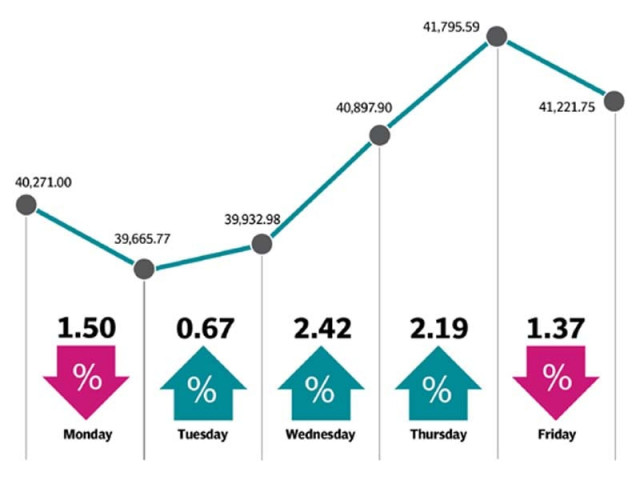

KSE-100 ends with 951-point gain as volatility increases

Election euphoria, rupee devaluation, hike in interest rate drive market sentiment

Among major highlights of the week were; rupee plunged to Rs128 against dollar.

PHOTO:FILE

The week witnessed important development as euphoria over the general elections continued to drive the index. Reacting to the central bank’s decision of increasing the interest rate by over 100 basis points to 7.5%, a rally was witnessed in the banking sector.

However, bears soon took charge as the rupee underwent a massive devaluation of 5% against the US dollar. Higher interest rate added to pressure on leveraged stocks, which also dragged the index lower.

Market watch: KSE-100 plunges 574 points as profit-booking takes over

Things took a turn on Tuesday, as buying in cement and fertiliser stocks wiped off the negativity. Cement and fertiliser manufacturers increased prices and interest was shown by several mutual funds that improved confidence of investment climate. The positive trend continued in the following session, leading the index to power past the 41,000 mark. Market activity also continued to improve with average daily traded value increasing 35% week-on-week to $66 million and volumes going up by 68% 219 million.

Market watch: KSE-100 crawls up as political clarity emerges

In terms of sectors, contribution to the index was led by banks (up 279 points), cements (165 points), fertilisers (130 points), oil and gas marketing companies (65 points) and power generation and distribution (59 points). On the other hand, tobacco (down 27 points) and pharmaceuticals (15 points) took away points from the index. Scrip-wise, UBL, LUCK, HUBC, ENGRO and HBL contributed 382 points to the index. The gains in UBL came as it posted recovery on laying concerns of possible penalty by Federal Reserve Bank of New York (FRBNY) to rest.

Foreign investors, on the other hand, continued their selling spree, dumping another $21 million worth of equities during the week in almost all sectors except fertilisers where foreigners built exposure of $1.5 million. Liquidity inflows were visible in buying pattern of local mutual funds, which bought $6.2 million worth of equities, contributing towards market gains during the week.

Market watch: KSE-100 falls 246 points in sixth successive negative close

Among major highlights of the week were; rupee plunged to Rs128 against dollar, LSM sector growth clocked in at 2.76% in May, current account deficit increased to $18 billion and foreign exchange reserves held by the State Bank of Pakistan decreased by a massive 4.4%.

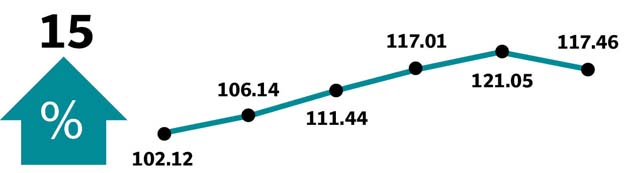

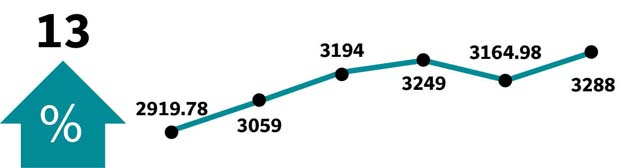

Winners of the week

Systems Limited

Systems Limited is a Pakistan-based software company. The company’s products include EdgeAX, OneLoad, SysHCM and AX Talent Suite. It operates in three geographical segments, such as North America, Middle East and Pakistan.

Colgate Palmolive (Pakistan)

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

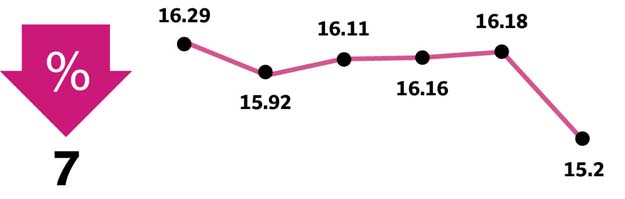

Losers of the week

Philip Morris (Pakistan)

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Jahangir Siddiqui & Company

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Published in The Express Tribune, July 22nd, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ