Weekly review: KSE breaks record, hits historic high during week

Corporate results were the motivating force with auto stocks among major gainers.

Corporate results were the motivating force with auto stocks among major gainers.

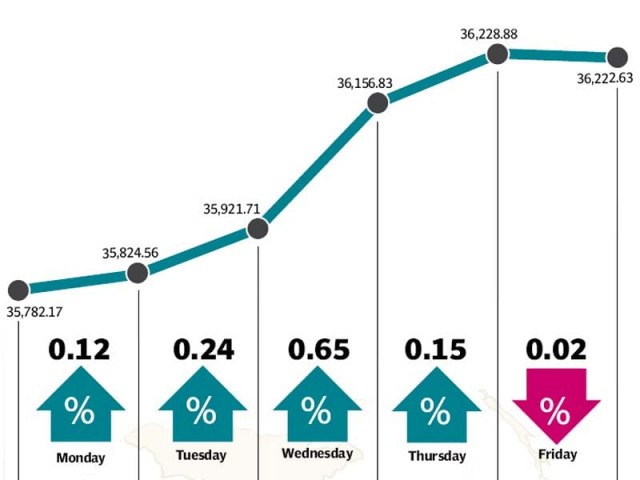

Except for lacklustre trading on the last day of week on Friday, the stock market witnessed one of the most eventful weeks and closed at a historic high at 36,223 points.

With the corporate result season driving stock movements, the benchmark KSE 100-share index rose 1.35% week-on-week for the period ended August 7.

Several political developments were behind the impressive march upwards at the bourse. One of the key triggers was Iran’s nuclear deal with global powers that would pave the way for strengthening of trade relations with Tehran as well as geo-political stability.

Investor confidence got a further boost from the talks held in Dubai with the International Monetary Fund (IMF) as part of the eight quarterly review of the $6.2 billion Extended Fund Facility.

On Monday, the week started on a positive note at the bourse as index rose 83.04 points. However, it was not until Thursday when the index broke the previous record and stood above 36,200 points.

A slight drop of 6.25 points on Friday failed to dampen the spirits and the market ended the week at 36,222.63.

Auto stocks captured most of the attention after news that the Ministry of Industries and Production had told a Senate standing committee that it had tabled the much-awaited automobile policy with the Economic Coordination Committee (ECC) for formal approval.

Apart from this, Pak Suzuki Motor Company announced its financial results that came in above market estimates. It earned Rs1.5 billion in the second quarter against Rs0.6 billion in the same quarter of previous year.

Major gains were seen in the areas of pharmaceutical and biotech (8.4%), construction and materials (6.1%) and automobile and parts (4.8%), while big losers were in the categories of real estate investment and services (1.7%), tobacco (1.5%) and telecommunication (1.2%) during the week under review.

Foreigners focused on sectors like chemicals with net investment of $10 million, oil and gas got $3 million and banks $2.8 million while they sold shares in cement companies valuing $7.6 million.

Overall, local mutual funds and foreigners were net buyers of $10.5 million and $5 million worth of shares respectively. However, individuals and banks were net sellers, who sold shares worth $14.7 million and $1.4 million respectively.

Average daily volumes dropped sharply by 27% week-on-week and stood at 295 million shares, while average daily values increased 5% week-on-week to Rs13.5 billion.

Winners of the week

Punjab Oil

Punjab Oil Mills Ltd manufactures and sells vegetable ghee, cooking oil, and laundry soap.

Ghani Glass

Ghani Glass Limited manufactures and sells glass containers. The company manufactures international glass containers for pharma, food and beverage. Ghani Glass also manufactures float glass variations for commercial, domestic and industrial use.

National Refinery

National Refinery Ltd manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Losers of the week

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centres and offices located in Pakistan and elsewhere throughout the world.

Jubilee Life Insurance Co Ltd

Jubilee Life Insurance Company Ltd. is a general insurance company which offers both individual life insurance and corporate business insurance. The company’s individual products include life, personal accident, critical illness, and investment insurance. Jubilee’s corporate products include group life, health, and pension schemes.

Mari Petroleum

Mari Petroleum Company Limited specialises in the drilling, production and selling of natural gas.

Published in The Express Tribune, August 9th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ