Weekly review: KSE-100 continues upward drive despite foreign selling

Low inflation numbers, sector-specific triggers spurred index higher

Low inflation numbers, sector-specific triggers spurred index higher.

The stock market maintained its upward march, despite continued selling by foreigners, as low inflation numbers and positive news flows pushed the benchmark KSE-100 index higher by 164 points (0.4%) during the week ended November 6.

The latest gains come on the back of soft inflation figures for the month of October and positive news flows for the cement, oil and gas and energy sectors. The latter half of the week also saw renewed investor interest with trading volumes picking up and crossing 300 million shares traded on Friday.

The index’s climb was surprising given that foreigners continue to offload their holdings at the bourse amidst a wholesale selloff in emerging and frontier markets. Foreigners offloaded a net of $10 million worth of equity in the first week of the month after net selling of more than $50 million in October.

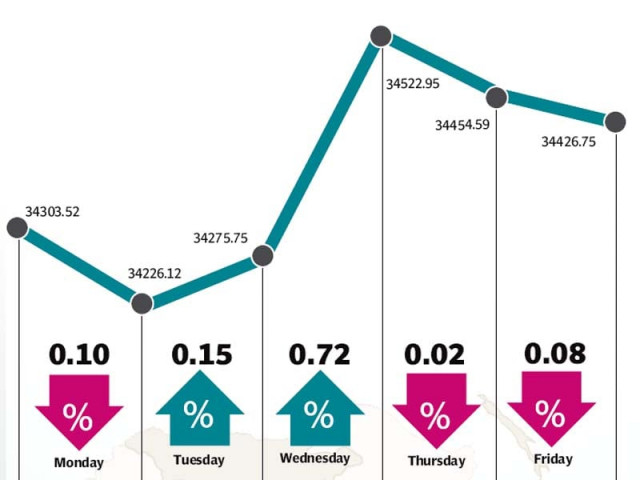

The week started off on a subdued note as the KSE-100 index failed to make an impression in the opening two days. However, the mood turned around on Wednesday with the index climbing 247 points (0.7%) before receding slightly in the final two days to close at 34,427 points on Friday.

The inflation figures for October were announced at the start of the week and clocked in at 1.6%, raising hopes of a further discount rate cut in the monetary policy announcement due later this month. Inflation numbers have remained low since the start of the current fiscal year and the current discount rate of 6% leaves room for the central bank to make further cuts.

The mid-week rally was triggered in part due to global crude oil prices shooting up on Tuesday and again crossing the $50 per barrel mark.

The price would slowly creep back to $47.5 per barrel by the end of the week, but still managed to make an impression on the bourse with oil and gas companies witnessing stellar gains during the week.

The oil marketing sector also witnessed strong gains after the government decided to increase the prices of petroleum products at the start of the month. Pakistan State Oil continued its impressive rally from the previous week and rose 4.6% during the week.

The cement sector was one of the star performers as sales data revealed a 10.6% year-on-year growth for October. The gain was led by growth in local sales and is expected to continue in the coming months as economic and construction activity picks up with the implementation of the China-Pakistan Economic Corridor.

Average daily volumes rose an impressive 13.1% and were recorded at 186.9 million shares traded per day, while average daily values fell 1.5% and stood at Rs9.14 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.31 trillion ($69.2 billion) at the end of the week.

Winners of the week

TRG Pakistan

TRG Pakistan Limited operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere.

PakGen Power Limited

Pakgen Power Limited generates and distributes electricity. The company operates an oil-fired electricity generating plant in Mehmood Kot, Muzaffargarh, Punjab.

Lalpir Power Limited

Lalpir Power Limited owes, operates and maintains an oil-fired power station with a gross capacity of 362MV in Mehmood Kot, Muzaffarghar.

Losers of the week

Associated Services Limited

Earlier called the Latif Jute Mills Limited, the company is one of the industrial machinery and services firms in Karachi.

Hum Network

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Published in The Express Tribune, November 8th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ