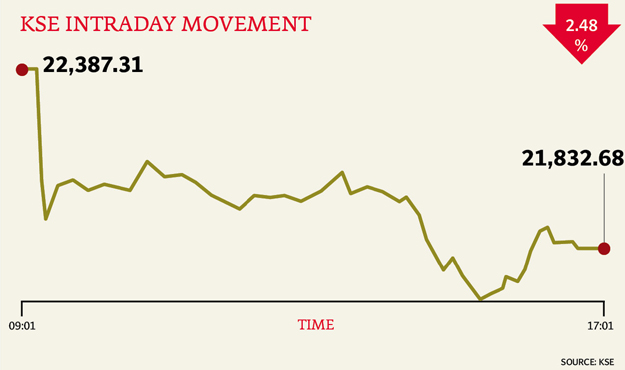

The Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 2.48% or 554.63 points to end at 21,832 points.

“The market continued on a downward spiral as the State Bank of Pakistan’s surprise move to raise the minimum deposit rate by 50bps and link it to the repo rate continued to send shockwaves of negativity throughout the market” said Adeel Jafri of JS Global.

“Participants had placed heavy bets on the banks to lead the market following an upturn in interest rates but the regulator’s action to clamp banking spreads decimated the investment case in the sector. The fallout of the sector hit other stocks as well due to rampant margin calls hitting leveraged participants,” Jafri added.

“Pakistan equities continued with the bearish momentum from last week, plunging a shocking 700 points during the day as panic selling ensued by banks managed to dampen investor sentiments throughout,” said Muhammad Raza Rajwani of Elixir Securities.

“The index however managed some recovery, closing 550 points in the negative as late buying in value stocks restored some momentum. Leading the decline were mainly financials, namely MCB Bank (MCB PA -5%), United Bank (UBL PA -3.8%), National Bank (NBP PA -5%) as investors who were long financials, expecting monetary tightening ahead, rushed to trim their positions post the 50bps hike in the minimum savings rate. The broader market followed suit, as margin calls in leveraged portfolios and trading by momentum traders extended market decline with index heavy oil stocks and cements sector companies taking the plunge,” Rajwani added.

Trade jumped to 208 million shares compared with Friday’s tally of 163 million shares.

Shares of 335 companies were traded on Monday. At the end of the day 83 stocks closed higher, 230 declined while 22 remained unchanged. The value of shares traded during the day was Rs7.1 billion.

Bank of Punjab was the volume leader with 17.8 million shares losing Rs0.83 to finish at Rs11. It was followed by Fauji Cement with 13.2 million shares losing Rs0.21 to close at Rs10.85 and National Bank with 11.4 million shares losing Rs2.59 to close at Rs49.29.

Foreign institutional investors were net buyers of Rs65 million, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 1st, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ