Weekly review: KSE-100 sheds 228 points during eventful week

Arrest of MQM chief takes shine off budget positives.

Despite the announcement of a relatively business-friendly budget, trading at the bourse turned into a series of highly volatile sessions after the arrest of Muttahida Qaumi Movement chief Altaf Hussain in London.

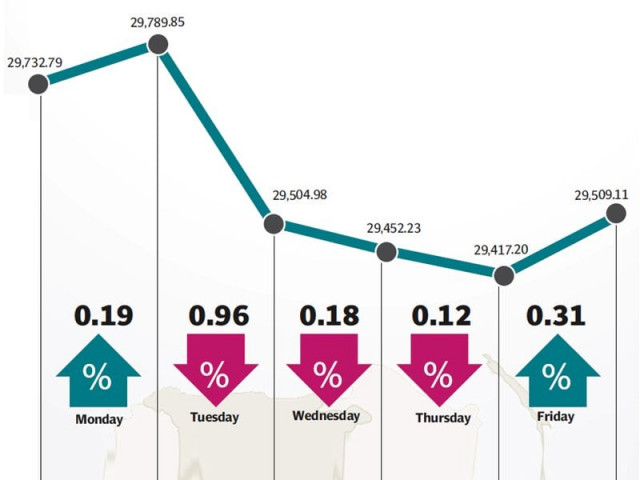

An eventful week came at the stock market came to an end with the benchmark KSE-100 index shedding 228 points (0.8%) as political news cast a shadow over the positives of the budget for fiscal year 2014-15.

Investors were all geared to resume last week’s rally if the budget lived up to their expectations. Yet, despite the announcement of a relatively business-friendly budget, trading at the bourse turned into a series of highly volatile sessions after the arrest of Muttahida Qaumi Movement chief Altaf Hussain in London.

After a slow but positive start to the week, investors keenly awaited the announcement of the budget on Tuesday. However, before the budget could be announced, news emerged that he was taken into custody by the Scotland Yard on charges of money-laundering.

Hussain’s MQM party dominates the political landscape in Karachi and his arrest wreaked havoc in the city and created panic at the bourse. The KSE-100 index nosedived and plummeted more than 800 points within a span of one hour, before recovering to close down by 285 points (1%) on Tuesday.

The budget was also announced that same day and lived up to investor expectations regarding Capital Gains Tax issue (increased to 12.5% instead of 17.5%), the public sector development fund (increased by 25%) and special incentives for the textile industry. Clarity on a number of other taxation issues also boosted investor sentiments.

Under normal circumstance, the budget would have been positively received at the bourse, however, the situation remained tense in Karachi for the following two days and the market remained range-bound before ending the week with a small gain on Friday.

Inflation figure for the month of May also did not help matters after clocking in at 8.3% and above markets expectations. With the inflation rate remaining above 8% consistently for the past few months, it seems less likely that the State Bank will reduce the discount rate in its future monetary policy announcements.

Certain aspects of the budget were also detrimental for the market as the government chose to implement withholding tax on foreign buying at the bourse, which will negatively impact foreign participation and also raised the Gas Infrastructure Development Cess on fuel gas by Rs200/mmbtu which will have a negative impact on business which rely on gas in their manufacturing processes.

Foreign participation remained strong as foreigners were net buyers of $31 million worth of equity. Institutional buying was also strong as they capitalised on the unprecedented drop witnessed at the bourse on Tuesday.

The volatility at the bourse attracted a lot of activity as average daily volumes increased 11% to 261 million shares traded per day. Similarly, average daily value also increased 18.7% to Rs13.24 billion traded per day. The market capitalisation of the Karachi Stock Exchange stood at Rs6.99 trillion at the end of the week.

Winners of the week

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Fauji Cement

Fauji Cement Company Limited manufactures and sells cement.

Grays of Cambridge

Grays of Cambridge (Pakistan) Limited is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

Losers of the week

Engro Corporation

Engro Corporation Limited manufactures and markets fertilisers and plastics, generates electricity, and processes food. The company produces nitrogenous, phosphatic and blended fertilisers, polyvinyl chloride resin, and industrial automation products, develops electricity generating plants, produces dairy foods, and operates a liquefied petroleum gas and liquid chemical terminal.

Hum Network Limited

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Thal Limited

Thal Limited manufactures jute goods. The company also undertakes engineering projects.

Published in The Express Tribune, June 8th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ