Weekly review: KSE-100 climbs 937 points as recovery continues

Oil and cement sectors led the gains while HBL SPO received great response

Oil and cement sectors led the gains while HBL SPO received great response.

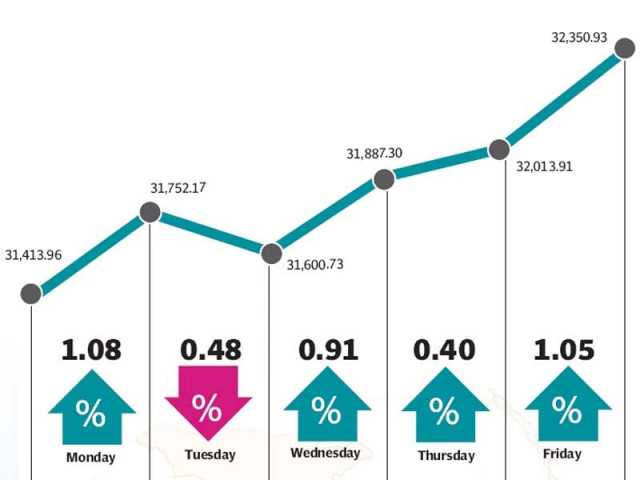

The stock market sustained its drive towards reclaiming lost ground as value-buying by investors helped the benchmark KSE-100 index climb 937 points (3%) during the week ended April 10.

The gains came on the back of strong performances from the oil and gas, fertiliser and cement sectors as investors rushed in to buy shares at attractive valuations. The week also saw the beginning of Habib Bank’s Secondary Public Offering (SPO), which received an overwhelming response from investors.

The week started off on a positive note which coincided with the reveal of the International Monetary Fund’s detailed report on Pakistan’s economy which posted a positive picture and highlighted strong progress and political stability. The index rose sharply on Monday, resuming where it left off at the end of the previous week.

A series of positive sector-specific news kept the index active throughout the rest of the week with the KSE-100 closing positive in 4 out of the 5 trading sessions. The biggest boost came from the oil and gas sector.

Pakistan Oilfields was the star performer after it announced a discovery of an oil and gas field in Mardankhel, in which it is a joint stakeholder with Pakistan Petroleum and the Oil and Gas Development Company. The field will produce 2,105 barrels per day and is expected to add Rs4 per share to POL’s bottom line.

POL’s share price rose 11.8% while Pakistan Petroleum Limited also increased 9.7% following the announcement. The sector cumulatively added 335 points to the KSE-100’s gains during the week.

During the week, the government also announced that it was postponing the proposed gas tariff hike to July 2015, which provided a boost to the fertiliser and cement sectors. Fertiliser gains were led by Engro Corporation and Engro Fertilizers, which rose 6.7% and 4.3%, respectively. The sector contributed 147 points to the index.

Towards the end of the week, the Secondary Public Offering of Habib Bank Limited kicked off with the government planning to offload 609 million shares at a floor price of Rs166 per share. The offering received an overwhelming response, particularly from foreigners, and raked in $1.02 billion for the government.

One sore spot for the market was foreigners again turning into net sellers and offloading a net of $6.5 million worth of equity, as compared to net buying of $4.1 million in the previous week. However, the response by foreigners to HBL’s SPO was a promising sign and helped to bolster investor sentiment at the bourse.

Average trading volumes dropped slightly and were recorded at 240.37 million shares traded per day. However, average daily values improved 15.1% and were recorded at Rs13.78 billion daily. The Karachi Stock Exchange’s market capitalisation rose Rs182 billlion to Rs7.12 trillion ($69.29 billion) at the end of the week.

Winners of the week

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Kohinoor Textile

Kohinoor Textile Mills Limited produces textiles. The company weaves, dyes, and prints natural and synthetic fibres.

Punjab Oil Mills Limited

Punjab Oil Mills Limited manufactures and sells vegetable ghee, cooking oil, and laundry soap.

Losers of the week

Jubilee General Insurance Company

Jubilee General Insurance Company Limited is an insurance provider. The group supplies a number of lines of coverage, including health, fire, marine and miscellaneous.

Lafarge Pakistan

Lafarge Pakistan Cement Company Limited manufactures and sells cement.

Shifa International Hospital Limited

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicine, pediatrics, surgical, obstetrics and gynaecology, dentistry, rehabilitation services and ophthalmology. Shifa also provides diagnostic services including specialised diagnostics, radiology and clinical laboratory.

Published in The Express Tribune, April 12th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ