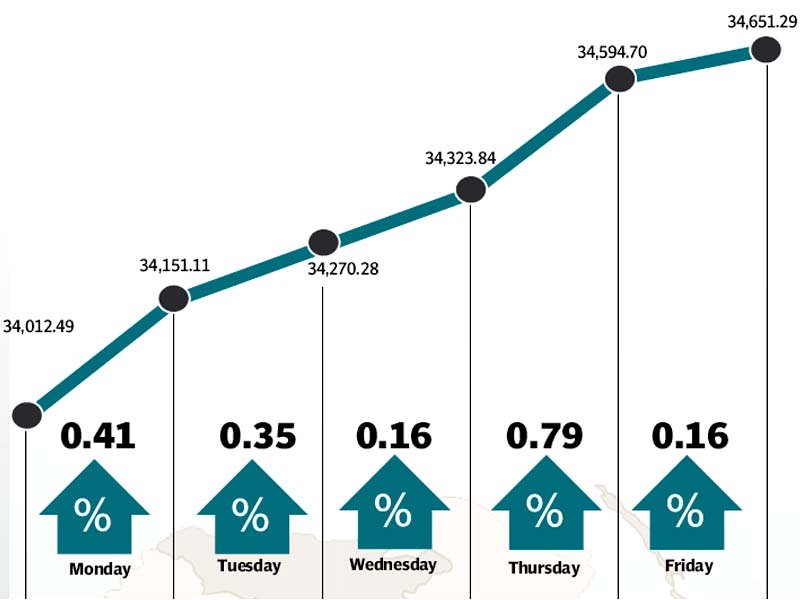

The stock market defied odds in the face of a mixed budget announcement and continued to climb upwards as the benchmark KSE-100 index rose 638 points (1.9%) to close just shy of its all-time high, during the week ended June 12.

The federal budget for fiscal year 2016 was revealed towards the end of the previous week and painted a bleak picture for the market with increased Capital Gains Tax and heavy taxation on large corporates. However, the market managed to overcome a slow start and steadily rose throughout the week.

The gains came amid announcements by the MSCI to review Pakistan’s classification and Moody’s upgrading of the country’s credit rating. The week also saw the successful book-building process of two IPOs and the revelation of impressive macro figures, all of which aided the index’s climb.

The week kicked off on a volatile note as the KSE-100 index dipped sharply by 875 points as a knee-jerk reaction to the budget announcement. The banking sector in particular was hard-hit and took a beating earlier in the session. The second half of Monday saw a recovery rally with cements leading the way and index eventually ending the day with a gain of 138 points (0.4%).

The index continued to consolidate from thereon and closed in the green in all four remaining trading days of the week. The KSE-100 index rose as high as 34,744 points, before easing off and ending the week at 34,651 points, just shy of its all-time high of 34,826 points it achieved in February 2015.

The big boost for the index came in the form of the MSCI announcing that it would consider reclassifying Pakistan from the Frontier Markets index to its Emerging Markets index. Soon after the MSCI’s announcement, the credit ratings agency, Moody’s announced that it was upgrading the country’s credit rating from Caa1 to B3 with a stable outlook.

The re-classification and the ratings upgrade can potentially bring the country’s market into the attention of larger foreign investors and result in higher foreign inflows.

The week also saw the successful completion of the book-building process of Dolmen REIT (real estate) and Al-Shaheer Corporation’s (meat exports) Initial Public Offering. Both offerings were oversubscribed and provided a boost to the market.

The star performer of the week was Fauji Fertilizer Bin Qasim Limited, which was an unintended beneficiary of Al Shaheer Corporation’s IPO. The company is in the process of setting up its own meat processing business and reacted positively to Al-Shaheer’s book building being oversubscribed by 3.7 times.

Foreigners continued to be net buyers and purchased $13.5 million worth of equity during the week. The 11-month remittance figure was also revealed during the week and stood at $16.6 billion, a 16% year-on-year gain.

Average daily volumes rose 26.7% and stood at 400 million shares. Average daily values also jumped 34% and stood at Rs17.4 billion. The Karachi Stock Exchange’s market capitalisation stood at Rs7.46 trillion ( $72.7 billion) at the end of the week.

Winners of the week

Fauji Fertilizer Bin Qasim Limited

Fauji Fertilizer Bin Qasim Limited manufactures, purchases, and markets fertilisers. The company produces Granular Urea and DAP. Fauji Fertilizer provides its products to farmers in Pakistan.

Jahangir Siddiqui & Co

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Arif Habib Corporation

Arif Habib Corporation Limited is a holding company. The company holds interests in the securities brokerage, investment and financial advisory, investment management, commercial banking, commodities, private equity, cement and fertiliser industries.

Losers of the week

Shifa International Hospitals Ltd

Shifa International Hospitals Limited establishes and runs medical centers and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetric and gynaecology, dentistry, rehabilitation services and ophthalmology.

MCB Bank Limited

MCB Bank Limited is a full service commercial bank. It offers a wide range of financial products and advice for personal and corporate customers, including online banking services.

Habib Metro Bank

Habib Metropolitan Bank Limited is a fully accredited commercial bank. The bank provides services to individual and corporate customers including personal loans, education loans, mobile banking, cash management services, short & long term financing, international trade, and savings accounts.

Published in The Express Tribune, June 14th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1722586547-0/Untitled-design-(73)1722586547-0-165x106.webp)

1732326457-0/prime-(1)1732326457-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ