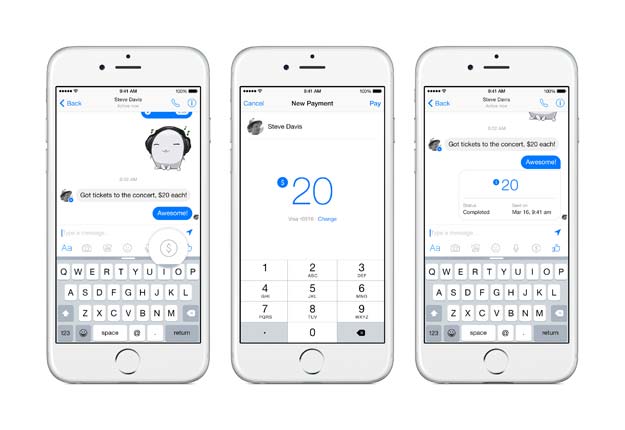

The new payments feature lets you connect your Visa or Mastercard debit card and enables sending money by tapping the “$” button.

Facebook previously worked with PayPal, Braintree and Stripe to power auto-fill of billing details for ecommerce checkouts.

In order to poach PayPal, it has spent millions of dollars in the creation of this feature which will now be independent, charging zero fees to its users.

Transactions will be protected and it says “these payment systems are kept in a secured environment that is separate from other parts of the Facebook network and that receive additional monitoring and control,” making it secure from scams and frauds.

To send money:

- Start a message with a friend

- Tap the $ icon and enter the amount you want to send

- Tap Pay in the top right and add your debit card to send money

To receive money:

- Open the conversation from your friend

- Tap Add Card in the message and add your debit card to accept money for the first time

Facebook’s product manager Steve Davis says “We’re not building a payments business here” but the goal it to offer p2p payments for free to make Messenger “more useful, expressive and delightful.”

Facebook ruled against credit cards as it would charge it users and it didn’t want what their users did not understand.

Once this feature is available to the users, they will be able to set up an in-app payments passcode or Apple TouchID fingerprint to confirm transactions. On this extra security measure Davis said: “It’s obviously not a feature you’re going to use 10 times a day. But when you do need to send money, this is probably going to be the best way to do it.”

This article originally appeared in TechCrunch

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ