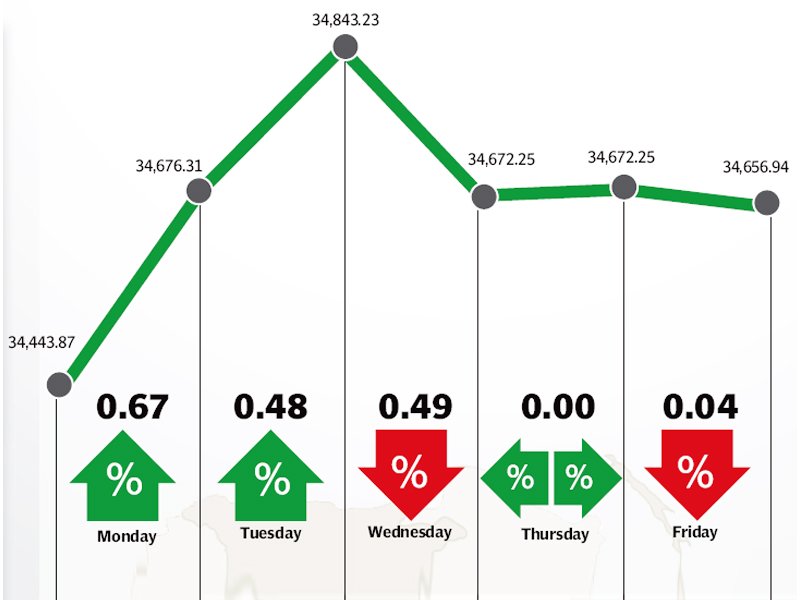

The stock market continued its upward trend following the announcement of low inflation figures for the month of January 2015, which resulted in the benchmark KSE-100 index climbing 213 points (0.6%) to close at a new all-time high of 34,656 points on Friday.

A sharp rebound in crude oil prices over the past week resulted in a lot of trading in the heavyweight oil and gas sector which aided the index’s gains. However, low inflation figures put pressure on the banking sector which was the main laggard of the week.

The week started off on a positive note following the announcement of inflation figures for January 2015, which clocked up at 3.88%, down from 4.3% in December 2014. The inflation numbers have been on a constant decline since the start of the year and are expected to come down further as the impact of reduced prices of petroleum products is felt.

The extremely low numbers gave investors hope of a further discount rate cut in the monetary policy announcement in March. The State Bank slashed the discount rate by 100 basis points to 8.5% in its last policy announcement in January.

A rebound in global crude oil prices was also witnessed during the week with the price of Brent crude jumping from $45 to $55 and resulting in recovery in the oil and gas sector. The sector as a whole contributed 184 points to the KSE-100’s gains with Pakistan Oilfields leading the way with a 5.9% rise, followed by PPL and OGDC with gains of 4.4% and 2.9% respectively.

The cement sector maintained its strong performance after the release of sales figures for January 2015, which were up 6.2% year-on-year, due to strong local demand.

Maple Leaf Cement and Fauji Cement were the star performers with gains of 7.7% and 6.9% respectively, while Lucky Cement also put in a strong performance, climbing 2% during the week.

The lower inflation figures were bad news for the banking sector as another rate cut is now on the cards which is likely to put further pressure on the already squeezed spreads of banks. United Bank Limited and MCB Bank were the biggest underperformers and knocked 143 points off the KSE-100 index over the course of the week.

Foreigners turned net sellers this week primarily due to K-Electric’s sponsors offloading 774.6 million shares of the utility in the local market. Net outflow for the week was recorded at $51.5 million as compared to an inflow of $3.3 million in the preceding week.

Average trading volumes improved 9.9% and stood at 327.9 million shares per day. Average daily values also rose 2.5% and stood at Rs19.91 billion. The Karachi Stock Exchange’s market capitalisation stood at Rs7.85 trillion ($77.65 billion) at the end of the week.

Winners of the week

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Pakistan State Oil

Pakistan State Oil Company Limited specialises in the marketing and storage of petroleum and related products. The company also blends and markets lubricating oils.

Avanceon Limited

Avanceon Limited serves a wide range of industries including, food and beverage, life sciences, waste water, oil and gas, fertiliser, chemicals and many others.

Losers of the week

Century Paper

Century Paper and Board Mills Limited manufactures and distributes different varieties of paper, paperboards and related products. The company also manufactures paper pulp, wood pulp and fibrous pulp. Century Paper also has a subsidiary that is engaged in the power generation business.

Sui Northern Gas Pipelines

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes, and supplies natural gas, in addition to marketing Liquefied Petroleum Gas.

Bata Pakistan

Bata Pakistan Limited manufactures and sells rubber, leather, and microlon sandals and shoes.

Published in The Express Tribune, February 8th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ