigners continuing to be net buyers at the bourse. Foreigners purchased a net of $7.7 million worth of equity, following up on the $7.5 million buying in the previous week.

Average trading volumes improved 11% and were recorded at 328.7 million shares traded per day. Similarly average daily values also rose 17% and stood at Rs16.77 billion. The Karachi Stock Exchange’s market capitalisation stood at Rs7.29 trillion ($71.9 billion) at the end of the week.

Winners of the week

Bank Al‐Falah Limited

Bank Alfalah Ltd. provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

United Bank Limited

United Bank Ltd. provides commercial banking and related services. The Bank offers a wide range of banking and financial services, including brokerage services.

Bank Of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial bank services.

Losers of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Nishat (Chunian) Limited

Nishat Chunian Limited manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing, and finishing units.

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Published in The Express Tribune, April 26th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ