Shortfall in tax collection widens to over Rs130 billion

FBR provisionally collects Rs1.067tr during July-November, filers of income tax returns also fall 38%

FBR provisionally collects Rs1.067tr during July-November, filers of income tax returns also fall 38%. PHOTO: AFP

The Federal Board of Revenue (FBR) provisionally collected Rs1.067 trillion during the July-November period of this fiscal year - registering just 1.7% growth over collection of the same period last fiscal year, according to FBR officials. In absolute terms, the collection was a mere Rs18 billion higher than the comparative period. The figure may slightly go up once the final collection numbers are made available next week.

Government misses tax collection target by wide margin

The five-month FBR results were even worse than last-year’s performance of the PPP government when the then government had achieved 3.38% growth rate in revenue collection. One reason for the poor performance was that FBR’s top hierarchy is going to retire and there is no zeal to put extra efforts, according to FBR officials.

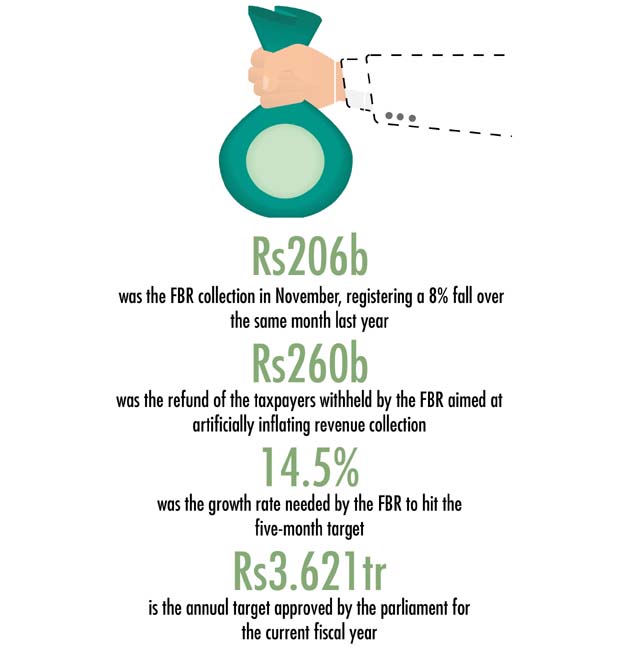

The monthly tax collection performance was more depressing. The FBR collected Rs206 billion in November, registering a negative 8% growth over the same month last year. It paid Rs23 billion in tax refunds, which the authorities said was a reason for negative growth. The FBR has withheld over Rs260 billion refunds of the taxpayers aimed at artificially inflating revenue collection.

The FBR needed 14.5% growth rate over its last year’s collection of Rs1.049 trillion to hit the five-month target. Against the target of Rs1.2 trillion, the FBR ended up collecting just Rs1.067 trillion. This indicates that FBR will not be able to achieve its annual target until some drastic steps are taken to improve the administration of tax matters.

CREATIVE COMMONS

The government’s tax and administrative policies are also to be blamed for the poor showing, as it has turned the tax machinery into its political muscle, according to the sources.

Tax collection a failed system in Pakistan

It also had to extend the last date for filing income tax returns by 15 more days after only 630,000 people filed their returns online for tax year 2016.

About 30,000 returns are filed manually. In the tax year 2015, as many as 1.074 million people had filed the returns after government gave half a dozen extensions in filing the returns, showing over 38% reduction in the number of filers.

Finance Minister Ishaq Dar said that the date has now been extended until December 15, hoping that by that time the number would significantly improve. He said that till November 30, 2015, over 400,000 people had filed the returns and this year’s results were far better than the previous year.

The original date for filing the returns is September 30 of every year, which the government has been extending due to multiple reasons including technological hiccups and delay in finalising the return forms.

FBR tops tax collection target by Rs35 billion

For the current fiscal year, the Parliament has approved an annual target of Rs3.621 trillion and the FBR was aiming at collecting one-third of it in the first five months.

In a testimony to the Senate Standing Committee on Finance, the FBR Chairman had admitted that the annual target of Rs3.621 trillion was high and unrealistic. He had said that the Finance Ministry had fixed the target without taking the input of the FBR.

The Senate Standing Committee on Finance Chairman Saleem Mandviwalla had regretted that the FBR was overburdening the existing taxpayers to meet the collection targets. He said that the tax authorities had failed to broaden the tax net. Mandviwalla had said that non-taxpayers were all at ease but those paying taxes have to bear the brunt of FBR’s highhandedness.

Dar blamed the government’s decision to keep the petroleum products prices unchanged for the shortfall in tax revenues.

The FBR officials said that the government’s decision to grant zero-rating regime to five export oriented sectors also affected the revenue collection.

Taking over Rs250 billion advances in the last fiscal year to claim achieving previous year’s target of Rs3.104 trillion was the main reason behind the continuous shortfall in collection, according to the sources.

Published in The Express Tribune, December 1st, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ