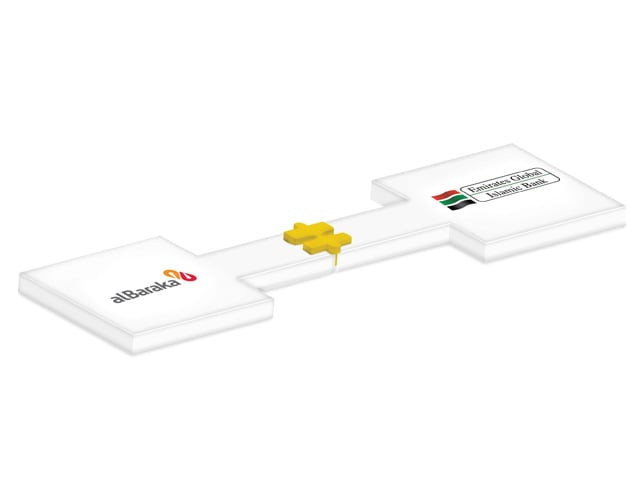

First-ever merger of Islamic banks in Pakistan

“An extraordinary general meeting of shareholders held on Tuesday, approved the scheme of amalgamation,” declared Husain.

The new institution will be called Al Baraka Bank (Pakistan) Limited. With a combined asset base of more than $582 million, the bank will boast 89 branches across 40 cities and towns. EGIBL will contribute about $175 million to the asset base and 60 branches to the network.

Al Baraka will be the majority stakeholder in the agreement, but will merge into Emirates Global because the latter is a listed company in Pakistan, while Al Baraka is currently a branch of the international Al Baraka Banking Group.

It was made clear that all employees of EGIBL will be retained, but the positions of senior level management have not been finalised as yet.

Officials from both banks have expressed hope that the process will be completed by the end of August as due diligence procedures on legal and financial conditions have already been completed. The merger will be formalised as soon as the State Bank of Pakistan (SBP) issues a formal approval.

Talks between the two banks were initiated last year and all stakeholders were taken on board before the decision was made.

The merged entity will be better positioned to comply with SBP’s regulations concerning minimum capital requirements as well as the condition that 20 per cent of all new branches must be established in rural areas.

“Given the international presence of the Al Baraka Banking Group, the merger will also open up international avenues,” hoped Husain. Growth in the banking sector has slowed in the past two fiscal years and smaller banks have suffered significantly due to non-performing loans and shrinkage in consumer banking. “Islamic banks had hoped to capture about 12 per cent of the total banking sector in Pakistan by 2012 but now that seems like a distant target. Islamic banks will probably manage to capture a share of about 9 to 10 per cent by 2012 if they continue to grow at twice the pace of conventional banks like they have in recent months,” remarked Tariq Husain.

In response to a question, Husain speculated that SBP would most likely maintain the discount rate in the upcoming monetary policy decision. He added “no one foresees rates coming down because inflation has not come down. Government is taking up liquidity that would otherwise have been available to the private sector.”

Commenting on the impact of political and economic instability on banking sector, he said that smaller banks had lagged behind the big five in past months but upcoming results would show that consolidation is underway and balance sheets are significantly healthier compared to last year.

Published in The Express Tribune, July 28th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ