SBP warns of long-term risks to growth, financial stability

Country’s financial system increased 20% to Rs9.2 trillion by June 2010, shows Financial stability review 2009-10.

The basic objective of financial intermediation, the efficient allocation of resources is not being met, warned the State Bank of Pakistan (SBP) in the financial stability review 2009-10 issued on Tuesday.

The central bank also said that “non-performing loans remain a key cause of concern for the banking sector,” acknowledging that deterioration in the quality of advances has persisted. However, the SBP pointed out that the rate of increase in non-performing loans slowed from 24.2 per cent in calendar year 2009, to 6.4 per cent by end-June of the current calendar year.

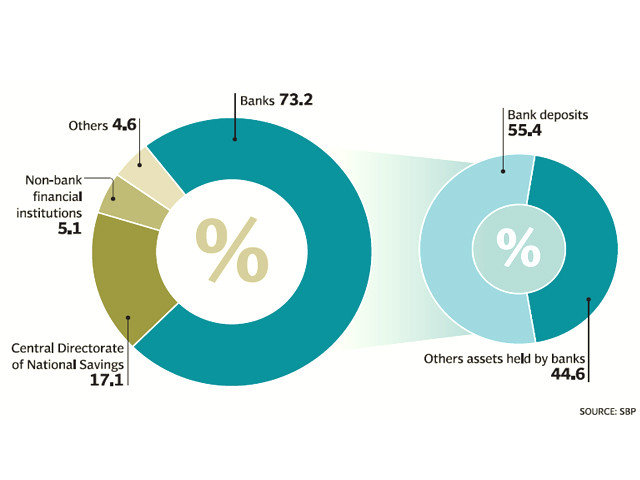

According to the publication, “Pakistan’s financial system, in terms of assets, increased to Rs9.2 trillion by the end of June 2010 showing a robust growth of 20 per cent from December 2008”. The growth of banking sector assets outpaced all other categories, amounting to Rs6.7 trillion by the end of this period. Deposits held by banks constituted 55 per cent of all financial assets in the country. While the report appreciated growth in home remittances as a contributing factor to increasing bank deposits, it criticised the government for excessive borrowing from SBP.

The publication said that the “government has had a historically traditional recourse to central bank borrowing for financing the budget deficit” which is tantamount to “printing money”. It asserted that this reliance on borrowings from SBP has worked against the monetary policy stance and fuelled inflation.

Debt-laden government

Government borrowings for commodity financing and public sector agencies have combined with a weak cash management system to increase the fiscal burden, said SBP. The report stated that the fiscal deficit has mushroomed to “6.3 per cent of GDP in fiscal year 2010, from 5.3 per cent in FY09”. Moreover, it cautioned that although the monetisation of the fiscal deficit had been substantially contained after the implementation of the International Monetary Fund programme, it “increased unabated from September 2010 onwards”.

“Structural weaknesses in the process of revenue generation, significant rigidities in government spending and the expansion in quasi-fiscal operations have added to the fiscal burden, which is increasingly financed from the financial system,” said the review.

SBP stated that “banks’ exposure to the government increased significantly during 2009 and in the first half of 2010” adding that this overreliance on sovereign-risk related assets has fuelled the “crowding out of the private sector”. The central bank warned that banks’ exposure to government borrowings may have negative long-term implications for economic growth and the stability of the country’s financial system.

Fears of disclosure

While lambasting the government for crowding out private sector credit, the central bank also criticised the private sector for failing to diversify their financing mix beyond bank loans. “The number of listed companies decreased to 651 in the year 2010 from 762 in 2000,” highlighted the central bank, asserting that a large majority of business entities in the country are reluctant to raise capital through means other than banks. “Fear of loss of control, sharing information, disclosure requirements and requirements relating to corporate governance” are viewed as impediments against raising capital through the public listing of companies. The SBP has expressed hope that ongoing reforms initiated by the Securities and Exchange Commission of Pakistan for improving liquidity in the secondary debt market and the introduction of the electronic bond trading platform in January 2010 will help bring down the turnaround time and transaction costs for term financing certificates, which will in turn facilitate fresh financing avenues for private enterprise.

Way forward

The central bank has said that capital markets and the insurance sector have provided requisite support to the financial system during this period. Net foreign portfolio investments in fiscal year 2010 tallied $521.49 million, helping local equity prices post substantial recoveries from the five-year low it touched in January 2009. The central bank acknowledged that it must take steps to improve the effectiveness of monetary policy implementation to encourage the development of debt markets in the country. However, it charged the government with the responsibility of implementing strong macroeconomic policies, as well as for improving governance to curb tax evasion and undocumented economic activity. The SBP has also advised banks to utilise risk mitigating tools such as interest rate swaps instead of relying heavily on sovereign-risk related assets.

Published in The Express Tribune, December 15th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ