Agriculture loans: Banks disburse Rs439.8b, meet 88% of annual target

Credit disbursed is 31.4% higher than the corresponding period of last year

Credit disbursed is 31.4% higher than the corresponding period of last year.

According to latest data released by the State Bank of Pakistan (SBP), the agriculture credit disbursed in July-May was 31.4% higher than the disbursement of Rs334.7 billion made during the corresponding period of previous fiscal year. The outstanding portfolio of agriculture loans has also surged by Rs43 billion, or 15.5%, on a yearly basis from Rs277.1 billion to Rs320.1 billion at the end of May.

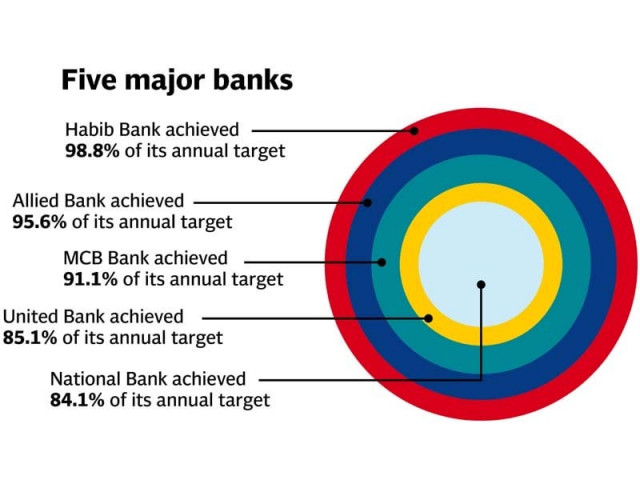

The SBP called the performance of five major banks satisfactory, as they have disbursed Rs229.3 billion or 90.8% of their combined annual target so far. Two specialised banks, namely Zarai Taraqiati Bank (ZTBL) and Punjab Provincial Cooperative Bank (PPCBL), disbursed Rs86.8 billion, or 85.4% of their annual target of Rs101.5 billion, during the first 11 months of 2014-15.

Fifteen domestic private banks collectively disbursed Rs91.2 billion, or 78.9% of their combined annual target of Rs115.6 billion. Eight microfinance banks disbursed Rs27.8 billion, or 98.8% of their annual target, the SBP said.

Four Islamic banks have collectively surpassed their annual target by disbursing Rs4.7 billion against the target of Rs2.3 billion during the period under review.

Among the five major banks, Habib Bank achieved 98.8% of its annual target in the first 11 months of 2014-15. Allied Bank achieved 95.6% of its annual target while MCB Bank, United Bank and National Bank could achieve 91.1%, 85.1% and 84.1% of their respective annual targets.

Under the category of specialised banks, ZTBL disbursed Rs78.7 billion, or 87.4% of its annual target of Rs90 billion. PPCBL disbursed Rs8.1 billion, which constitutes 70.4% of its annual target of Rs11.5 billion during the period under review.

Within the 15 domestic private banks, Faysal Bank achieved 95.1% of its annual agriculture credit disbursement target while Sindh Bank and Bank Alfalah achieved 73.6% and 72.7%, respectively. Bank of Khyber, Standard Chartered Bank and JS Bank surpassed their annual targets of Rs5 billion, Rs2.5 billion and Rs0.5 billion, respectively, during the 11-month period.

Published in The Express Tribune, June 23rd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ