Weekly review: PSX in grip of bears as index falls for 7th successive week

KSE-100 drops 1,550 points to settle at 33,166

Weekly review: PSX in grip of bears as index falls for 7th successive week

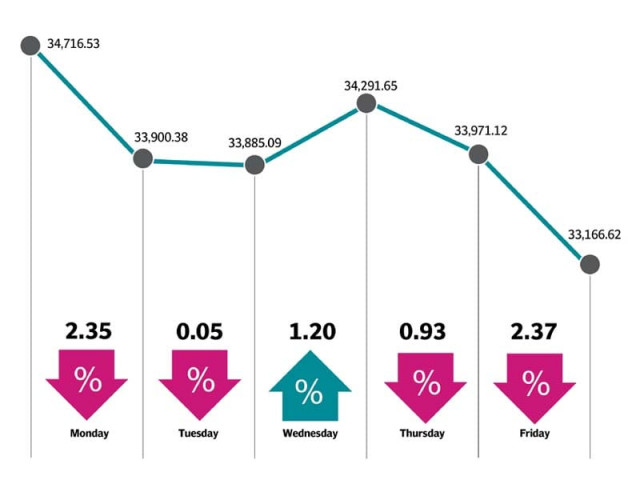

The benchmark KSE 100-share Index shed 1,550 points or 4.5% during the week to settle at 33,166 points.

The week commenced on a negative note as investors failed to react positively to the development regarding IMF loan package over the weekend. The index slipped over 800 points as expectations of a tough IMF programme and stringent conditions dented investor sentiments.

The following session also saw the index finish slightly in the red with participants remaining on the sidelines. In line with expectations, Pakistan successfully kept its status in the MSCI Emerging Market Index, which helped create positive momentum in the stock market.

Market watch: Stocks bleed as KSE-100 plunges 805 points

Wednesday saw a turn of events and the index advanced on the back of anticipation that hydrocarbon reserves would be found in the Kekra-I offshore well as drilling was nearing its end and an official announcement of the estimated reserves was on the cards. Investors resumed buying stocks at attractive valuations. The approval of an amnesty scheme by the cabinet also added to the optimism.

Bears returned in the last two sessions of the week as the massive rupee depreciation took its toll on the market. Weighed down by such developments, the market hit a 52-week low during intra-day trading on Friday.

Moreover, concern over the upcoming monetary policy - due to be announced on Monday - also caused the selling pressure because investors expected a significant hike in the key interest rate.

The KSE-100 closed on a negative note for the seventh consecutive week, with a cumulative seven-week loss of 15%, stated Topline Securities in its report.

Activity improved during the week as average daily trading volumes went up 46% week-on-week to 107 million shares while average daily traded value increased 29% to $29 million.

In terms of sectors, negative contribution came from fertiliser (down 335 points) over concerns of withdrawal of sales tax exemption and rumours related to replacement of GIDC with FED on gas supply, cement (237 points) as factors like slower economic growth, hike in policy rate and rupee devaluation were likely to have a substantial dent on the manufacturers’ profitability, commercial banks (229 points), oil and gas marketing companies (219 points) and pharmaceuticals (92 points). Sectors that contributed positively included oil and gas exploration companies (up 83 points) and power generation (19 points).

IMF deal at comparatively low mark-up: Hafeez Shaikh

Stock-wise, negative contribution came from Fauji Fertiliser Company (161 points), Pakistan State Oil (85 points), Engro (80 points) and HBL (76 points). On the other hand, positive contribution came from Pakistan Petroleum Limited (109 points), Hubco (84 points) and Pakistan Oilfields (49 points).

Foreign buying continued this week as well, which came in at $8.2 million compared to net buying of $10.4 million last week. Buying was witnessed in commercial banks ($8.2 million) and cement ($5.6 million).

On the domestic front, major selling was reported by mutual funds ($19.1 million) and insurance companies ($2.4 million).

Other major news during the week included ECC’s approval of 150MW additional power supply to K-Electric, overall foreign exchange reserves falling to $15.9 billion, textile ministry disbursing Rs52 billion, FBR slapping tax of Rs300 per kg on tobacco sale and OGDC discovering gas and condensate in Sindh.

Published in The Express Tribune, May 19th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ