Finance and revenue : NA panel seeks cut in advance income tax on importers

Wants abolition of sales tax on agriculture machinery, opposes move to tax inputs of stationary, milk.

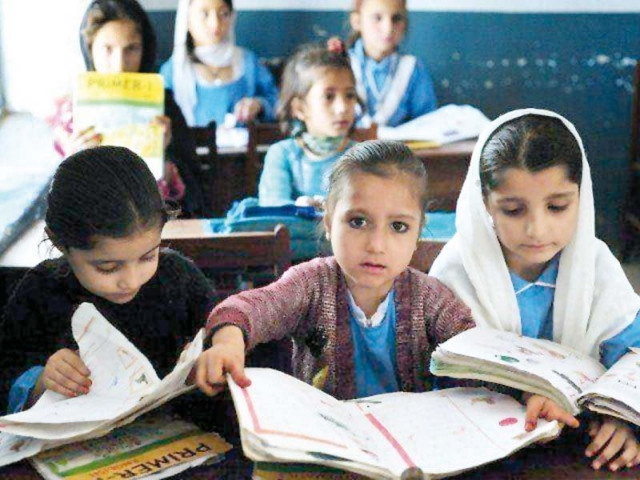

The industry people argue that 117% sales tax on inputs of stationary would increase burden on common man and violate government’s constitutional obligation under Article 25A and 37B to provide free and compulsory education for all. PHOTO: FILE

The National Assembly Standing Committee on Finance and Revenue also opposed the government’s proposal to charge standard 17% sales tax on inputs of stationary and milk.

It has also opposed Rs500 per metric ton federal excise duty on cement.

In a rare post-budget move, the standing committee forwarded about eight recommendations to the Finance Minister, which if accepted can dent the government’s revenues by over Rs60 billion.

Usually, the Senate Standing Committee on Finance gives post-budget recommendations, as the upper house of the Parliament does not have the right to vote on the Finance Bill.

However, it is for the first time in recent years that the standing committee members have given post-budget recommendations. The members of the National Assembly usually give their budget recommendations on the floor of the House.

The Chairman of the standing committee, Qaiser Ahmad Sheikh, belongs to the PML-N.

Finance Minister Ishaq Dar is expected to wind up the on-going budget debate in the National Assembly on either Wednesday (today) or Thursday as there is little time left to get these recommendations incorporated in the budget.

Advance tax on commercial importers

The Standing Committee recommended the government to lower the 6% rate of advance tax to 4% that it charges from commercial importers. “A level playing field should be provided to both commercial importers and manufacturers and there must be a reasonable differential of income tax between them, so that the industries cannot misuse commercial entrepreneurs,” said Qaiser Sheikh.

After taking a presentation from the commercial importers, the committee adopted a proposal, suggesting the government to set the industrial importer withholding tax rate at 2%.

However, Federal Board of Revenue member Policy Rehmatullah Wazir opposed the move to cut rate for commercial importers, saying the government could not reduce the rates due to adverse revenue implications. “The government collected over Rs135 billion from commercial importers at 6% rate,” he said.

Before 2013, commercial and industrial importers were equally treated. After increase in rates, the share of yarn imported by commercial importers has come down to only 8% from pre-change level of 80%, indicating massive underhand deals.

The chairman standing committee termed the 6% withholding tax rate unjustified and said commercial importers were doing business at 3% profit margins. “The 6% advance income tax means that they should have at least 20% profit margin,” he added.

The standing committee also opposed the government’s proposal to levy 17% sales tax on inputs of educational stationery and dairy products.

“The 117% sales tax on the inputs of stationary would essentially mean drastic increase in prices of pens, pencils, exercise books and other essential educational items,” said the industry people. They argued that this would significantly increase the burden on common people and violate the government’s constitutional obligation under the Article 25A and 37B to provide free and compulsory education for all.

They further said that the federal government was levying sales tax on inputs at a time when the Prime Minister Nawaz Sharif had declared education a national priority.

Agriculture machinery

The standing committee also recommended that the sales tax on agriculture machinery including tractors should be withdrawn. The representatives of the farming community informed the standing committee that the reduction in fertiliser prices would not solve the sector’s problems.

They demanded the government to fix the minimum support price of rice, maize, cotton and potatoes.

The committee also proposed the government to maintain zero-rating on rice exports.

In the budget, the government also proposed subsidy on fertiliser. However, Pakistan Tehreek-e-Insaf’s Asad Umar disagreed with the government’s policy and said that even after the subsidy urea was still sold higher than international prices.

“The only solution is for the government to direct the National Fertilizer Marketing Limited to import urea to break the monopoly of local manufacturers,” he said.

Published in The Express Tribune, June 15th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ