Share float: WAPDA plans to offer assets to general public

Funds will be spent on water storage, power generation projects.

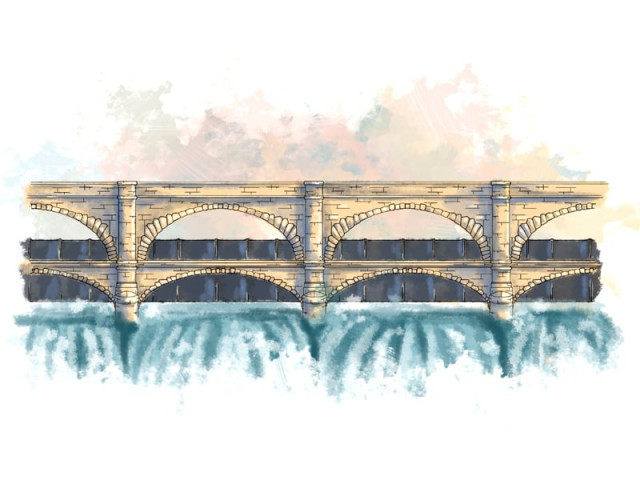

Despite abundant water resources, Pakistan could develop only 14% of storage capacity for surface water against the world average of 40%. DESIGN: ALI DARAB & JAMAL KHURSHID

“We have been approaching capital markets to generate funds for the construction of projects by issuing bonds and sukuk. We have never defaulted on those bonds,” Wapda said.

“However, bond issues have their limitations as they are accompanied by sovereign guarantees.”

In a meeting presided over by Chairman Zafar Mahmood at the Wapda House, it was decided that Wapda assets should be re-evaluated according to market rates in order to assess their current value.

Meeting participants expressed concern over difficulties being faced by Wapda in developing water storages and establishing hydroelectric power projects because of financial constraints.

Despite abundant water resources, Pakistan could develop only 14% of storage capacity for surface water against the world average of 40%. Over the years, that capacity too has eroded considerably due to sedimentation.

The meeting noted that the country had a potential of generating about 100,000 megawatts of hydroelectric power with identified potential at 60,000MW. However, it has so far been able to generate just 7,000MW of this low-cost electricity, which is a fraction of the identified potential.

Financial difficulties were at the heart of delay in the development of hydroelectric power resources.

After the construction of Mangla and Tarbela dams and setting up power stations, according to Wapda, the Ministry of Finance used to determine the end-consumer tariff, which kept enough built-in financial cushion, enabling Wapda to undertake future projects.

With such financial space, Wapda said it was able to establish a number of projects including thermal power plants such as Jamshoro and Muzaffargarh.

However, Nepra, after its establishment, has been treating Wapda like other independent power producers (IPPs) in tariff determination and the present tariff mechanism for Wapda’s hydel power did not have any fiscal space for implementation of future projects.

As a result, Wapda said it had failed to achieve financial close for 969MW Neelum-Jhelum, 106MW Golen Gol and other power projects.

Published in The Express Tribune, March 14th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ