KARACHI:

One out of every four cigarettes sold in Pakistan is illicit, according to the Pakistan Tobacco Company’s (PTC) annual report for calendar year 2012.

The sale of illicit cigarettes in the country has increased over 60% in the last five years, the report said, estimating the government could lose up to Rs100 billion, close to $1 billion, in potential revenues by 2017 due to tax evasion.

Illicit tobacco trade includes the supply, distribution and sale of smuggled or counterfeit cigarettes or tobacco products on which applicable duties and taxes have not been paid in the country of consumption, Pakistan in this case.

The unlawful tobacco trade has been of grave concern for the legitimate tobacco industry, the highest taxpaying sector in Pakistan.

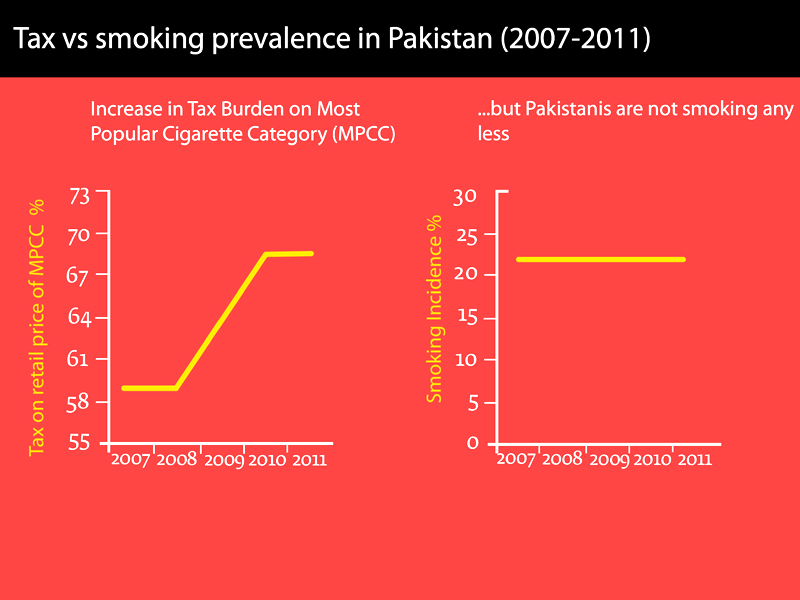

The tax levied on retail price of each packet of cigarettes ranges from 68.5% to 81%, according to PTC, the largest tobacco manufacturer in the country and a subsidiary of British American Tobacco Group.

PTC and Philip Morris Pakistan, the second largest cigarette manufacturer in the country by market share, alone contributed more than Rs72 billion in sales tax, excise duty and income tax to the national exchequer in calendar year 2012.

The industry’s concerns regarding smuggled, counterfeit and tax-evaded tobacco products seem to be true considering it pays all the applicable taxes and duties. By contrast, the government’s inability to curb the illicit trade of tobacco products is not only hurting their business interests but also straining the cash-strapped economy of the country.

The illicit tobacco business, according to PTC, accounts for 18.4% of total cigarette sales in the country, which translates into a loss of over Rs2 billion per annum to the legitimate industry.

The presence of a large unlawful tobacco sector, according to PTC, is holding both the government and the industry from achieving their revenue targets. It is one of the major factors discouraging foreign investment.

The legitimate industry, specifically PTC and PMP, fully endorses Euromonitor’s report on illicit trade, said an industry official, who wished not to be quoted for he was not authorised to comment. “It is a neutral third party report and all of us [the tobacco industry] completely agree with and refer to it,” he said.

The report is very comprehensive and there is not much the industry can add to it, the official said. While highlighting three major issues, he said Pine, a low-end imported cigarette brand, is the major contributor to the illicit trade in Pakistan.

Secondly, Mardan brands in Khyber-Pakhtunkhwa, which produces around three-fourth of the tobacco leaves grown in the country, come under tax evasion category as they don’t pay full tax, the official said.

The third factor, he said, is the illegal units that manufacture counterfeit of the established cigarette brands. The government needs to pay attention to these areas in particular, he suggested.

The Express Tribune visited some tobacco shops and spoke to some consumers and learnt that the smuggled tobacco products – high-end brands such as Benson & Hedges, Dunhill and low-end brands such as Pine and Marlboro Light – are easily available in the market.

“It is of grave concern for the legitimate industry because it hurts the business and at the same time it is a strain on our economy, which desperately needs to raise tax revenues,” the official said.

---------------------------------------------------------------------------------------------------------------------------------------------

[poll id="1211"]

Published in The Express Tribune, September 2nd, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

The illicit manufacture, smuggling and trade of cigarettes speaks the volume of prevailing corrupt activities hurts the interests of genuine manufacturers and the national exchequer and oh also the health of the consumer with varying degree. But corruption is the most hated and simultaneously desired activities.