Weekly review: Bourse crawls up on pre-budget reports

Oil and gas sector came under the spotlight following deregulation of key petroleum products.

Budget related news brought some life to a quiet stock market during the week ended June 3.

The KSE-100 benchmark index gained only 0.1 per cent to close at 12,236.66 on a weekly basis.

The oil and gas sector came under the limelight and gained 1.7 per cent as the petroleum ministry deregulated local prices of key petroleum products. The move allows companies to determine monthly product prices. Refineries, being the key beneficiaries of this decision, led the index climb with Attock Refinery gaining 4.6 per cent and National Refinery firming 3.4 per cent on a weekly basis. The government’s move to deregulate prices of petroleum products forced the Oil and Gas Regulatory Authority (Ogra) to announce a cut in prices of three petroleum products. Ogra notified a reduction in price of petrol by Rs1.7 per litre, kerosene oil by Rs5.05 per litre and high speed diesel by Rs3.20 per litre to Rs86.71, Rs84.65 and Rs94.11 per litre, respectively.

Number of shares traded improved by 24.2 per cent on reports that the government may switch Capital Gains Tax with transaction tax for individuals and the partial deregulation of petroleum products.

The heightened activity in the market was well supported by the foreign portfolio investment that jumped by 326 per cent to $7.1 million.

Outlook for the future

The federal budget announced on Saturday amid a noisy parliament session had nothing on capital gains tax (CGT) relaxation against market expectation that the government may announce some measure regarding the tax.

After the recent round of meetings with the finance ministry and Federal Board of Revenue officials, it was expected that CGT may be deferred at least for the individual investors who have been deserting the market and causing value of shares traded to decline to eight-year low of Rs4 billion in fiscal 2011.

This will not only affect the market depth and volumes but have adverse implications to the government plan to privatise its units through the stock market, according to Topline Securities research note. The trend of initial public offerings that slowed down last year with only one offering against ten initial public offerings on an average will remain affected and impact the capital formation.

The market is expected to react negatively on Monday by a drop of 100 to 200 points unless some confidence building comments in this regard are made by Finance Ministry officials, adds the note.

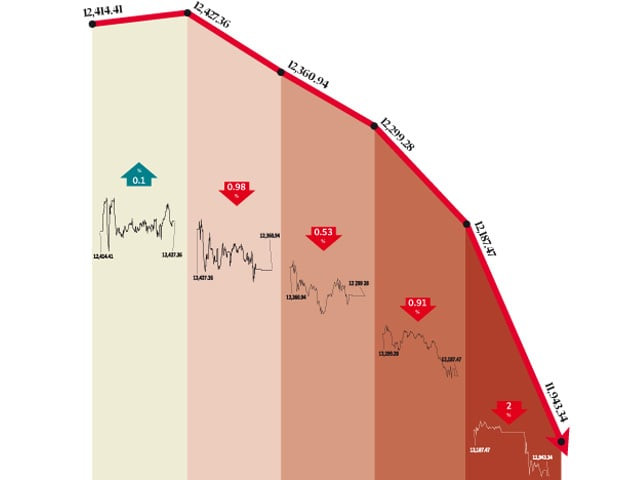

Monday, May 30

The stock market’s six-day upward run came to an end amid lack of participation from local institutions. Most local institutions preferred to stay on the sidelines ahead of the budget scheduled for June 3.

Tuesday, May 31

Equities dropped amid low volumes as uncertainty prevails ahead of the budget. Investors preferred to remain on the sidelines ahead of the federal budget which will decide the fate of the capital gains tax on sale of shares.

Wednesday, June 1

The stock market turned bullish amid a rally in oil stocks following deregulation of oil prices. Change in the local oil price mechanism sparked a rally amid hopes that oil and refinery sectors will reap the benefit.

Thursday, June 2

The local bourse followed regional markets and remained lacklustre for most part of the day amid thin activity.

Shanghai’s main index slumped to a four-month low while shares in Hong Kong fell two per cent whereas India’s Sensex index dropped 0.6 per cent.

Friday, June 3

Investors turned bullish on the last trading session of the week amid thin activity due to the budget announcement later in the day. Investors turned bullish as the stock exchange board of directors recommended replacement of Capital Gains Tax with capital value tax at 0.02 per cent on value of transaction.

Published in The Express Tribune, June 5th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ