The importance of Karachi

Does the city really generate 70% of country’s revenue?

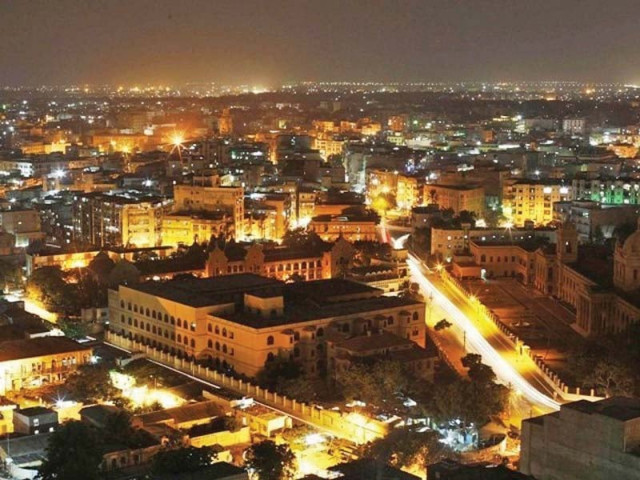

The claim that Karachi generates 65-70% of the revenue needs to be corrected. PHOTO: REUTERS

Some debates continue forever with statistical evidence and philosophical arguments driving the dispute forward in perpetuity.

One of those is Karachi’s input to the country’s overall tax revenue. Even on its face, the need to isolate Karachi merits discussion. But that’s what people do when they come out with all guns blazing in hailing the metropolis as the saviour.

One might even concede to their overzealous nature. Karachi, the business hub and former capital, attracts millions to its workforce and generates a lot of economic activity. But is it true that it drives the entire country? Many claim that.

“It is quite irresponsible for you to state this … journalists don’t want to read, they say whatever they want. They need to be held accountable,” was a political economist’s comment to an article that claimed “Karachi generates 65% of Pakistan’s revenue, and if the metropo lis’ security situation improves, there can be better economic prospects for everyone”.

The statement, not driven by an academic study, was a mere repetition of the popular opinion.

PTI, MQM and PPP have all mentioned the populist view.

None of them have, however, mentioned the source of this figure nor has anyone felt the need to question this ‘sacred percentage’.

But exploring facts comes close to answering the question.

Revenue collected from the country includes three Large Tax Units (LTUs) in Karachi, Lahore and Islamabad, 18 Regional Tax Offices (RTOs), including Karachi RTO–I, II, III, Lahore, Peshawar, Rawalpindi and Quetta, among others. States earn their revenue mainly through direct, indirect taxes and income from public corporations.

Read: The irony: Cost to collect tax higher than tax collection

In Pakistan, provincial budgets and provision of public goods in the provinces are dependent on transfers by the federal government.

The provinces are also obliged to collect taxes, ie capital value tax on immoveable properties, property taxes, stamp duties, motor vehicle levies, land revenue and agriculture income tax, but their collection is minimal. Reports suggest provinces, overall, contribute about 7% of tax and 9% of non-tax revenues of the country.

While there is no scepticism on Karachi’s improving security situation favouring the economy, economists argue that rather than generation, the city ‘dominates’ the country’s revenue-collection statistics.

The distinguishing factor

Much of the country’s economic, manufacturing, services and other value addition takes place in Karachi.

But what is the difference between revenue generation and collection? According to an article by State Bank of Pakistan’s deputy governor Mohammad Ashraf Janjua, we should know two terms: impact and incidence. Those who pay tax, but pass on the final burden to others are bearing the impact of a tax, those who bear the final burden are bearing the ‘incidence’. Thus, if machinery is unloaded in Karachi (tax is paid here), but is being used in Punjab, the tax is collected from Sindh, but generated by Punjab.

“It has the advantage of being a port city, as well as housing head offices of major financial institutions,” economist Kaiser Bengali, who is also adviser to Balochistan chief minister, told The Express Tribune. “Most companies have their head offices in Karachi where they pay their income tax but earn their income from the entire country.”

Asim Bashir Khan, in Akbar Zaidi’s Issues in Pakistan’s Economy, says Karachi ranks on top on the basis of average overall tax collection between 2000 and 2012 — it has an average of 62.4% followed by Lahore 13.63%, Rawalpindi 8.33%, Multan at 5.50% and Peshawar at 3.3%.

The average of direct tax collection is almost the same, with Sindh being the highest with 64.97%, Punjab with 30.93%, Khyber Pakhtunkhwa with 3.24% and Balochistan with 0.86%. Karachi dominates with an average 61.49%, followed by Lahore, Rawalpindi, Multan and Peshawar with 17.33%, 4.30%, 3.65% and 3.03%, respectively.

Province-wise average revenue collection calculated by Asim Bashir Khan. DESIGN: NABEEL AHMED

Province-wise average revenue collection calculated by Asim Bashir Khan. DESIGN: NABEEL AHMEDIndirect tax collection statistics are also similar as direct taxes with Karachi dominating with an average 62.79%, followed by Lahore, Rawalpindi, Multan and Peshawar.

“On average, the two most developed provinces of Pakistan – Sindh and Punjab – make significant contributions; but this is strictly due to its monopoly over port resources, which facilitate superiority in collection of indirect taxes such as custom sales tax and FED on imports,” writes Khan. “Sindh’s share in collection of custom duty was 84.21%, followed by Punjab with 12.43%, K-P with 2.3%, and Balochistan with 1.05%.”

Read: Oversight committee formed to implement tax reforms

But does Karachi have an edge just because of revenue from customs or profits declared by financial institutions or the metropolis contribute to the national treasury in other ways too?

The indirect input

“Millions of migrants from other provinces flock to Karachi to earn their living. Billions are remitted to their families based outside Karachi. These remittances make the difference between a family’s survival and a life of despondency due to no earning opportunities available to the migrants in their localities or cities,” says former Karachi Chamber of Commerce and Industry president Majyd Aziz. “All this is tax-free for migrants, but these remittances spur up economic activity in areas outside Karachi.”

Aziz argues Karachi’s potential is way beyond the current oft-repeated figures.

“Goods destined for the northern areas traverse through Karachi’s roads and use other facilities and utilities. What if a substantial toll tax is levied on every truck moving out of Karachi? This would bring in billions to Karachi’s coffers, which could be spent on improving the physical infrastructure,” he says.

According to FBR data (as of December 9, 2014), 881,262 tax returns were filed across the country. Karachi leads this list as well — and by a wide margin.

Zaidi, in his book, says that in terms of direct taxes, Karachi contributes more than 35% of all of Pakistan’s taxes. Similarly, he adds, if one looks at the sales tax collected, which is consumption tax, it gives an indication of the nature of economic activity, and of the consumer market in Karachi as compared to the rest of Pakistan.

We can safely conclude the amount taxed through Karachi includes both collection and generation. Those referring to Karachi’s contribution, either in naivety or deliberately, refer to collection and they are right.

Karachi, the industrial hub, does contribute the most to tax collection. But the word should not be generate because, while it generates much, it collects far more than that.

The writer is a staff correspondent

Published in The Express Tribune, October 12th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ