2008 stock market crash: Report blames former SECP chief for taking unilateral decisions

Then finance minister opposed removal of trading floor that continued for 110 days.

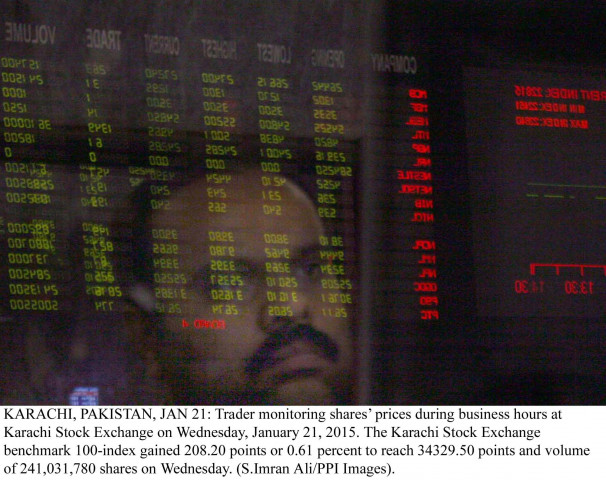

The report, finalised in June this year, stated that Rehman took decisions without bringing those to the notice of the full bench of commissioners. PHOTO: PPI

During the 2008 market crisis, the apex regulator was functioning as a non-collegiate body and then SECP chairman Raziur Rehman, who was also the commissioner of Securities Market Division, unilaterally handled the entire situation, revealed findings of the Shamim Ahmad Khan Committee.

The SECP had constituted the committee in 2012 to analyse the factors behind the crisis, but it became inactive due to Shamim Ahmad Khan’s resignation. However, current SECP Chairman Zafar Hijazi reactivated the committee, which was also asked to give policy recommendations.

The report, finalised in June this year, stated that Rehman took decisions without bringing those to the notice of the full bench of commissioners and there was no discussion about the grave crisis during SECP meetings at that time.

The market crash swallowed savings of many small investors. Although the report did not mention the quantum of losses, some estimates suggested that Rs1.3 trillion was wiped off the market capitalisation.

“The then chairman was directly running the commission’s affairs from his room,” said Hijazi while sharing details of the report with the media.

It was a very complex area and a single person should not have taken these decisions, he remarked.

Hijazi said there was nervousness and neither the SECP and State Bank of Pakistan nor the federal government was ready to tackle the situation.

In order to bring things under control, the regulator and the Karachi Stock Exchange (KSE) imposed a trading floor with effect from August 25 and that continued for 110 days. Hijazi termed it the “gravest mistake”, saying the best decision could have been to close the market for few days.

He said the brokers who lent support to the imposition of trading floor “had commercial motives” and almost every broker took benefit of it. Though there were restrictions on trading, off-market settlements continued, facilitating the brokers to make money, he added.

Then KSE chairman Kamran Mirza and SECP’s nominee on the KSE board, Ali Ansari, opposed the trading floor. However, the then KSE managing director and broker-directors were in favour, according to the findings.

When the floor was going to be removed, Shaukat Tarin got the decision delayed. According to minutes of a KSE board meeting, Tarin considered the time inappropriate for lifting the floor, saying its fallout would have adverse implications for bailout negotiations with the International Monetary Fund, said Musarat Jabeen, Executive Director of the Securities Market Division while sharing details.

The SECP presented the report to the policy board in a meeting held on Monday.

The committee recommended the framing of a strategic capital market development plan by the SECP and putting in place procedures for improved coordination between the SECP and State Bank.

It expressed concern over the arbitrary use of force majeure powers and abrupt and ad hoc policy shifts, including changes to risk management rules by stock exchanges. It asked the SECP to devise a transparent policy, spelling out the circumstances in which the regulator can intervene in the market.

The committee made recommendations aimed at preventing the repeat of the crisis. It suggested reforms in the SECP, stock exchanges, the Central Depository Company (CDC) and the National Clearing Company of Pakistan.

About 90% of the recommendations had already been implemented, said Hijazi. The remaining was part of the SECP’s reform agenda and in the implementation phase, he added.

The committee recommended revamping of the broker regime and stringent criteria for CDC participants whereby only select institutions meeting the criteria would be allowed custody of clients’ securities.

Published in The Express Tribune, August 12th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ