With almost three-quarters of the insurance companies listed on the bourse registering a share price appreciation in double digits since the beginning of the fiscal year, the volumes of shares traded have also risen substantially in recent weeks.

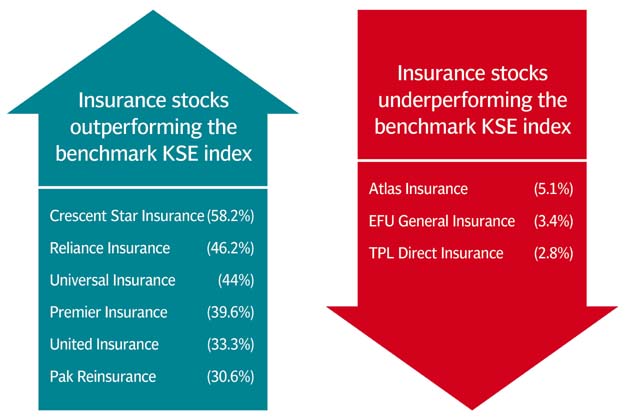

Each insurance stock registered a gain in its price between June 30 and August 11, KSE data shows. Moreover, 19 of the 22 insurance stocks outperformed the benchmark index, which rose 5.2% over the six-week period.

The biggest share price appreciation was recorded in Crescent Star Insurance, which registered a rise of 58.2% between June 30

and August 11.

Other insurance companies whose stocks saw a substantial increase in the six-week period included Reliance Insurance (46.2%), Universal Insurance (44%), Premier Insurance (39.6%), United Insurance (33.3%) and Pak Reinsurance (30.6%).

Read: Manipulators spread rumours to raise stock prices

The three insurance companies that underperformed the benchmark index in the period under review were Atlas Insurance (5.1%), EFU General Insurance (3.4%) and TPL Direct Insurance (2.8%).

Speaking to The Express Tribune, Taurus Securities Head of Research Zeeshan Afzal said the across-the-board rise in insurance stocks signals that investors foresee a jump in economic activities in the months ahead.

“New assets added by the industry have to be insured. Businesses cannot grow without simultaneous growth in the insurance sector,” he said.

Afzal said many stocks within the insurance sector have specific reasons for a sudden appreciation in their prices. As an example, he cited the stock of Crescent Star Insurance, which has posted the largest gain in the insurance sector in the six-week period.

The insurance company recently established a subsidiary in the food sector, which has joined hands with an American fast-food chain to set up 30 restaurants over the next decade starting December 2015.

According to the Insurance Association of Pakistan, six life insurance companies operating in the private sector earned a net profit of Rs2.4 billion in 2014, which was up 20.2% from a year ago.

Similarly, 28 non-life insurance companies operating in the private sector earned a net profit of Rs8.7 billion in 2014, which was up 13.6% from a year ago.

But how can the fundamentals of 22 companies improve simultaneously in a short period of time, resulting in a sector-wide stock rally?

“The reason for the sector-wide rally in insurance stocks is the imposition of a 10% tax on undistributed reserves through the Finance Act 2015,” said an equity trader while requesting anonymity.

In order to avoid the tax on their reserves accumulated over the past years, brokers expect insurance companies to announce major cash dividends going forward, the trader noted.

The Finance Bill had originally entailed a 10% tax on undistributed reserves of a publicly traded company in case it did not pay cash dividends. The tax also applied to those listed companies that distributed dividends, but to an extent that their reserves still exceeded the paid-up capital after the distribution of dividends.

Read: KSE loses 1% as bullish momentum dies down

An amendment introduced to the proposed bill later ensured that the tax does not apply to those listed companies that distribute dividends equal to 40% of their net profit or 50% of their paid-up capital - whichever is less - within six months of the end of the financial year.

“Investors foresee heavy cash dividends ahead and that’s causing a rally in insurance stocks,” he said.

Published in The Express Tribune, August 15th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1732521023-0/biden-(1)1732521023-0-405x300.webp)

1732520496-0/BeFunky-collage-(86)1732520496-0-165x106.webp)

1732519472-0/lamar-(3)1732519472-0-165x106.webp)

1732519298-0/BeFunky-collage-(85)1732519298-0-165x106.webp)

1732486769-0/image-(8)1732486769-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ