Weekly review: Market continues its upward drive

Institutional and foreign buying results in the KSE-100 climbing 531 points.

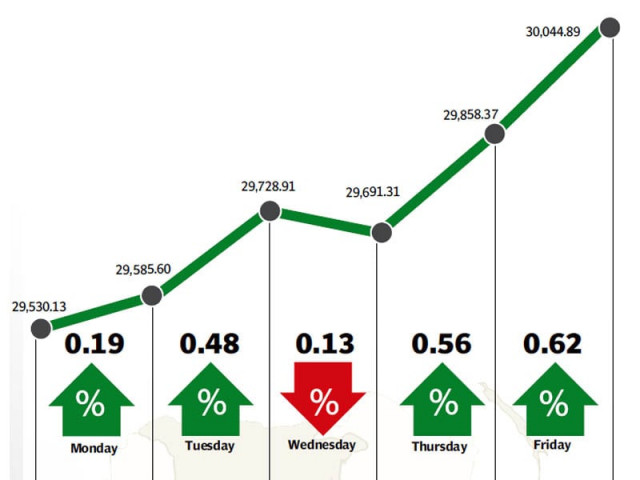

The stock market resumed its upward drive and continued to make up for lost ground as the benchmark KSE-100 index soared 531 points (1.8 percent) to close above the 30,000-point barrier during the week ended September 12.

The index posted a gain of 946 points (3.3 percent) in the previous week and followed it up with another impressive performance as active participation by institutional and foreign buyers helped the index close at 30,044 points on Friday.

Heavy buying in the oil and gas, banking and cement sectors was the highlight of the week as investors shrugged off the ongoing political tension and returned to purchasing stocks.

However, floods in Punjab proved to have a dampening effect and kept trading volumes on a leash.

The week started off on a positive note as the KSE-100 index posted a small gain, setting the trend for the rest of the week. The index maintained a steady rise and closed in the green in four out of the five trading days.

Foreigners and institutional buyers were the major source of buying at the bourse as the former mopped up a net of $18.7 million worth of equity, similar to last week. Institutional buying was also witnessed as the ex-dividend dates for several dividend-bearing shares approach.

The oil and gas sector was the star performer, with both the Oil and Gas Development Company and Pakistan Petroleum Limited outperforming the market. Similarly, the banking sector also claimed its stake as the majority of banks’ share prices climbed following the PIB auction in which yields were on the higher side.

Additionally, the cement sector also posted strong gains, climbing 1.7% as cement offtake remains strong after the slowdown during Ramazan.

The release of the latest macroeconomic information, resulted in mixed responses as remittance figures for the first two months of the current fiscal year jumped up 12.6% and stood at $2.97 billion. However, the country’s trade deficit shot up 28% to $4.24 billion for the same period and was damper to investor sentiment.

With the ongoing political crisis, the government has decided against implementing unpopular policies such as increasing the power tariff by 7% as demanded by the International Monetary Fund (IMF).

As a result, it is highly likely that the IMF will not clear the latest installment of $550 million and will continue to put pressure on the country’s already-depleting foreign exchange reserves.

Average trading volumes dropped 25.9% and stood at 130.6 million shares traded per day, while average daily values also fell 25.4% and were recorded at Rs. 7.0 billion per day. The KSE’s market capitalisation crosses the Rs7-trillion mark and stood at Rs7.01 trillion at the end of the week.

Winners of the week

Hum Network Limited

Hum Network Ltd operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Shifa International Hospitals Limited

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicine, pediatrics, surgical, obstetric and gynecology, dentistry, rehabilitation services and ophthalmology. Its diagnostic services include specialized diagnostics, radiology and clinical laboratory.

Atlas Honda Limited

Atlas Honda Limited manufactures and sells motorcycles and spare parts. The company operates in Pakistan.

Losers of the week

Pakistan Tobacco Limited

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Bata (Limited)

Bata Pakistan Limited manufactures and sells rubber, leather, and microloan sandals and shoes.

NetSol Technology

NetSol Technologies Limited provides information technology solutions and services. The company’s services include custom software development, technology outsourcing, systems integration, application development, and business intelligence consulting.

Published in The Express Tribune, September 14th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

https://i.tribune.com.pk/media/thumbs/logo-tribune1588976358-0-450x300.webp

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ