tax

More News

-

Sindh govt, HIT embroiled in decade-old dispute over sales tax, duties

The Sindh Police had procured weapons and other products from the HIT, but the payment was never made

-

FBR officials told to record interactions with traders

Move aims at eradicating corruption in tax collecting body

-

ECC okays tax concessions to attract hot money

Govt aims to lure foreign money in a bid to inflate foreign currency reserves

-

PTI govt asked to open escrow account for tax refunds

Businessmen argue it will ensure timely release of refunds to exporters

-

FBR kicks off nationwide anti-smuggling drive

Special joint teams will check import documents of foreign items at all markets

-

NA speaker calls for tax reforms, phasing out indirect taxes

Discusses economic situation and measures with finance adviser

-

FBR to launch crackdown on smugglers from Sept 1

Aims to stem inflow of goods through illicit channels that has badly hit local industries

-

Tractor industry advises against imposition of MVA tax

Says it will hike input cost, adversely impact end consumers

-

Reimagining tax mechanism in Pakistan

Re-think the mechanism, co-opt the family structure into how returns are filed & bring attention to tax avoidance

-

FBR scales down target for business registration

Once again serves income tax notices on wealthy people

-

Rs5.7b collected in taxes in July

Rs699.44 m was collected in terms of motor vehicle tax, Rs3999.688 m in infrastructure & Rs47.04 m in professional tax

-

Atletico Madrid's Costa to pay €1.7 million in tax fraud case

30-year-old hid income earned in 2014 from a sponsorship deal signed with Adidas shortly before he joined Chelsea

-

Online tax collection facility kicks off at PESS

Meeting held to analyse the performance of the Human and Labour Department

-

Romania plans anti-obesity tax on sugary drinks

This tax is aimed at discouraging consumption of sugary drinks and increasing public revenues, says finance ministry

-

Importing taxpayers

In its attempts to cast a wider tax net, PTI govt appears to not notice the influential in its own ranks

-

Traders announce four-day shutter-down strike

Say their demands, including fixed tax system, have not been accepted

-

'Tax machinery incapable of prosecuting fraud cases'

Report finds discrepancies between tax collected, deposited in national kitty

-

Taxes imposed, increased on kitchen items

Cost of living to rise due to new levies; FBR issues notification

-

Debt commission to also probe tax concessions

FBR told to submit 10-year records of duty waivers granted to traders, industrialists and exporters

-

Sindh govt imposes 19.5% sales tax on internet

Tax is applicable from July 1, 2019

-

Case of Rs1.34b tax theft facing delay for two years

FBR has unearthed hidden and undeclared transactions

-

Omission stalls sales tax payment by flour industry

Reason said to be FBR’s omission of HS code in budget document

-

70% of markets closed as traders observe strike

With business community divided a 100% shutter-down could not be observed

-

Tax on flour leaves stakeholders confused

Experts believe omission from Schedule VI might be a mistake

-

Online sales tax system not yet working

The system was supposed to be effective from July 1 this year

-

Finance Act 2019: Non-filers to pay higher taxes

Non-filers of tax would have to pay double in taxes than filers

-

Easier said than done

As PM Imran struggle with tax collection

-

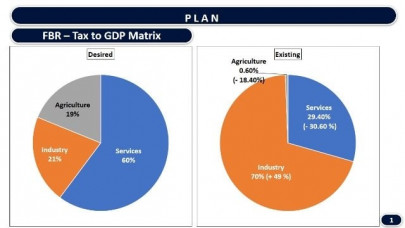

Govt aims to bring parity in tax collections from three sectors

Taxes on industry, services and agriculture sectors to be brought at par with their share in GDP

-

State of confusion: Excise dept stumped by vehicle tax hike

Seeks clarification from the Federal Board of Revenue

-

Govt to miss tax collection target by Rs600b

FBR has collected less than Rs36 billion under tax amnesty scheme so far

-

After due date, FBR to begin action against tax evaders

Measures may include heavy taxes along with penalties

-

Amnesty explained: Sword of Damocles hangs over heads of tax dodgers

Citizens have few days left to legalise most movable and immovable assets

-

MTTCR to protest against high property tax

Token-strike and sit-in to be held on Mall Road today

-

Sindh govt imposes 5% sales tax on ride-hailing services

Argument for provision of tax advantage has no force, states SRB

-

Domestic consumers get commercial tax notices

Local traders say investors are shying away

-

Massive spikes in property tax valuations on cards

Comments on proposal sought till June 30; new rates to come into effect from July 1

-

Strategy stressed to broaden tax base

. The consumption of electricity by economic groups reveals that the domestic sector has been the largest user

-

Beauticians take to the streets against new taxes

Say the fresh levies will make it difficult to survive in the industry

-

$18 million tax trouble: Neymar mansions put to freeze by Brazil authorities

Paris Saint-Germain forward has also been accused of rape, an allegation that Brazilian police are investigating

-

From apples to almonds, India hikes tariffs on US goods

In retaliation to Washington's recent withdrawal of trade privileges for New Delhi

-

Ministry seeks 20-year tax break for shipping companies

Wants extension in tax and duty exemptions from 2020 to 2040

-

Finance adviser says zero-rated regime intact for exporters

Insists businesses will have to pay tax on domestic sales

-

PTI govt unveils tax loaded and bloated budget

8.2% deficit projected. Income tax threshold slashed. Customs duty on 2,400 tariff lines up.

-

PTI govt proposes 10% increase in pensions

Slashes salaries of ministers by 10%; people earning Rs50,000 per month will have to pay tax

-

Tax loaded and bloated budget

Pay, pensions rise; income tax threshold slashed; FBR collection target set at Rs5.5t; 8.2% budget deficit projected

-

Pakistan introduces FED slabs for auto sector

Duty levied on cars of all engine capacities

-

PTI govt lifts curbs on property purchase

Govt withdraws 3% tax on price differential to close window for legalising black money

-

Pakistan sets lower revenue targets for oil, gas firms

Govt eyes collection of Rs359b against Rs486b in previous year

-

PTI govt slaps Rs516b ‘unprecedented’ taxes

Proposes harsh, inflationary taxation measures to qualify for IMF programme

-

Income tax: What the salaried class will pay now

The Express Tribune reviews new taxes proposed in FY20 and imposed in previous years