The stock market showed no signs of slowing down and hit a new all-time high in anticipation of strong corporate earnings as the benchmark KSE-100 index gained 212 points (1.2%) to close at 14,478 points during the week ended February 8.

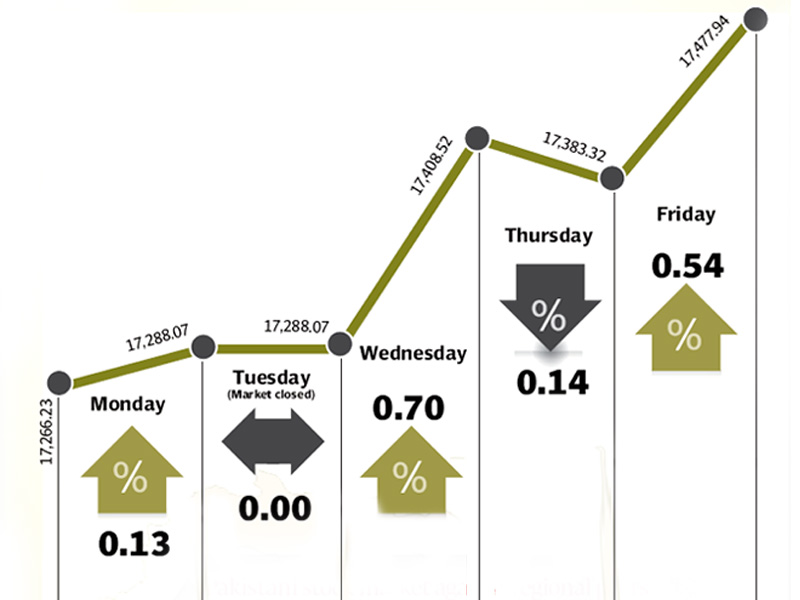

The index has not looked back since falling sharply to 16,000 points in mid-January, amidst Dr Tahirul Qadri’s long march and the court order to arrest the prime minister over the rental power projects scandal. Since then, the index has clawed back, crossing the 17,000-point barrier and has yet to show signs of slowing down.

With the corporate earnings season in full flow, the market was provided a boost by strong earnings expectations from the banking, cement and telecom sectors. Volumes surged 35% to 292 million shares traded per day during the week, representing high investor participation in the market.

The market was also aided by the relative lull in the political scenario as the dual-office case of President Asif Zardari came to an amicable conclusion after the Lahore High Court accepted the president’s written statement that the presidency will not be used for political activities.

There were major corporate developments as well, as the Fauji Group, comprising Fauji Fertilizers, Fauji Fertilizers Bin Qasim and the Fauji Foundation, entered into an agreement with the Army Welfare Trust for the purchase of a 51% stake in Askari Bank at Rs24.32 per share. Askari Bank rose 6.8% to Rs19.69 during the week.

Furthermore, foreign interest remained high as foreigners purchased shares in the index-heavyweight Oil and Gas Development Company. They bought a net $5.9 million worth of equity during the week, matching the $5.6 million inflow a week earlier.

On the macro front, however, things were a bit gloomy as the country’s foreign exchange reserves dropped $75 million to $13.47 billion. Two payments to the International Monetary Fund amounting to $539 million are also due in February, which will put further pressure on the reserves in coming weeks.

There were rumours that the State Bank of Pakistan (SBP) might cut the discount rate by 50 basis points, but were quelled once the SBP announced the monetary policy at the end of the week and maintained the status quo. The treasury bills auction during the week also resulted in stable yields and negated chances of a rate cut in the near future.

The central bank highlighted a rise in food inflation since the start of the year and also pointed out that the economy was susceptible to external and fiscal pressures. This sentiment was echoed by Moody’s, which maintained its Caa1 rating on Pakistan expressing concern over the weak macroeconomic structure of the country.

While average volumes rose 35%, average daily values increased only 6.2%, as a lot of activity took place in second-tier telecom stocks. The market capitalisation increased 1.2% to Rs4.39 trillion by the end of the week.

Winners of the week

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. It manages call centres and offices in Pakistan and throughout the world.

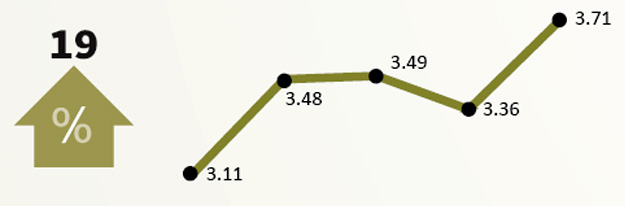

Pace Pakistan

Pace Pakistan develops real estate in both the residential and commercial sectors. The company develops and constructs shopping malls, supermarkets, and apartments.

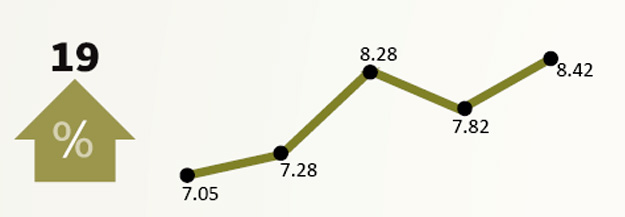

Engro Foods

Engro Foods produces a wide range of dairy products. The company’s products include ice cream, flavoured milk, fruit juices and milk powders.

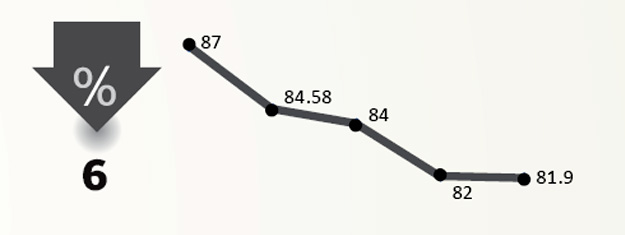

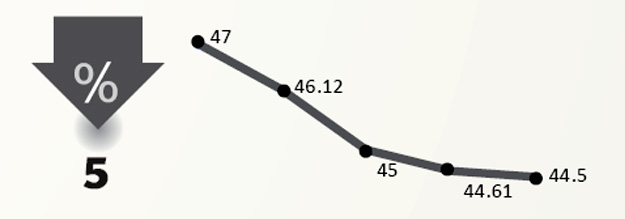

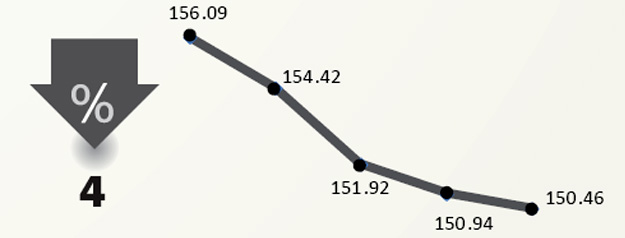

Losers of the week

Pakistan Tobacco Company

Pakistan Tobacco Company manufactures and sells cigarettes.

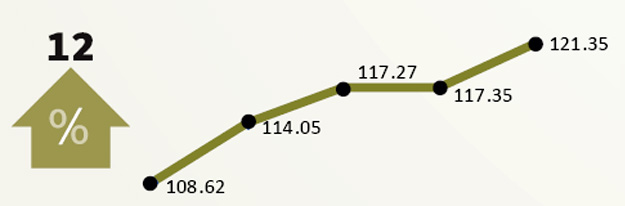

Pakistan Cables

Pakistan Cables manufactures and distributes copper rods, wires, cables and conductors, aluminium profiles and anodised fabrications.

ICI Pakistan

ICI Pakistan manufactures a range of industrial and consumer goods. The product line includes polyester staple fibres, POY chips, soda ash, paints, sodium bicarbonate, polyurethane, adhesives, pharmaceuticals and animal health products.

Published in The Express Tribune, February 10th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1714024018-0/ModiLara-(1)1714024018-0-270x192.webp)

Isn't a strange happenings: The investors showing confidence is growing even the economic indicators, local & international, political opponents and full media full cry against the government having no impact on this continued confidence.