Weekly review: Bourse climbs as new government vows to end energy crisis

President’s refusal to sign tax amendments aided the index’s growth.

President’s refusal to sign tax amendments aided the index’s growth.

According to news reports, the incoming government, led by Nawaz Sharif’s Pakistan Muslim League-Nawaz, is already working hard to chalk out a strategy to bring short and long-term solutions to the country’s crippling energy crisis.

A report from KASB Securities noted that PML-N intends to raise Rs500 billion by issuing treasury bills within the first 100 days of it coming into power to eliminate the circular debt in the energy sector. This will enable reactivation of around 2,000-3,000 megawatts of power supply which is going unutilised due to lack of cash flows with power producers.

Sharif also held a press conference during the week and stated that his government plans to tackle the electricity and gas shortages by building more dams and consuming coal for thermal energy. This will allow a more long-term solution to the energy crisis.

The developments lured investors towards the heavy-weight energy sector at the bourse, with state-owned companies like Pakistan State Oil and the Oil and Gas Development Company being the major beneficiaries, climbing 6.6% and 5.4% respectively during the week.

The index’s growth was also aided by the fact that President Asif Ali Zardari returned the draft of tax amendments to parliament without signing it. The amendments were aimed at increasing taxation for the auto, fertiliser, cement and textile sectors. They will now be discussed by new parliament before they are ratified.

The market was also buoyed by expectations of a discount rate cut by the State Bank of Pakistan in June. The T-bill auction held on Thursday saw cut-off rates decline by 4-6 basis points and skewed heavily towards the 12-month bills, indicating that banks expect a rate cut in the short term.

Foreign inflow also remained strong as foreigners were net buyers of $11.8 million worth of equity during the week. The country’s foreign exchange reserves also increased $190 million to $11.62 billion, according to latest figures from the SBP.

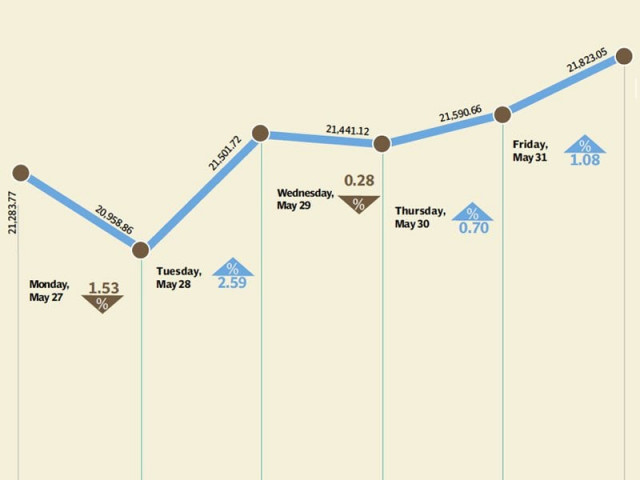

Average trading volumes were up 5.2% to stand at 461 million shares per day. Average daily value dropped 20.4% and stood at Rs11.16 billion. Market capitalisation rose 2.7% to Rs5.29 trillion by the end of the week.

Inflation numbers for May will be announced during the coming week and will be watched closely by investors as a clue to a potential discount rate cut. However, investors should also tread cautiously as the market appears to be overbought at this stage and a strong correction can be anticipated in coming weeks.

Winners

Fauji Cement

Fauji Cement Company Limited manufactures and sells cement.

Askari Bank

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu, Kashmir and Bahrain.

Pakistan Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Losers

Grays of Cambridge

Grays of Cambridge (Pakistan) is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

JDW Sugar

JDW Sugar Mills produces and sells crystalline sugar. The company is located in Rahimyar Khan, and was formerly named United Sugar Mills Limited.

Abbott Laboratories

Abbott Laboratories (Pakistan) manufactures, imports, and markets research-based pharmaceutical, nutritional, diagnostic, hospital, and consumer products.

Published in The Express Tribune, June 2nd, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ