Weekly review: Politics and year-end selling drag KSE-100 down by 641 points

Institutional and foreign selling were witnessed as fiscal year draws to a close.

Institutional and foreign selling were witnessed as fiscal year draws to a close.

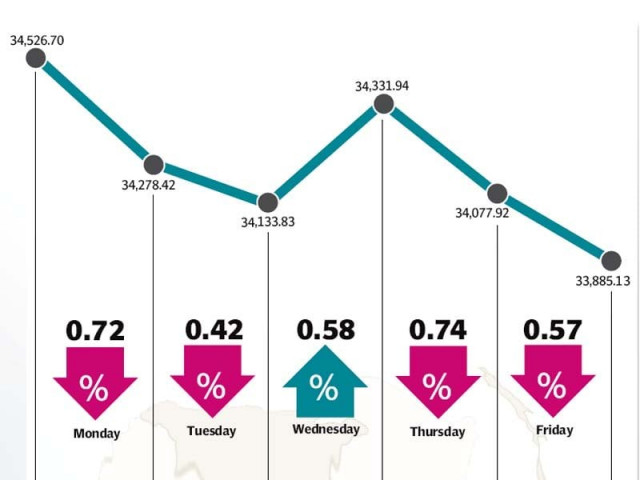

The stock market remained hostage to political developments and year-end profit taking as the benchmark KSE-100 index fell 641 points (1.9%) to end the week at 33,885, falling below the 34,000 barrier.

Volumes dropped sharply with the start of short trading days in Ramazan and activity being restricted to second- and third-tier stocks. Foreigners and local institutions alike were sellers at the bourse, choosing to book profits ahead of the end of the fiscal year.

The improving macroeconomic position of the country could do little to counter the selling with the KSE-100 index being dragged down by the heavyweight oil and gas sector, while the chemicals sector also remained under pressure.

After last week’s controversial statements by the co-chairman of the Pakistan Peoples Party against the Army, this week saw a new controversy erupt after the BBC published a report alleging that the Muttahida Qaumi Movement (MQM), the leading political party in Karachi, received funding from India’s intelligence agencies.

The MQM, which has been embattled in recent times after similar accusations by high ranking police officials and bearing the brunt of the Karachi operation, was quick to dismiss the allegations as completely baseless. However, the government has decided to investigate the matter and will be looking at the accusations in the coming weeks.

With the fiscal year drawing to a close, local institutions like mutual funds engaged in profit-taking and were major sellers at the bourse. Furthermore, foreigners continued to be net sellers and offloaded a net of $16 million worth of equity following the $5.7 million net selling in the previous week.

The index’s decline came despite an overall improving macroeconomic situation of the country. According to the latest figures, the country’s foreign exchange reserves rose $706 million to $18.20 billion, just shy of its all-time high of $18.24 billion reached in 2011. The country’s oil import bill also fell 20% in the 11 month period of the current fiscal year.

The heavyweight oil and gas sector was the main victim of the institutional selling as global oil prices stabilised around the $60 per barrel mark. The sector contributed 308 points to the KSE-100’s decline with OGDCL and Pakistan Petroleum leading the losses.

Similarly, the chemicals sector also witnessed selling pressure with rumors persisting about a gas price hike. On the other hand, the cement sector outperformed the market in anticipation of the hike in the Public Sector Development budget which was approved with the Finance Bill by parliament this week.

Average daily volumes dropped sharply by 22% and stood at 357.6 million shares traded per day. Average daily values also fell 17.6% and stood at Rs11.01 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.32 trillion ($72.4 billion) at the end of the week.

Winners of the week

Arif Habib Corporation

Arif Habib Corporation Limited is a holding company. The company holds interests in the securities brokerage, investment and financial advisory, investment management, commercial banking, commodities, private equity, cement and fertiliser industries.

Nishat Chunian Limited Limited

Nishat Chunian Limited manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing, and finishing units.

Lafarge Pakistan

Lafarge Pakistan Cement Company Limited manufactures and sells cement.

Losers of the week

Oil and Gas Development Company

Oil and Gas Development Company Limited explores and develops oil and natural gas properties in Pakistan.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

K-Electric Limited

K-Electric Limited is a state-controlled power producer, which transmits and distributes electricity.

Published in The Express Tribune, June 28th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ