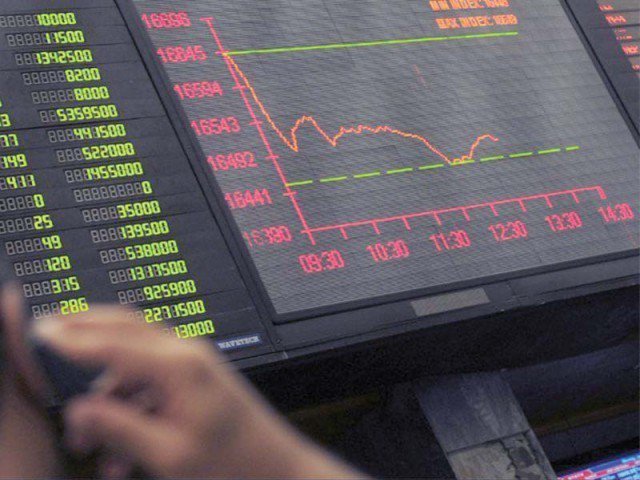

Like most days, stocks opened positive and remained in the black till the half-day mark before aggressive and panic-induced selling began the southward journey.

At close on Tuesday, the Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 1.69% or 545.84 points to end at 31,709.36.

Elixir Securities, in its report, said lower-than-consensus inflation reading at 2.73% for November was ignored by the market as nervous investors struggled to find refuge with most retail driven momentum plays hitting lower price limit.

“Expect volatile trading to continue with value buyers likely tracking foreigners’ activity, while rumours and news flow related to brokers will keep locals on the lookout.

“We see support to kick in near 31,000 levels with cement, fertilisers and financials our top buys,” it added.

Meanwhile, JS Global analyst Ovais Ahsan said there was no respite as the market closed in the negative.

“Major index movers were Habib Bank Limited (HBL -1.73%), Pakistan Petroleum Limited (PPL -3.03%) and ENGRO (-2.34%).

“The overall theme behind the fall remained the same as fear of foreign selling and political concerns affected sentiment,” said Ahsan, adding that concerns also remained over government’s decision to impose regulatory duties on various items to raise Rs40 billion of tax revenue which will have an inflationary impact going forward.

Market watch: Index ends negative for 5th straight session

“The auto sector led by Honda Atlas Cars (HCAR +1.48%) enjoyed an early rally on imposition of duty on imported cars, though most stocks in the sector succumbed to selling pressure during the day.

“CPI inflation for November clocked in at 2.73% YoY depicting an uptick from October’s CPI of 1.61% YoY,” he added.

Trade volumes rose to 189 million shares on Tuesday compared with Monday’s tally of 143 million shares.

Shares of 358 companies were traded. At the end of the day, 47 stocks closed higher, 298 declined while 13 remained unchanged.

The value of shares traded during the day was Rs7.7 billion.

Pak Elektron was the volume leader with 14.8 million shares, losing Rs3.14 to finish at Rs60.43. It was followed by K-Electric Limited with 13.5 million shares, losing Rs0.05 to close at Rs7.15 and Pace Pakistan Limited with 12.8 million shares, losing Rs0.44 to close at Rs7.

Foreign institutional investors were net buyers of Rs125 million during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 2nd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1714024018-0/ModiLara-(1)1714024018-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ