Market watch: Stocks bleed as political noise gets louder

Benchmark KSE 100-share Index falls 328.50 points

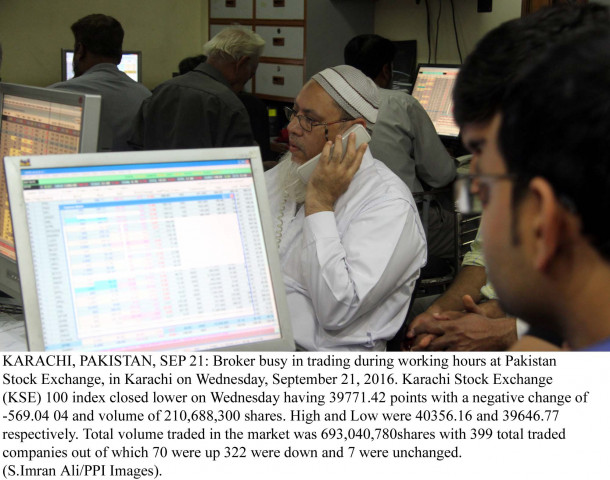

Benchmark KSE 100-share Index falls 328.50 points. PHOTO: PPI

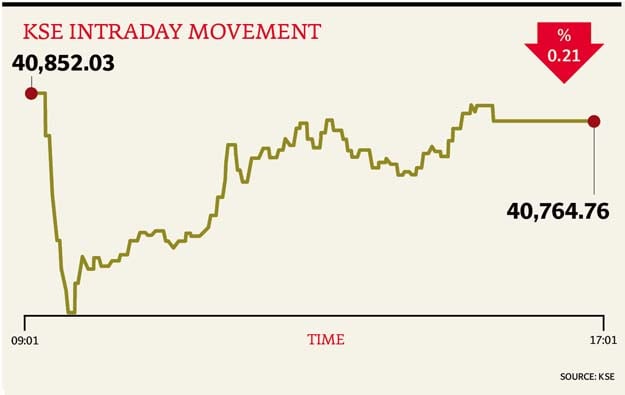

Equities endured a horrid start to the day, plunging over 500 points post mid-day before a minor recovery meant the index finished 0.8% lower.

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a fall of 0.80% or 328.50 points to end at 40,954.22.

Elixir Securities, in its report, said that soon after the opening bell, equities lost ground with notable index names skidding lower and leading the declines as institutional sellers struggled to offload amid thin volumes in early hours.

“Sideboards names followed suit and traded lower with retail investors trying to liquidate positions in risky bets. Activity, however, improved near mid-day with select sideboard plays and relatively illiquid names seeing a bounce back on cherry picking by savvy investors.”

“Meanwhile, the Hub Power Company (HUBC PA -2.5%) succumbed to selling pressure and dented KSE-100 the most after it notified the exchange that its JV China Power Hub Generation Company may scale back its expansion project due to timing issues with the Government of Pakistan (GoP), that according to our analyst, if materialises, will have a negative impact of around 5% on Hubco’s valuation,” said the report.

“We see volatile trading in days ahead with benchmark KSE-100 index likely slipping further as domestic politics continue to dominate sentiments despite the on-going quarterly earnings season,” remarked Elixir Securities analyst Ali Raza.

JS Global analyst Ahmed Saeed Khan, on the other hand, said the oil sector refused to follow the trend of global crude oil prices that trade comfortably above $50/barrel. Instead profit taking was witnessed in the aforementioned sector, where Oil and Gas Development Company (OGDC -0.72%) and Pakistan State Oil (PSO -1.29%) were the biggest index movers of the sector on Tuesday.

“The cement sector was the major laggard of the day as the sector was down around 2.37% on the back of rising global coal prices. Maple Leaf Cement (MLCF -4.02%) and Lucky Cement (LUCK -1.69%) were the major index mover of the sector.”

“Overall, the market sentiment gravitates towards negativity and caution ahead is advised till political environment calms down,” concluded Khan, in his report.

Trading volumes rose to 383 million shares compared with Monday’s tally of 379 million.

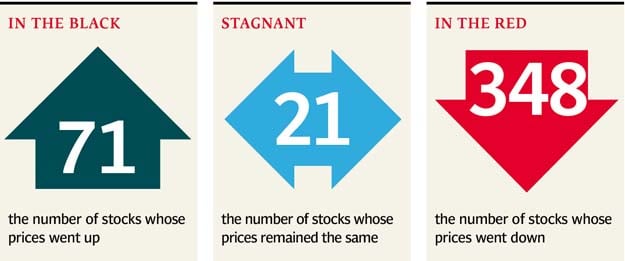

Shares of 451 companies were traded. At the end of the day, 137 stocks closed higher, 291 declined while 23 remained unchanged. The value of shares traded during the day was Rs13.1 billion.

The Bank of Punjab was the volume leader with 52 million shares, gaining Rs0.49 to finish at Rs16.50. It was followed by TPL Trakker Limited with 18.9 million shares, gaining Rs0.40 to close at Rs16.88 and Nimir Resins with 18 million shares, gaining Rs1 to close at Rs13.10.

Foreign institutional investors were net sellers of Rs329 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 19th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ