Weekly review: KSE-100 closes 219 points lower during volatile week

Investors chose to book profits despite strong corporate results.

Investors chose to book profits despite strong corporate results.

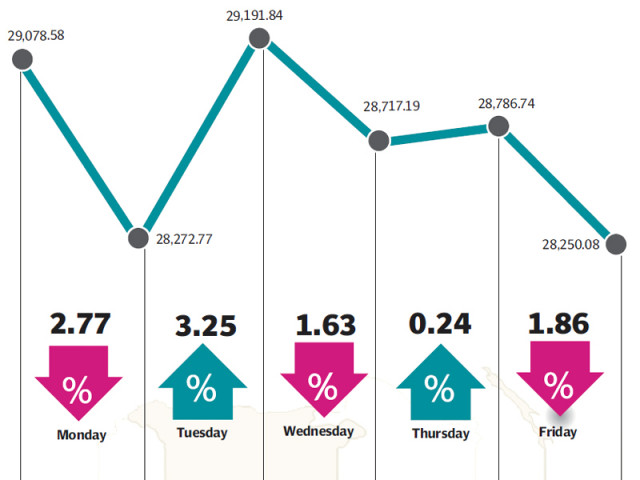

The stock market remained volatile throughout the week as investors chose to book profits amid strong corporate earnings, resulting in the benchmark KSE-100 index closing at 28,850 points, down by 219 (0.8%) over the previous week.

The decline came despite a strong showing by local corporates in their quarterly earnings reports and continued buying by foreign investors. Volumes declined significantly with investors choosing to cherry-pick in all the volatility.

The week started off on a negative note as foreign participation remained low due to the Easter holiday on Monday. The declines were overturned the following day as foreign buying returned and corporate results started to flow in.

Profit-taking kicked in on Wednesday as the marked dropped sharply by 474 points (1.6%) before recovering nominally in the final two days of the week to close at 28,850 points on Friday.

The market’s decline could have been amplified had it not been for a variety of positive news at the bourse. On the macro side, the country’s foreign exchange reserves shot up by $1.9 billion to $11.75 billion. The increase came from the receipt of $2billion from the Eurobond issue and $139 million from the Islamic Development Bank.

The country also successfully completed the 3G spectrum auction in which it received bids totaling $1.1 billion from the auction of 4 licences of in the 3G spectrum and 1 licence in the 4G spectrum. One licence in the 4G spectrum remains unsold and will be auctioned at a later date. The receipts from the auction will add to the country’s growing forex reserves.

Foreigners also returned in force and were net buyers of $18.5 million worth of equity during the week, up from $7.5 million in the previous week. It was foreign buying which helped the bourse close in the green in the final two trading days.

Sector-specific news was also positive as corporates announced their earnings for the quarter ended March 31. Cements led the way with Lucky Cement reporting earnings growth of 17%, along with strong results from smaller players like Maple Leaf and Fauji Cement Limited.

Banks also continued to perform strongly and attracted buying on improved earnings outlook on the back of the recent Pakistan Investment Bond (PIB) purchasing spree. This week’s PIB auction was also oversubscribed, and the government raised Rs425 billion by issuing PIBs with yields between 12.1% and 12.9%.

The fertiliser sector, however, came under pressure as Engro Fertilizer reported lower than expected earnings, resulting in a decline in its share price.

Average daily volumes dropped sharply by 43% and stood at 209 million shares traded per day. Similarly, average daily values also plummeted and stood Rs9.87 billion traded per day, down 30% over the previous week. The market capitalisation of the KSE stood at Rs6.90 trillion at the end of the week.

Winners of the week

Kohinoor Energy Limited

Kohinoor Energy Limited owns and operates a 120MW, net capacity power plant, which is based on furnace oil fired diesel engines.

Packages Limited

Packages Limited manufactures and sells paper, tissue products, paperboard and packaging materials. The group has joint venture agreements with Tetra Pak International, to manufacture paper for liquid food packaging, the Mitsubishi Corporation, to manufacture polypropylene films, and Printcare (Ceylon) Limited, to produce flexible packaging materials in Sri Lanka.

Abbott Laboratories

Abbott Laboratories (Pakistan) Limited manufactures, imports, and markets research based pharmaceutical, nutritional, diagnostic, hospital, and consumer products. The company’s key products include antibiotics for respiratory tract infections, peptic ulcer disease, and dental infections.

Losers of the week

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Askari Commercial Bank

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu & Kashmir and Bahrain.

Pakistan International Container Terminal Limited

Pakistan International Container Terminal operates a container shipping facility in Karachi, Pakistan.

Published in The Express Tribune, April 27th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ