Weekly review: KSE-100 plummets 1,842 points as investors panic

Positive news flows failed to stop bearish tide as index fell below 30,000.

Positive news flows failed to stop bearish tide as index fell below 30,000.

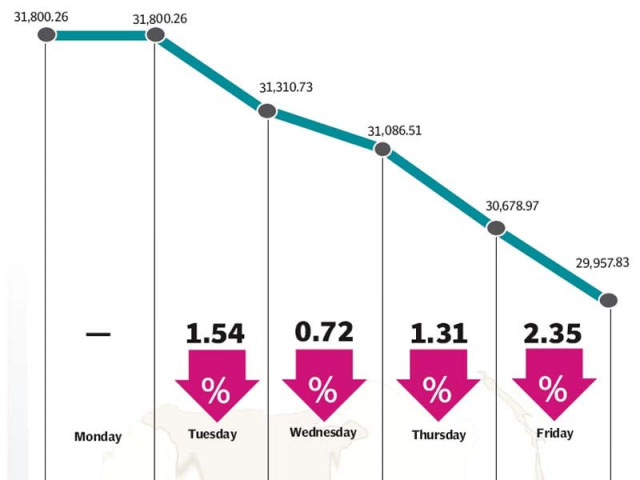

Carnage was one word to sum up the performance of the stock market as panic-struck investors offloaded their investments, resulting in the benchmark KSE-100 index plummeting 1,842 points (5.8%) to close at 29,957 during the week ended March 27.

It was the KSE-100’s worst single-week performance since July 2011 as the index fell for four successive days in a shortened week due to the Pakistan Day holiday. The dreadful performance came despite a series of positive news flows, which would have, otherwise, provided a boost to the market.

It was somewhat of a sign of things to come that the KSE-100 index fell below the crucial 30,000 point barrier on Friday. The sell-off was witnessed across the board with the market failing to react to the discount rate cut, an improved credit rating by Moody’s and a sudden spike in global oil prices.

Local institutional and individual selling was the biggest cause of the decline as investors resorted to panic selling in light of continued foreign selling, especially after the announcement of a leading foreign hedge fund winding up its investments in emerging markets.

Foreigners, too, contributed to the market’s ill fortune as they continued to offload their positions at the bourse. Foreigners sold a net of $15 million worth of equity during the week, bringing the monthly total outflow to $72 million.

The State Bank of Pakistan’s (SBP) decision to cut the discount rate by 50 basis points over the weekend failed to have any positive impact on the bourse as the KSE-100 index opened the week with a sharp decline. The SBP’s latest discount rate cut has brought down the rate to 8% from 10% in November 2014.

During the week, Moody’s announced that it was improving Pakistan’s rating from a stable to a positive outlook, but investors paid no heed to the announcement as the market continued to plummet downwards. Moody’s also downgraded the rating of Pakistani banks, which had a negative impact on the banking sector.

The oil and gas sector also failed to benefit from the sudden spike in oil prices after Saudi Arabia launched a military operation against Yemen. The sector, however, did manage to outperform the broader market and also received a boost from the OGDC’s discovery of oil at the Palli field.

Average trading volumes shot up by 23.7% to 174.7 million shares traded per day as selling pressure built up at the bourse. However, average daily values only improved 11.7% and were recorded at Rs9.43 billion daily. The Karachi Stock Exchange’s market capitalisation fell Rs343 billlion and ended the week at Rs6.71 trillion ($67.30 billion).

What to expect?

The KSE-100 index has dropped approximately 13% since the start of February. The declines have been sentiment driven while fundamentals remain largely intact. With blue-chip stocks approaching attractive valuations, a relief rally can be expected in the coming weeks.

Winners of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the Group’s bottles and jars.

Pakgen Power Limited

Pakgen Power Limited generates and distributes electricity. The company operates an oil-fired electricity generating plant in Mehmood Kot - Muzaffargarh, Punjab.

Losers of the week

Bank of Punjab

The Bank of Punjab operates under the status of a scheduled bank in Pakistan. The bank provides commercial banking services.

Packages Limited

Packages Limited manufactures and sells paper, tissue products, paper board and packaging materials. The Group has joint venture agreements with Tetra Pak International, to manufacture paper for liquid food packaging, the Mitsubishi Corporation, to manufacture polypropylene films, and Printcare (Ceylon) Limited, to produce flexible packaging materials in Sri Lanka.

Kohinoor Textile

Kohinoor Textile Mills Limited produces textiles. The company weaves, dyes, and prints natural and synthetic fibres.

Published in The Express Tribune, March 29th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ