Market watch: Energy, power stocks fall amid pessimism

Heavy foreign selling on Friday dampened investor sentiment.

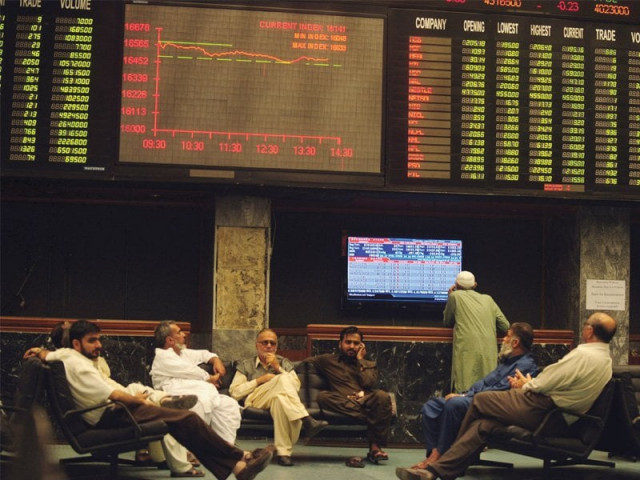

Heavy foreign selling on Friday dampened investor sentiment. PHOTO: AFP

Samar Iqbal, Topline Securities’ senior manager equity sales, commented that heavy selling by foreigners on Friday made market participants sceptical about the days ahead. According to reports, net outflows touched their highest level in three months in last week’s final session.

She observed that the market fell largely because of heavy selling in oil stocks, particularly of Oil and Gas Development Company and MCB Bank, both heavily weighted stocks.

The Karachi Stock Exchange’s (KSE) benchmark 100-share index dropped 1.44% or 325.18 points to end at 22,216.46 points. Trade volumes plunged to 378 million shares compared with Friday’s tally of 489 million shares. The value of shares traded during the day was Rs8.31 billion.

“The first day of the week witnessed profit-taking mainly in energy and oil shares,” echoed Elixir Securities analyst Fareesa Baig, “as Pakistan State Oil shed 2.4% and Oil and Gas Development Company declined 2.8% on reported foreign selling.”

“The downward spiral was pushed further by selling in cement stocks on rumours of a possible ban on import of Pakistani cement by Afghanistan,” she continued. “However, financials, mainly lagging banks, managed to generate investor interest and closed positive ahead of the monetary policy announcement expected later this week.”

Shares of 358 companies were traded on Monday. At the end of the day, 123 stocks closed higher, 193 declined and 42 remained unchanged.

Bank of Punjab (rights issue) was the volume leader with 112.23 million shares, gaining Rs0.89 to finish at Rs3.78. It was followed by Maple Leaf Cement with 24.84 million shares, losing Rs0.50 to close at Rs24.20 and Fauji Cement with 24.36 million shares, losing Rs0.29 to close at Rs13.07.

“Positive interest was seen in the banking sector, where expectations are that the minimum deposit rate will be revised downwards,” explained Fahad Ali, analyst at Elixir Securities.

Foreign institutional investors were once again net sellers, offloading Rs199.08 million worth of shares, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, June 18th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ