Market watch: Bourse succumbs to political noise, ends in the red

Benchmark KSE 100-share Index falls 439.40 points

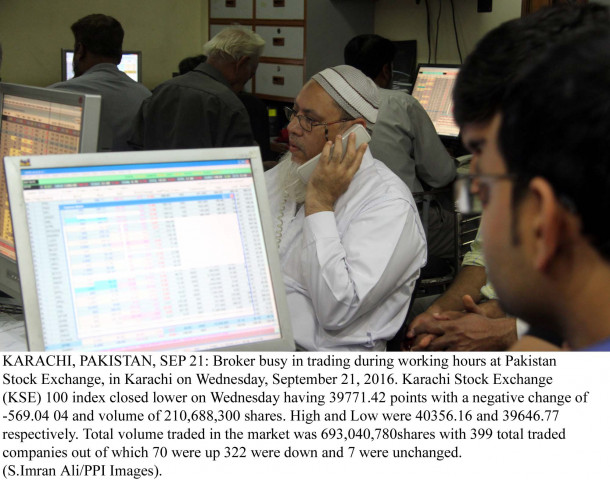

Benchmark KSE 100-share Index falls 439.40 points. PHOTO: PPI

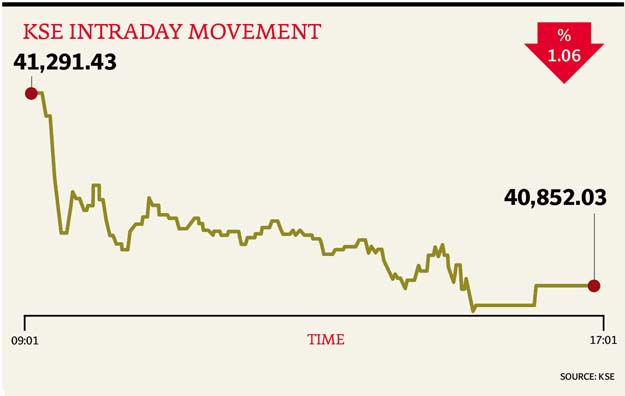

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a decline of 1.06% or 439.40 points to end at 40,852.03.

Elixir Securities, in its report, said the KSE-100 index opened gap down and continued to skid lower as the day progressed with index names mainly dealing a blow amid no serious institutional participation.

Only $57 million worth of shares changed hands on the benchmark index, down 41% versus last week’s average.

“Subdued activity was also witnessed in second and third-tier names as retail investors traded cautiously amid political uncertainty and the start of futures roll-over week.”

Earnings excitement kept Pakistan State Oil (-0.6%) in the limelight as it closed with trimmed losses after the company announced stellar earnings that beat consensus. Fauji Fertilizer Bin Qasim (-3.1%) closed lower after posting sub-par quarterly results, said the report.

Meanwhile, recently listed Hi-Tech Lubricants (+2.8%) attracted the interest of participants after the company announced the much-awaited news of successfully securing an oil marketing licence from the regulator.

“Expect stocks to remain volatile in the near term as politics remains a dampener with Imran Khan-led PTI preparing to show its street power in the federal capital on November 2,” remarked Elixir Securities analyst Ali Raza.

Meanwhile, JS Global analyst Ahmed Saeed Khan said volatility prevailed at the bourse and the benchmark index lost 439 points to close at 40,852 as political noise continued to dent investor sentiments ahead of PTI’s Nov 2 protest plan.

“Heavyweight oil and gas sector remained under pressure as PPL lost 1.58% and OGDC fell 0.82% on the back of depressed crude oil prices after Iraq backed off from joining efforts to trim the output to prop up crude prices,” he said.

The cement sector showed some signs of recovery as the news broke that manufacturers in the country’s south were increasing prices by Rs5 per bag.

“We expect the market to remain largely range bound in view of the increased political noise,” concluded Khan in his report.

Trade volumes fell to 278 million shares compared with Friday’s tally of 530 million.

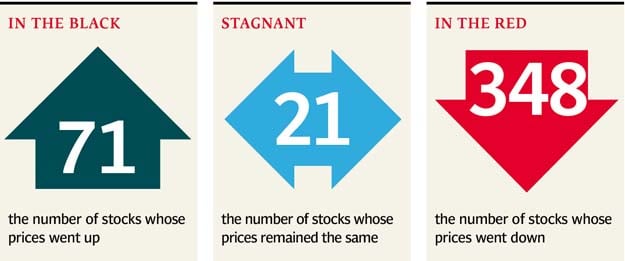

Shares of 440 companies were traded. At the end of the day, 71 stocks closed higher, 348 declined while 21 remained unchanged. The value of shares traded during the day was Rs9.5 billion.

The Bank of Punjab was the volume leader with 35.2 million shares, losing Rs0.91 to finish at Rs17.25. It was followed by K-Electric Limited with 21.5 million shares, gaining Rs0.03 to close at Rs9.12 and Pakistan International Airlines with 11.6 million shares, losing Rs0.33 to close at Rs9.15.

Foreign institutional investors were net sellers of Rs5.4 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 25th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ