UBL outperforms its peers, with 42% earnings growth

Announcement of interim cash dividend of Rs2 per share takes cumulative payout to Rs5.

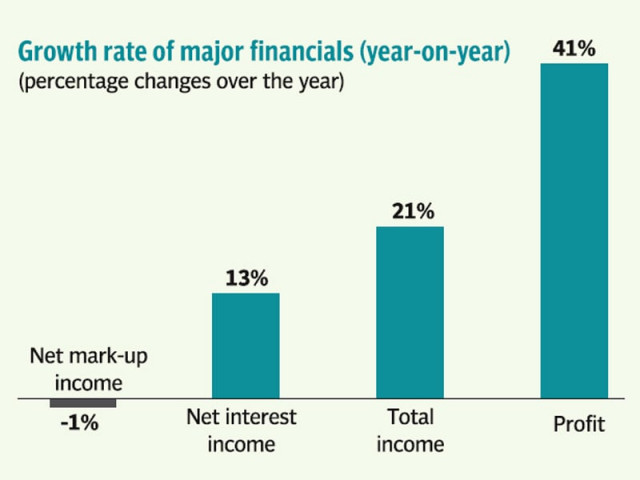

United Bank Limited (UBL) profits grew by a stellar 42% during January and September 2012, making it the top performing bank among the big four.

The board of directors announced the results accompanied by an interim cash dividend of Rs2 per share, taking cumulative dividend payout to Rs5 per share in the period under review.

The bank recorded a profit of Rs15 billion during the first nine months of 2012 up from Rs10.6 billion in the corresponding period of the preceding year, according to consolidated results sent to the Karachi Stock Exchange on Wednesday.

The result was above analyst expectations, primarily due to higher than expected other income likely on account of income recorded on derivatives, said Shajar Capital Head of Research Umer Pervez.

The robust growth in earnings mainly stems from a steep decline of 51% in total provisions and growth in non-interest income. Additionally, share of profit from associates supported profitability on the back of robust price performance at the KSE during the review aperiod.

Despite tighter interest yields, net mark-up income of the bank witnessed a decline of 1% to Rs29.9 billion.

On the other hand, net interest income – core area of earnings – climbed 13% to Rs26.7 billion on the back of a steep 51% decline in provisions with loan provision falling 54%.

The banking industry’s focus has recently shifted towards government securities rather than private sector dealing and better dividend income from treasury and trading and higher income from fee boosted non-interest income to Rs13 billion, says analyst.

Resultantly total income from core operations grew 21% to Rs39.8 billion in the period under review.

One factor pulling down the bank’s profitability was increase in non-interest expenses to Rs20.4 billion, however the bank was able to manage its position as income from associate holdings supported profitability.

Profit share from associates clocked in at Rs1.7billion against a loss of Rs100 million in the same period last year.

Quarterly profits (July to September 2012) jumped 34% to Rs5.55 billion, which represented a record high earnings for UBL.

With earnings above market expectations, the bank’s stock price climbed 1.4% to close at Rs75.26 during trade at the local bourse.

Published in The Express Tribune, November 1st, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ