A highly volatile week at the stock market ended with the benchmark KSE-100 index shedding 282 points (0.8%) as falling crude oil prices and regulatory action led to a sell-off.

Despite positivity on the macro front along with encouraging sector-specific news, the index was hamstrung by continuously declining crude oil prices, devaluation of the Pakistani rupee and reports of investigations of the SECP against investors and brokers.

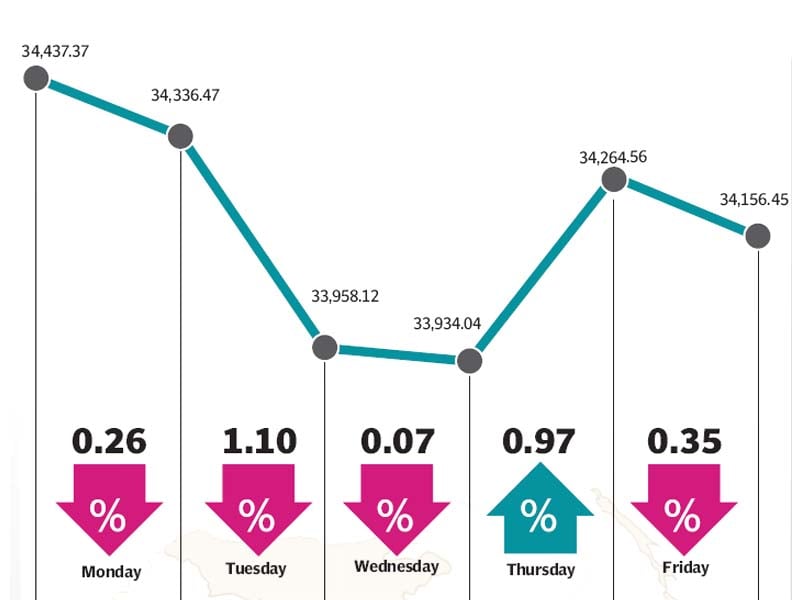

The week started off on a negative note after global crude oil prices took a plunge over the weekend. Oil prices would continue to fall steadily throughout the week resulting in the KSE-100 index declining for three consecutive days, falling 493 points in the process.

Value buying was witnessed on Thursday as the index bounced back strongly and by 330 points. However, the index failed to build momentum and ended the week with a 120-point decline as the market reacted to falling oil prices and negativity in global equity markets.

Oil prices had a major impact on the bourse after falling from $48 per barrel to $44 per barrel by the end of the week. The Oil and Gas Development Company, Pakistan Petroleum Limited and Pakistan State Oil were the worst hit and knocked off 113 points from the KSE-100 during the week.

The ongoing saga of the SECP taking action against market manipulators took a major turn this week as the regulatory body suspended accounts of five individuals for irregular practices. The news created panic amongst investors and created selling pressure in the market.

There were some positive developments during the week as macroeconomic data revealed the country’s trade deficit falling by 12% lower to $7.7 billion in the first four months of the fiscal year. Remittances on the other hand grew by 5% in the same period and stood at $6.5 billion.

The banking sector was the star performer of the week after the credit ratings agency, Moody’s, lifted the outlook for Pakistan’s banking sector from negative to stable. The gains in the sector partially offset the losses in other sectors.

Foreigners continued to be net sellers at the bourse, offloading net equity worth $5.7 million during the week, down from $10 million sell-off in the previous week. Towards the end of the week, it was revealed that Pakistan is expected to make a re-entry into the MSCI emerging markets index, which could turn the tide of foreign flows in the coming weeks.

Average daily volumes remained almost flat and stood at 185.3 million shares traded per day, down from 186.9 million shares in the previous week. Average daily values fell 12.3% and stood at Rs8.01 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.22 trillion ( $68.5 billion) at the end of the week.

Winners of the week

Associated Services Limited

Earlier called the Latif Jute Mills Limited, the company is one of the industrial machinery and services firms in Karachi.

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

Packages Limited

Packages Limited manufactures and sells paper, tissue products, paperboard and packaging materials. The group has joint venture agreements with Tetra Pak International, to manufacture paper for liquid food packaging, the Mitsubishi Corporation, to manufacture polypropylene films, and Printcare (Ceylon) Limited, to produce flexible packaging materials in Sri Lanka.

Losers of the week

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a Polyester Staple Fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres. also owns an in-house power generation plant.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere.

Pakistan Telecommunication Company Limited

Pakistan Telecommunication Company Limited provides fixed line domestic and international telephone services, telex, telegraph, fax and leased circuit services in Pakistan. The company owns all public exchanges, the nationwide network of local telephone lines, principal long distance transmission facilities and international telephone gateways in Pakistan.

Published in The Express Tribune, November 15th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ