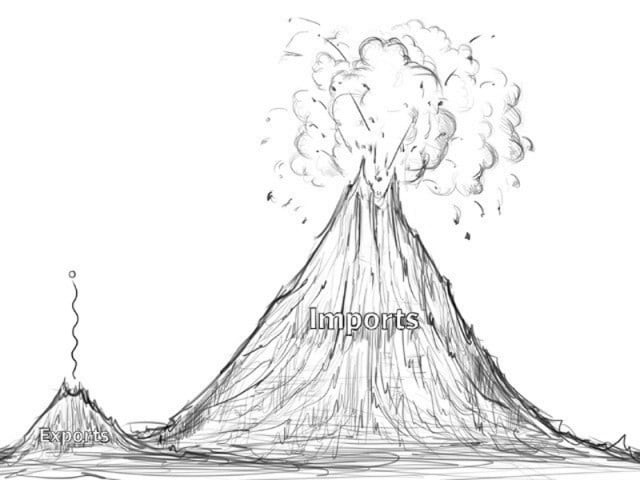

The trade conundrum

Private sector needs to come up with innovative means to increase exports, as we cannot rely on govt policy alone

The trade conundrum

The worrying issue is that exports experienced a dip despite Pakistan being granted the GSP Plus status in January this year, meaning the country could avail duty-free access to the European Union (EU) markets. However, the textile sector — the biggest beneficiary of the EU’s special incentive — has been unable to fully utilise the advantages that the status gives. If one asked those at the helm of the sector the reason behind this, they would point to the shortage and/or suspension of gas supply to industries. While one could concede that our industries do face load-shedding issues, it is a reality that the rest of the country does too. Power crisis, along with the security situation, is the biggest hindrance to the country’s economic growth. But, to quietly accept that the country’s exports will continue to suffer on the back of load-shedding, amounts to just caving in in the face of a difficult situation. We have to be better than that and look for alternative solutions to the problems we face. The IMF has put forth a target for Pakistan: to increase the central bank’s reserves equivalent to three months of imports. At the current rate of imports, that figure is over $12.5 billion — the State Bank of Pakistan currently has around $8.5 billion in the kitty. Increasing the import bill and not doing enough to increase exports is what the country is doing right now. Maybe, for a change, the private sector can step in and take up the challenge at hand. We cannot rely on government policy alone to increase our exports. The private sector also needs to come up with innovative means to do so.

Published in The Express Tribune, November 14th, 2014.

Like Opinion & Editorial on Facebook, follow @ETOpEd on Twitter to receive all updates on all our daily pieces.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ