Weekly review: KSE-100 gains 955 points in pre-budget rally

Banking and cement sectors led the gains while foreign buying picked up.

Banking and cement sectors led the gains while foreign buying picked up.

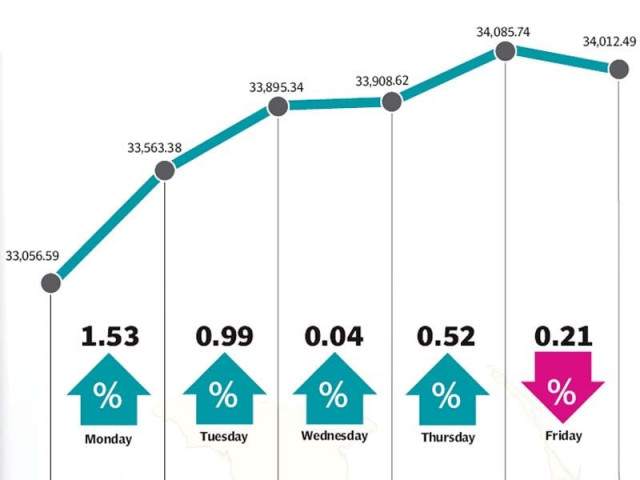

The stock market continued to climb upwards as investors went on a buying spree ahead of the budget announcement, resulting in the benchmark KSE-100 index gaining 955 points (2.9%) to close above the 34,000-point barrier during the week ended June 5.

After falling sharply during May, the index bounced back last week following the discount rate cut by the State Bank of Pakistan and continued its upward trajectory. Investors jumped upon the opportunity to buy stocks at attractive valuations with the cement and banking sectors, in particular, leading the way with impressive gains. Foreigners pitched in with aggressive buying after being net sellers in the previous week.

Towards the end of the week, the budget was announced by Finance Minister Ishaq Dar and is likely to have a negative impact on the market in the coming week.

The week started off on a positive note as inflation numbers for May 2015 were revealed, clocking in at 3.16%. Despite increasing from 2.1% in April 2015, the number signalled that inflation can be expected to remain low in the coming months and the discount rate would remain stable in the next announcement.

The index gained 839 points (2.5%) in the opening two days before finally breaching 34,000 on Thursday as foreign buying picked up. The index ended the week a bit lower as the market came under pressure and closed at 34,012 points.

The banking and cement sectors were the star performers of the week. Investors flocked to the banking sector which had taken a beating following the discount rate cut announcement. The sector contributed 270 points to the KSE-100’s gains with United Bank, Habib Bank and MCB Bank leading the way.

The cement sector continued to benefit from news flows regarding the hike in the public sector development budget and impressive sales figures for May. The sector contributed 166 points to the KSE-100’s gains.

Foreigners made a resounding comeback to the bourse and mopped up a net of $23.5 million worth of equity. The buying was a welcome change after foreigners had offloaded $6.8 million worth of equity in the previous week.

Average daily volumes rocketed upwards and stood at 315 million shares, climbing 69.5% over the previous week. Average daily values increased a relatively modest 35% and stood at Rs12.9 billion. The KSE’s market capitalisation stood at Rs7.33 trillion ($71.7 billion) at the end of the week.

The budget was finally announced on Friday and confirmed fears of a hike in the capital gains tax and the introduction of CGT on shares held for more than 2 years.

Furthermore, taxation measures on larger companies and banks in particular are surely going to be negatively received by investors. As a result, the market can be expected to plunge in the coming week.

Winners of the week

Pace Pakistan Limited

Pace Pakistan Limited develops real estate in both the residential and commercial sectors. The company develops and constructs shopping malls, supermarkets, and apartments.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. TRG Pakistan manages call centers and offices located in Pakistan and elsewhere throughout the world.

Kohinoor Textile Mills

Kohinoor Spinning Mills Limited is a textile spinning company.

Losers of the week

Grays of Cambridge

Grays of Cambridge (Pakistan) Limited is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and

sells cigarettes.

Hum Network Limited

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Published in The Express Tribune, June 7th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ