The KSE-100 fell victim to regional pressures as stock indices across emerging markets fell as the United States’ Federal Reserve announced a tapering in its bond-buying activities.

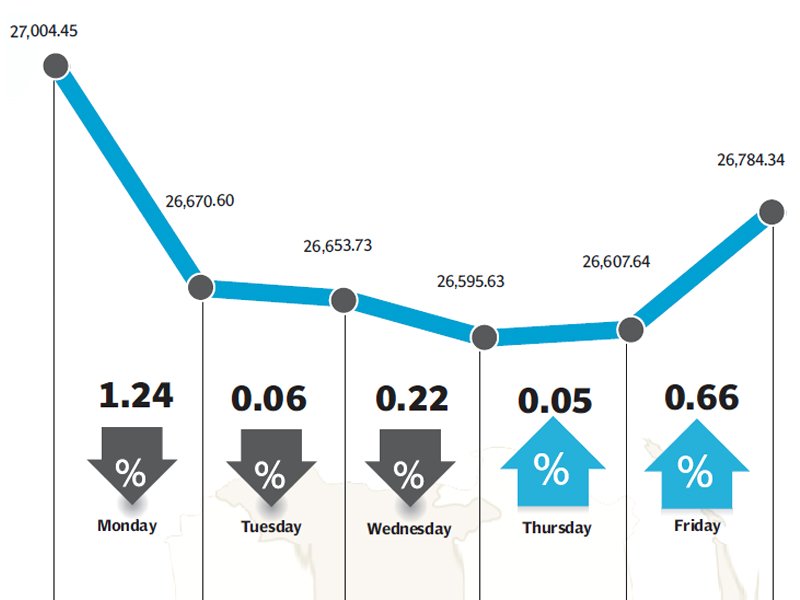

Regional markets fell across the board with losses ranging from 0.4% to 3.5% during the week. The KSE-100 index was relatively unscathed as it suffered a decline of 218 points (0.8%) to close at 26,784, well below the 27,000 mark.

The Fed’s decision caused panic at regional bourses as foreign investors pulled out of their investments in emerging markets. The KSE also felt the impact as net foreign buying stood at only $2.3 million, down from $17.1 million in the previous week.

The KSE-100 index fell marginally throughout the week due to the situation, but managed to claw back on its losses on the final day of the week, in which activity picked up and the index closing in the green on expectations of lower-than-expected inflation numbers for the month of January.

The week had its share of drama, as the governor of the State Bank of Pakistan tendered his resignation during the week, becoming the third successive governor to vacate the position prior to completing his term. The resignations could signal tensions between the central bank and the government about how the fiscal deficit is being managed.

The fiscal deficit for the first six months of the current fiscal year stood at 2.2% of Gross Domestic Product (GDP), showing a marked improvement over the previous year. The improvement was due to a 21% year-on-year growth in non-tax revenue.

However, the country’s macro-economic situation remains precarious as foreign exchange reserves fell below the $8 billion mark to $7.99 billion, a decline of $174.5 million over the previous week’s figures.

There was a silver lining though, as the US is expected to release $345 million to Pakistan next week under the Coalition Support Fund. The government also continued to make progress towards conducting the spectrum auction, from which it expects to raise more than $1 billion in March.

The earning’s season also kicked into full gear as the Fauji Foundation announcing earnings for its companies. While Fauji Fertilizers Bin Qasim disappointed, the parent company Fauji Fertilizers provided a positive surprise with its above-expectations dividend payout.

The companies’ share price came under pressure due to profit-taking following the results announcement, with FFC and FFBL ending the week down by 3.4 and 3.3% respectively.

Average trading volumes fell slightly by 3.5% and stood at 299.5 million shares traded per day. However, average daily values fell 23.5% and stood at Rs8.8 billion, reflecting investor preference towards second and third-tier stocks. The market capitalisation of the KSE stood at Rs6.60 trillion at the end of the week.

Winners of the week

IGI Insurance

International General Insurance Company of Pakistan Limited provides property and casualty insurance products and services. The company’s products include fire, marine, and motor insurance.

Feroze1888

Feroze1888 is a manufacturer and an exporter of specialised yarn and textile terry products in Pakistan.

Nestle Pakistan Limited

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Losers of the week

Pak Cables

Pakistan Cables Limited manufactures and distributes copper rods, wires, cables and conductors, aluminium profiles and anodised fabrications.

Rafhan Maize

Rafhan Maize Products Company produces corn oil, industrial starches, liquid glucose, dextrin, gluten meals, and other corn related products. The company also produces a wide range of co-products such as gluten feeds, meals, and hydrol.

TPL Trakker Limited

TPL Trakker Limited is a vehicle tracking and fleet management service provider for markets in the Middle East and South Asian (MESA) region. The company’s business is to supply GPS, GSM and satellite mobile asset tracking, management and information solutions.

Published in The Express Tribune, February 2nd 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1714129906-0/Clint-Eastwood-(1)1714129906-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ