Market watch: Profit-taking drags index into red

Benchmark KSE-100 index decreases 250.11 points .

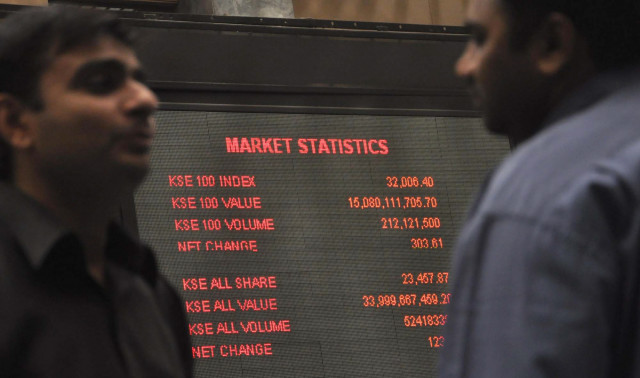

At close, the Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 0.78% or 250.11 points to end at 31,756.29.

Elixir Securities analyst Harris Ahmed Batla said investors opted to book profits in the latter half.

“Selling in the latter half of the session pulled the index in red with Pakistan Petroleum (PPL-2.2%), recording its recent low keeping other oil names under pressure.

“Engro Corporation (ENGRO -1.16%) has gained around 30% in the last six sessions, while cement plays namely Pioneer Cement (PIOC -4.3%) DG Khan Cement (DGKC -1.5%) and Cherat Cement (CHCC -3.7%) also witnessed profit booking.

“We expect the market to remain volatile and resist near 32k with financials namely National Bank of Pakistan, MCB and Bank Alfalah Limited likely generating interest while broader continues to track flows.”

JS Global analyst Arhum Ghous said Hascol hit its upper circuit due to optimism of investors towards a better fourth quarter earnings as oil margin companies (OMC) margins have been approved.

“Cherat Packaging (CPPL) witnessed euphoric growth due to cost reduction programme and expanding sales pool to Africa and Europe region.”

Ghous said, going forward, the market was expected to rally further as space is still left caused by recent discount rate cut.

Trade volumes fell to 282 million shares compared to 312 million on Tuesday.

Shares of 379 companies were traded on Wednesday. Of these, 262 companies declined, 99 closed higher while 18 remained unchanged. The value of shares traded during the day was Rs17.8 billion.

Jahangir Siddiqui and Company was the volume leader with 29.8 million shares, gaining Rs0.70 to close at Rs15.29. It was followed by Engro Fertilizer Limited with 15.1 million shares, gaining Rs0.70 to close at Rs66.04 and Maple Leaf Cement with 14.1 million shares, gaining Rs0.08 to close at Rs34.60.

Foreign institutional investors were net buyers of Rs167 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, November 20th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ