Weekly review: KSE falls 369 points despite soft inflation numbers

Foreigners sold net equity worth $4.4 million during the week

Foreigners sold net equity worth $4.4 million during the week.

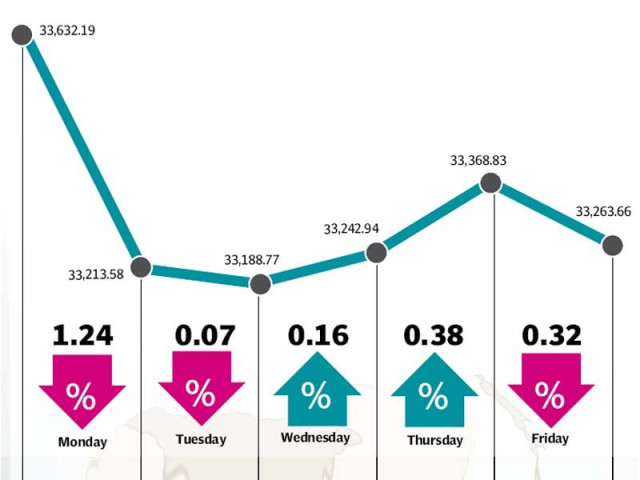

The stock market continued its downward trend despite the announcement of lower-than-expected inflation numbers with the benchmark KSE-100 index declining 369 points (1.1%) during the week ended March 6.

A variety of factors contributed to the index’s underperformance as foreigners continued to sell at the bourse. Investors offloaded their holdings in heavyweight banking and oil and gas sectors. Furthermore, the release of the draft Securities Act 2015 also took its toll on the bourse.

The week started off on a negative note despite the announcement of lower inflation figures as the KSE-100 tumbled 467 points (1.2%) on Monday and a further 25 points on the following day. The index made a slight recovery, climbing 180 points in the next two days before closing in the red again on Friday.

The much-anticipated inflation numbers failed to create positive sentiments in the bourse, despite hitting a much lower-than-expected figure of 3.24% for the month of February. The decline came as a result of lower food prices and falling prices of petroleum products.

The latest numbers meant that average inflation for the first eight months of the current fiscal year stands at 5.45% and is likely to trigger another discount rate cut in the State Bank’s monetary policy announcement later this month.

Despite being net buyers on the opening day of the week, foreigners remained net sellers for the rest of trading sessions and sold net equity worth $4.4 million during the week. The number was down from $9.8 million in the previous week, but was nevertheless a source of concern for local investors.

Some heavyweight companies also played a major role in the market’s fortunes with MCB Bank and Oil and Gas Development Company coming under selling pressure and knocking 127 points and 84 points respectively off the KSE-100 index.

The cement sector also failed to create excitement, despite impressive sales figures for February. The sector has come under pressure in recent weeks due to fears of a price war, following DG Khan Cement’s plan to set up a plant in the southern region of the country.

A major development also took place during the week which could have long-lasting impact on the stock market. The Securities and Exchange Commission of Pakistan (SECP) unveiled the draft of Securities Act 2015, under which insider trading will be declared a criminal offence.

The SECP also revealed that it had begun inquiries into instances of insider trading and market manipulation by big investors and brokers and planned on taking action against the offenders. The revelation raised several eyebrows at the bourse and developments will be monitored closely by market participants.

Average trading volumes remained flat and stood at 172.6 million shares per day. Average daily values, however, improved 15.1% and stood at Rs10.47 billion. The Karachi Stock Exchange’s market capitalisation reached Rs7.48 trillion ($73.81 billion) at the end of the week.

Winners of the week

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Hum Network Limited

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Pakistan Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide Rent-A-Car, travel arrangements and tour packages.

Losers of the week

Shezan International

Shezan International Limited manufactures and sells juices, beverages, pickles, preserves, and flavorings which are all derived from fresh fruits and vegetables.

Abbott Laboratories

Abbott Laboratories (Pakistan) Limited manufactures, imports, and markets research based pharmaceutical, nutritional, diagnostic, hospital, and consumer products. The company’s key products include antibiotics for respiratory tract infections, peptic ulcer disease, and dental infections.

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Published in The Express Tribune, March 8th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ