Clots in the system: Why a robust regulatory framework has failed to work

It is a well-known maxim that certainty and not quantum of penalty, is more effective.

It is a well-known maxim that certainty, not quantum of penalty is more effective.

Over the last few years, the government of Pakistan has put in place a robust regulatory regime intended to curtail, if not eliminate, trade of illicit cigarettes. These regulations govern each step of cigarette industry’s supply chain including cultivation, crop threshing, procurement of raw materials, manufacturing, transportation, storage, retailing, import and export.

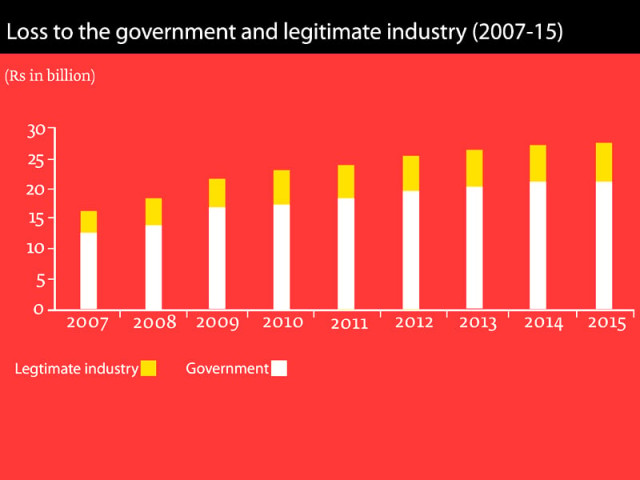

With such comprehensive laws in place, it is indeed unfortunate that Pakistan still faces high illicit cigarette prevalence. The situation suggests inadequate enforcement of existing legislation. It serves as a reminder that the law sans enforcement and monitoring is of little value to society as it fails to fulfill the intended objective. Without a combination of skilled manpower with requisite capacity, enforcement of regulatory framework will continue to remain difficult, even elusive.

Given these systemic issues surrounding illicit cigarette trade in Pakistan, the government will need to execute a comprehensive strategy to effectively tackle the burgeoning problem.

Enhanced regulatory and fiscal measures

Cigarette tax rates should ideally be set to protect public health and to maximise government revenues. When setting taxation policies governments also need to consider factors such as consumer purchasing power, consumer behaviour, magnitude of illicit industry and efficacy and ability of law enforcement agencies.

According to Euromonitor report, research shows that in a country where consumer purchasing power is low and law enforcement is weak, as is the case in Pakistan, high tax rates merely boost illicit sector. From 2001 to 2009, the Malaysian government raised excise taxes on cigarettes by 365%. As a result, duty-paid cigarette volume declined by 23.4% whereas illicit cigarette consumption rose by a staggering 51.7%.

Evidently, tax hikes led to a large increase in illicit volume as law enforcement agencies in Malaysia were unable to control the growth of illicit cigarettes.

As long as there is a gap in law enforcement, tax hikes will only lead to an expansion of illicit cigarette volume instead of reducing smoking prevalence or increasing government revenue. According to World Health Organisation data, global average excise tax burden on lower priced cigarettes is 43.3% whereas in Pakistan excise tax burden in the same category is 52.5%.

Similarly the global excise burden on cigarettes is 49.3% but it is 65% in Pakistan. Unfortunately, these high tax rates have neither been successful in reducing smoking rate nor in reducing revenue loss to the national exchequer in Pakistan.

Consumers are put off by the tax-driven price hikes of legitimate brands. They simply switch to cheaper, readily available alternatives in the black market. In view of the foregoing, moderating cigarette taxes should be a key priority for policymakers, in order to discourage illicit trade.

Stronger enforcement

Currently law enforcement agencies dealing with illicit cigarette trade in Pakistan include the Inland Revenue Service, the Customs Service, the Police, the Federal Investigation Agency and the Rangers. Existence of multiple enforcement agencies dealing with the same subject creates a lack of accountability and makes it difficult to ensure effective coordination. The absence of clear authority and jurisdiction further impedes enforcement.

Instead of multiple agencies dealing with different aspects of illicit cigarette trade, the government could form a single dedicated task force comprising representatives from each agency. This would allow for a more coordinated approach towards the problem as better and more frequent communication can identify overlaps and gaps otherwise left unchecked and unattended.

Government needs to actively initiate enforcement by conducting physical raids on suspected manufacturing units, warehouses and retail outlets, carefully auditing company accounts, and prosecuting violators.

It is an understood maxim of law that it is not the quantum but the certainty of punishment that deters crime. Hence, enforcement must be made certain, persistent and resolute. Most important, strong political will and enhanced resources are needed to eradicate local DNP cigarettes, which have major share of illicit cigarettes.

---------------------------------------------------------------------------------------------------------------------------------------------

[poll id="1211"]

Published in The Express Tribune, September 2nd, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ