The stock market suffered another torrid week as investors remained concerned over regulatory action against large brokers, resulting in the benchmark KSE-100 index dropping sharply by 911 points (2.7%).

The market remained oblivious to the State Bank’s decision to cut the policy rate and the rebound in global oil prices, closing negative in four of the five trading sessions of the week. Concerns about a rate hike by the US Federal Reserve also dominated investor sentiment and had a negative impact on the market.

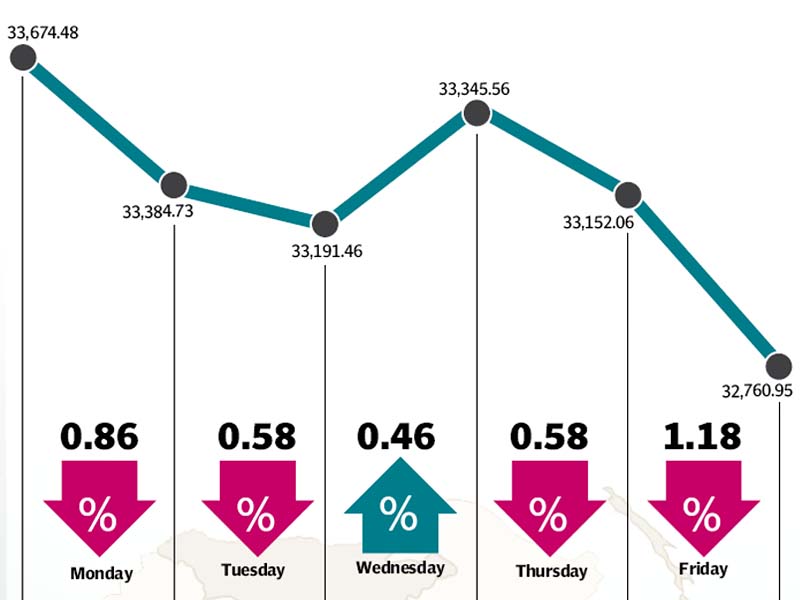

The week was supposed to kick off on a positive note after the SBP decided to cut the policy rate by 50 basis points to 6% in the monetary policy over the weekend. Monday did start off on a positive note, but the mood soon turned sour and the index ended the day with a 288-point (0.9%) decline.

The negative trend continued on Tuesday before a slight reprieve on Wednesday. The KSE-100 index lost a further 585 points in the final two days of the week to fall below the 33,000-point barrier and closed at 32,760 at the end of trading on Friday.

Investors remained concerned about regulatory bodies (SECP) and law enforcement agencies (NAB) taking action against large brokers. Although the news did not materialise, investors chose to remain on the sidelines and trading volumes plunged to a 17-week low.

Market sentiment was also dampened by concerns over the possibility of a rate hike by the US Federal Reserve. With China’s growth slowing down, the growth in the US economy has kept global markets stable in recent times and a rate hike would have had a negative impact on markets globally. However, the concerns did not materialise as the Fed delayed the rate hike to December when it announced its policy on Thursday.

Foreigners continued to be sellers and did not help the market’s cause. Foreigners sold net equity worth $5 million during the week, following up on the $8 million net selling in the previous week.

In sector specific news, the oil and gas sector led the losses as the index heavyweight Oil and Gas Development Company knocked off 99 points from the KSE-100 index. The decline was surprising because global oil prices rebounded during the week, which should have provided a boost to the market.

Average daily volumes fell sharply by 34% and stood at 135.2 million shares traded per day, while average daily values also fell 31.2% and stood at Rs6.3 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.04 trillion ($68.3 billion) at the end of the week.

With the earnings season now ended and monetary policy announcement also done, the market will be in search of triggers. The direction of foreign flows and the price of crude oil will be key factors in the market’s direction in the coming week.

Winners of the week

Punjab Oil

Punjab Oil Mills Limited manufactures and sells vegetable ghee, cooking oil, and laundry soap.

Pioneer Cement

Pioneer Cement Limited produces ordinary portland cement and sulphate resistant cement.

Kot Addu Power Company

Kot Addu Power Company Limited owns, operates, and maintains a power station and generating units.

Losers of the week

Servis (Shoes) Industries

Servis started in 1959 a single outlet in Lahore. It is now the largest retail network in Pakistan, with more than 450 retail outlets and roughly 2,500 independent dealers.

Ibrahim Fibers Limited

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a Polyester Staple Fiber manufacturing plant. The company manufactures a wide range of polyester staple fiber and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Ltd. also owns an in-house power generation plant.

Pakistan Telecommunication Company

Pakistan Telecommunication Company Limited provides fixed line domestic and international telephone services, telex, telegraph, fax and leased circuit services in Pakistan. The Company owns all public exchanges, the nationwide network of local telephone lines, principal long distance transmission facilities and international telephone gateways in Pakistan.

Published in The Express Tribune, September 20th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ