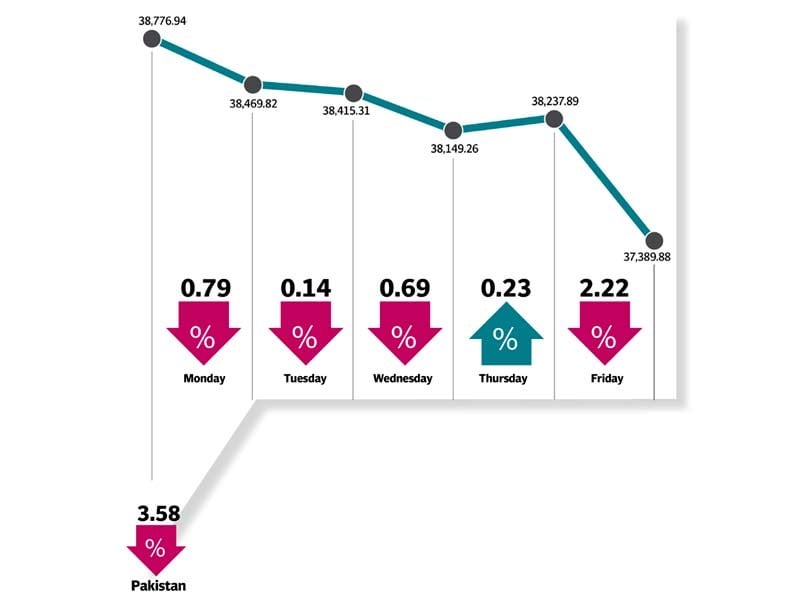

As a result, Pakistan market also fell 848 points (2.2%) after recording 2016’s biggest intra-day slump of over 1,400 points. The benchmark KSE 100 Index closed at 37,389 after investors went about buying on low valuations.

The local bourse was dull throughout the week and after Friday’s collapse, KSE-100 index fell 3.6% week-on-week.

Pakistan equities started the week lower on Monday as profit-taking, mainly in financial stocks, pulled the index down. The next trading session was no difference as stocks closed marginally negative in a range-bound and lacklustre trading session. By Thursday stocks showed mild recovery after institutional selling but Brexit forced the market to tumble down.

In terms of sectors tobacco and refinery were among the gainers this week as they rose 8.1% and 2.2%, respectively. Automobile assemblers, oil & gas exploration companies and textile composite were the losers this week, mainly due to Brexit’s impact. The sectors fell in the range of 2.2%-4.4% this week.

Profit taking was witnessed in major MSCI candidates, which along with decline in international crude prices led to banking and oil stocks to drag the benchmark index by 270 points. Moreover, Engro Corporation and Lucky Cement contributed 77 points and 65 points to the decline, respectively.

Other dominant news flow throughout the week was the $500 million loan agreement with the World Bank that boded well for the exchange rate which remained stable at Rs104.75.

Additionally country’s foreign direct investment (FDI) increased by 10% to $1.084 billion in 11MFY16 mainly due to healthy investment in energy ($533 million) and oil & gas ($245 million).

Nepra allowed Rs3.32/unit reduction in the tariff under the fuel price adjustment for May-16. In addition, a consortium of 16 banks lead by the National Bank of Pakistan (NBP), has arranged Rs100 billion Sukuk for the Neelum-Jhelum Hydropower.

During the week foreign institutional portfolio investment (FIPI) witnessed an outflow of $20.56 million during the week vs $19.6 million inflow last week, whereas the average volume traded fell by 15% week-on-week and the value of shares traded decreased by 26.6% week-on-week.

Winners of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

National Refinery

National Refinery Limited manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Losers of the week

Bank Alfalah Limited

Bank Alfalah Limited provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

MCB Bank Limited

MCB Bank Limited is a full service commercial bank. The bank offers a wide range of financial products and advice for personal and corporate customers, including online banking services.

Rafhan Maize

Rafhan Maize Products Company Ltd produces corn oil, industrial starches, liquid glucose, dextrin, gluten meals, and other corn-related products. The company also produces a wide range of co-products such as gluten feeds, meals, and hydrol.

Published in The Express Tribune, June 26th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1714024018-0/ModiLara-(1)1714024018-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ