These Pakistani startups help you take 'smart decisions'

SmartChoice, KarloCompare offer comparison of different products and services to consumers for 'free'

SmartChoice, KarloCompare offer comparison of different products and services to consumers for 'free'. PHOTO: AFP

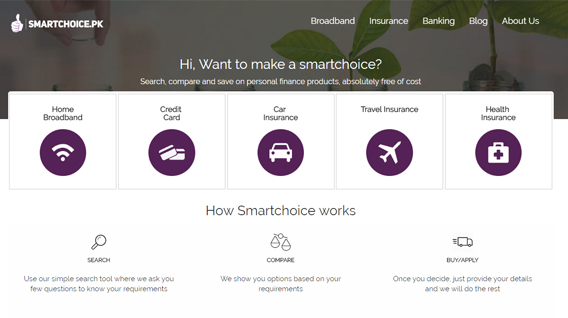

Taking advantage of such a scenario, different startups are offering services and helping customers to make informed choices. One such startup is SmartChoice.

The portal, which was among the first batch of startups incubated at the Google-backed Nest i/O, was launched in January 2015 with broadband comparison. It now offers comparison of different products and services, including credit cards, broadband connection (both home and corporate), health, car and travel insurance.

10 Pakistani startups that made a mark in 2016

Sibtain Jiwani, the co-founder and CEO of SmartChoice, told The Express Tribune he wanted to launch the startup soon after moving back from England after completing his education in 2008 but couldn’t due to slow adoption of technology.

“I moved back to Pakistan in 2008, hoping to start this venture. However, with no local network and looking at slow adoption of technology I decided to wait and gain experience,” said Sibtain, adding, “Finally, in late 2014, I decided to initiate this in form of a plan, and to achieve the goal I had to quit my job.”

Explaining what purpose his startup actually serves, Sibtain said product comparison is only one aspect of their service. “We are a bridge between consumers and service providers. Any user who finds a suitable product on our platform can easily order it, be it getting broadband connection installed, buying insurance policy or applying for credit card online.”

'Pakistani e-commerce expected to hit $1b by 2020'

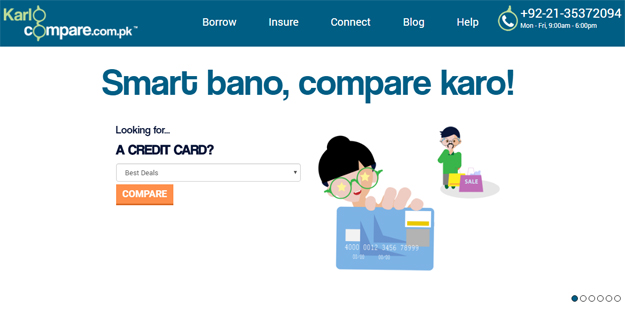

SmartChoice is not the only one providing such services in the country. KarloCompare, a personal finance aggregation platform of CompareOn Pakistan Private Limited, also offers similar services.

Co-founded by Sumair Farooqui and Ali Ladhubhai, the website went live on April 1, 2016 and became transactional on in June 2016. Prior to launching the startup, both Sumair and Ali worked in the banking sector.

“KarloCompare is dedicated to personal finance (i.e. credit cards, personal loans, and auto loans), general insurance and broadband services. In the coming quarter we will be adding deposits, investments and other consumer oriented insurance products,” said Sumair.

Both Sibtain and Sumair feel that there’s a market for such business in Pakistan.

“Customers are always looking for a professional suggestion,” Sibtain commented adding that consumer can make the informed choice only if they are aware of all the options.

KarloCompare co-founder also echoed this opinion, saying that, “We have a win-win business for consumers as well as the service providers. Consumer can make more informed decisions and evaluate all the options available to them at a few clicks, and providers have a new channel to acquire new to company customers.”

Making money while serving consumers for ‘free’

The basic purpose of every business is to make money. So if these startups serve consumers for free, how do they sustain.

Explaining their monetisation model, Sibtain said: “We primarily monetise by generating leads for the partners we work with, it’s a success based marketing fee which is charged on each successful sale.”

Despite challenges, entrepreneurial landscape flourishing in Pakistan

However, he contended that it is not same as typical sales approach. “We are not exclusive to any partner and work with all. Hence, customer has the choice to opt for the service they feel comfortable with.”

Additionally, the startup also runs promotional campaigns for their partners to advertise their products to generate revenue.

KarloCompare also generates revenue through similar means. “We work on a few different pricing models depending on the product category and generate income through conversions from our service partners (i.e. banks, insurance, and broadband companies),” said Sumair.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ