Flying away: Foreign investment falls 59% in five months

With investment decline, technology transfer also slows down.

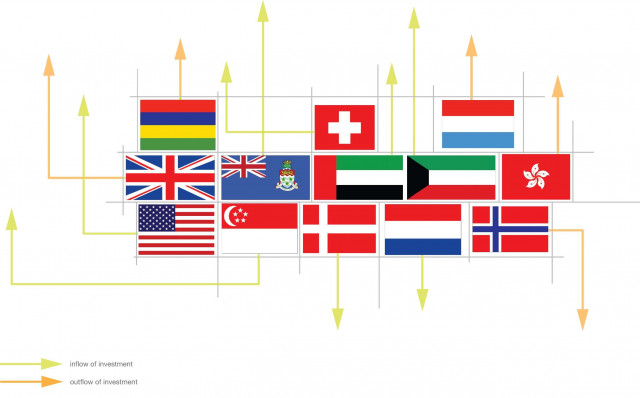

Foreign investment in the country dropped 59 per cent to $305.4 million in the first five months (July-November) of fiscal year 2011-12 compared to investment of $748.7 million in the same period last year, State Bank of Pakistan (SBP) said on Friday.

According to breakdown, foreign portfolio investment fell significantly by 166 per cent to $114.5 million against $172.5 million in the previous year. On the other hand, foreign direct investment declined 27 per cent to $419.8 million compared to $576.2 million last year.

JS Global Capital Limited economist Muzammil Aslam said the decline in foreign direct investment (FDI) is certainly not good for the country. “What is disturbing is that there is no inflow of technology and knowledge that usually comes with FDI,” he said. “Similarly, it is also a bad sign for growth and employment opportunities.”

The decline in foreign investment from $5 billion in 2007 to the present level of $305 million is significant for a country that is now facing a current account deficit, he said.

Aslam said the government can overcome this challenge by reviving the privatisation programme and marketing viable sectors where foreign investment can come easily.

“The government has to move on and attract investors because the country’s image as an investment destination has been shattered. It can be achieved through continuous interaction with investors, which the government is not doing efficiently,” he added.

Though most analysts are attributing the continuous decline in foreign investment to the sluggish economy, some experts have divergent views as well.

AF Ferguson and Company partner SM Shabbar Zaidi said as far as FDI is concerned, the situation is not that bad as is being portrayed by some quarters.

It is a misperception that Pakistan got huge FDI in the good times of 2007 or before as around 70 per cent of foreign investment before 2007 comprised portfolio investment, which is usually considered “unreliable” in the world. Portfolio investment comes in stock markets and then quickly vanishes within months, he pointed out.

“As an investment adviser, I can tell you that huge investments, especially from South Korea and China, are coming. Most probably, the investments will come in 2013,” he said.

Compared to portfolio investment, investments are much more reliable in manufacturing, “but I do not see much investment in this area in the last two decades,” he noted.

Published in The Express Tribune, December 24th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ