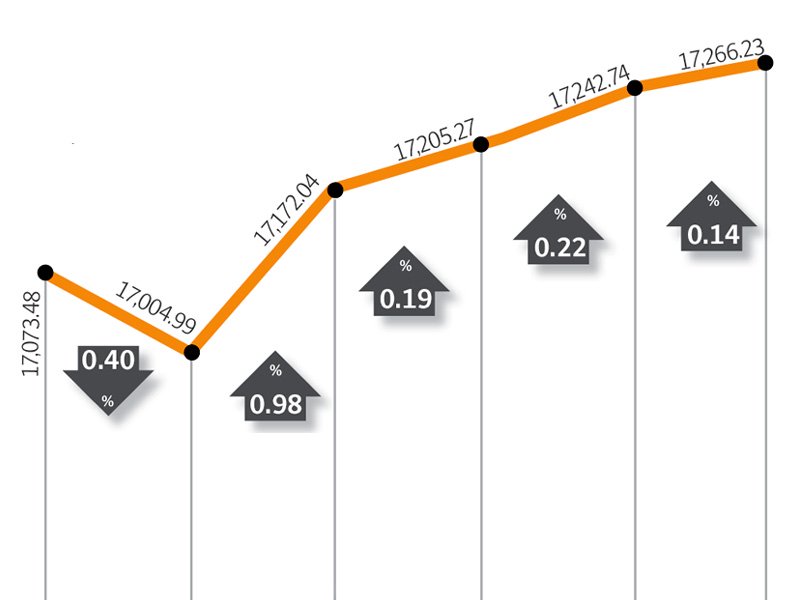

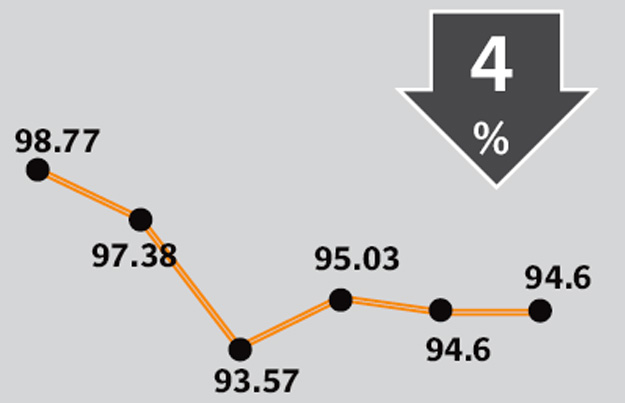

The stock market maintained its impressive performance, with the corporate earnings season acting as the driver for further growth, taking the benchmark Karachi Stock Exchange (KSE)-100 index 210 points (1.2%) ahead during the week ended February 1.

The market brushed aside political wrangling over the installation of a caretaker setup, and a controversial letter written by the chairman of the National Accountability Bureau, as volumes remained healthy amid enthusiastic investor participation.

After shooting past the 17,000 point barrier in the previous week, the KSE-100 index showed no signs of relenting. It climbed steadily through the week to hit 17,266 points, achieving a new record high for the index in the process.

With the corporate earnings season in full swing and announcements by several heavyweights during the week, foreigners also became active participants with net inflows of $5.6 million during the week.

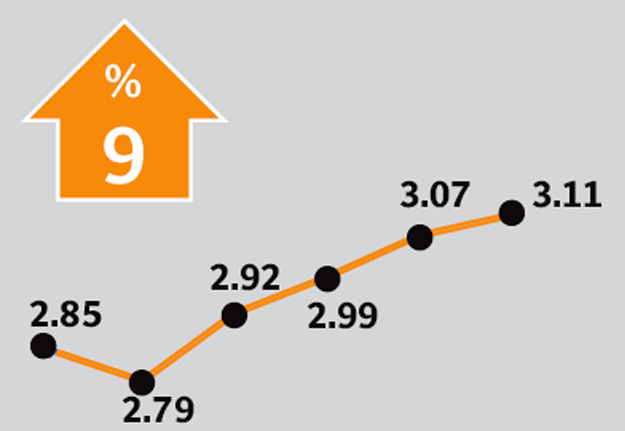

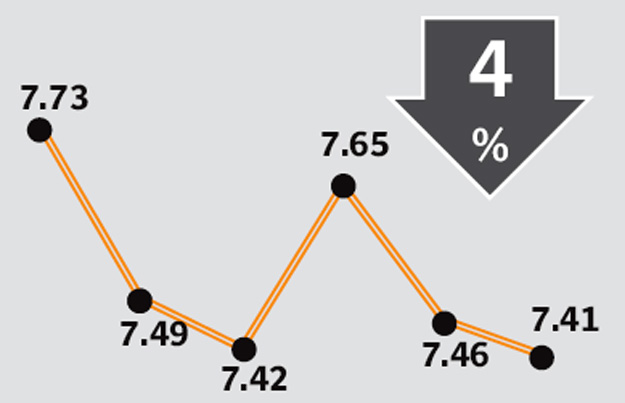

Several major news reports surfaced during the week, mostly providing a positive impact on the bourse. On the macro front, CPI for the month of January 2013 clocked in at 8.07%, providing some relief to investors who were expecting the number to be higher.

The State Bank of Pakistan’s (SBP) next monetary policy announcement is due on February 8. With inflation relatively stable, it is likely that the status quo will be maintained for the discount rate. A rate cut, however, will be a positive surprise for the market.

During the week, the SBP also cut the export refinance rate by 10 basis points to 8.2% – lower than expectations, but a positive stimulus nonetheless.

On the industry side, the most significant announcement came from the Economic Coordination Committee. A new gas allocation policy has been approved, under which residential and commercial sectors will be given top priority, followed by the power and fertiliser sectors respectively. The cement sector has also been moved ahead the CNG sector.

At the same time, the Islamabad High Court has declared the Gas Infrastructure Development Cess unconstitutional and void. The fertiliser sector is likely to be the biggest beneficiary of the announcement, as it is unlikely to immediately pass on the drop in price to end customers. The cost differential will come to around Rs272 per bag, according to analysts at JS Global Capital.

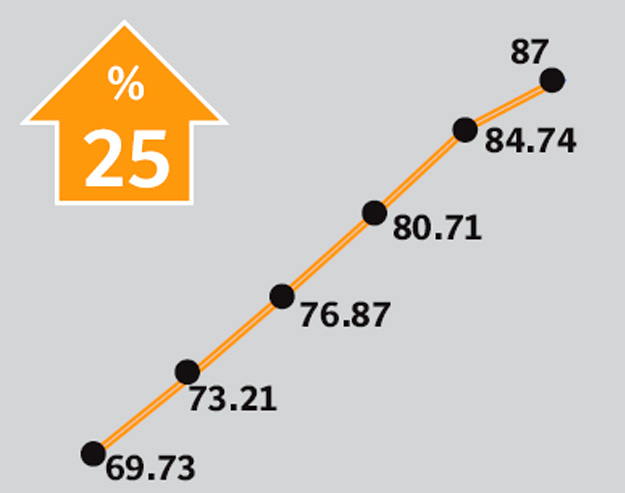

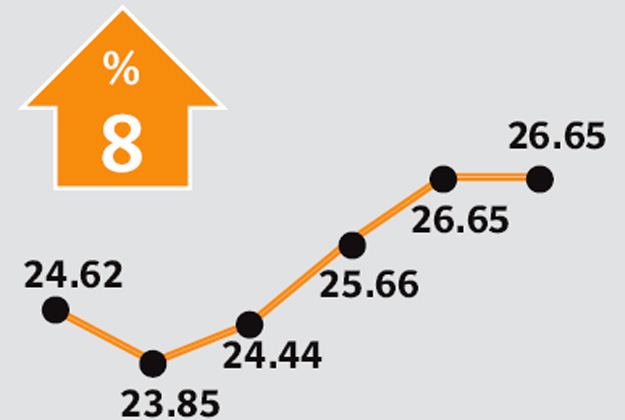

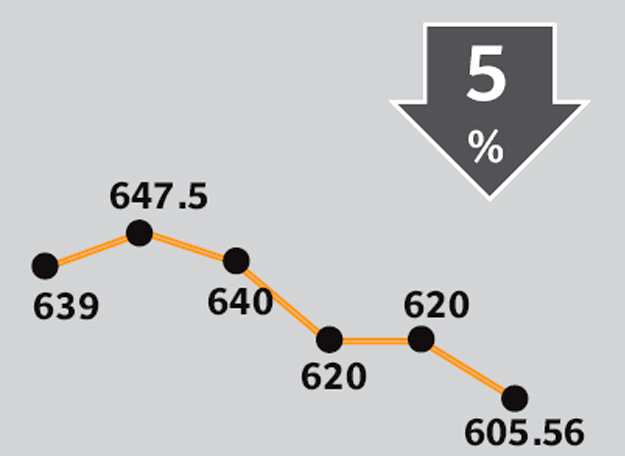

Average daily volumes rose 7.8% to 215 million shares traded per day during the week. Average daily values, however, registered a decline of 4.3%, as activity shifted towards second-tier stocks. The market capitalisation of the KSE increased 1.5% to Rs4.32 trillion by the end of the week.

Winners of the week

Pakistan Tobacco

Pakistan Tobacco Company manufactures and sells cigarettes.

Pace Pakistan

Pace Pakistan develops real estate in both the residential and commercial sectors. The company develops and constructs shopping malls, supermarkets, and apartments.

Hum Network

Hum Network operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Losers of the week

Siemens Engineering

Siemens Pakistan Engineering Company manufactures, installs, and sells electronic and electrical products.

IGI Insurance

International General Insurance Company of Pakistan provides property and casualty insurance products and services. The company’s products include fire, marine, and motor insurance.

Azgard Nine

Azgard Nine manufactures and exports textile products such as denim fabrics, and apparel. The company also manufactures and sells urea and phosphatic fertilisers from its fertiliser plants.

Published in The Express Tribune, February 3rd, 2013.

Like Business on Facebook to stay informed and join in the conversation.

1713904359-0/burn-(1)1713904359-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ